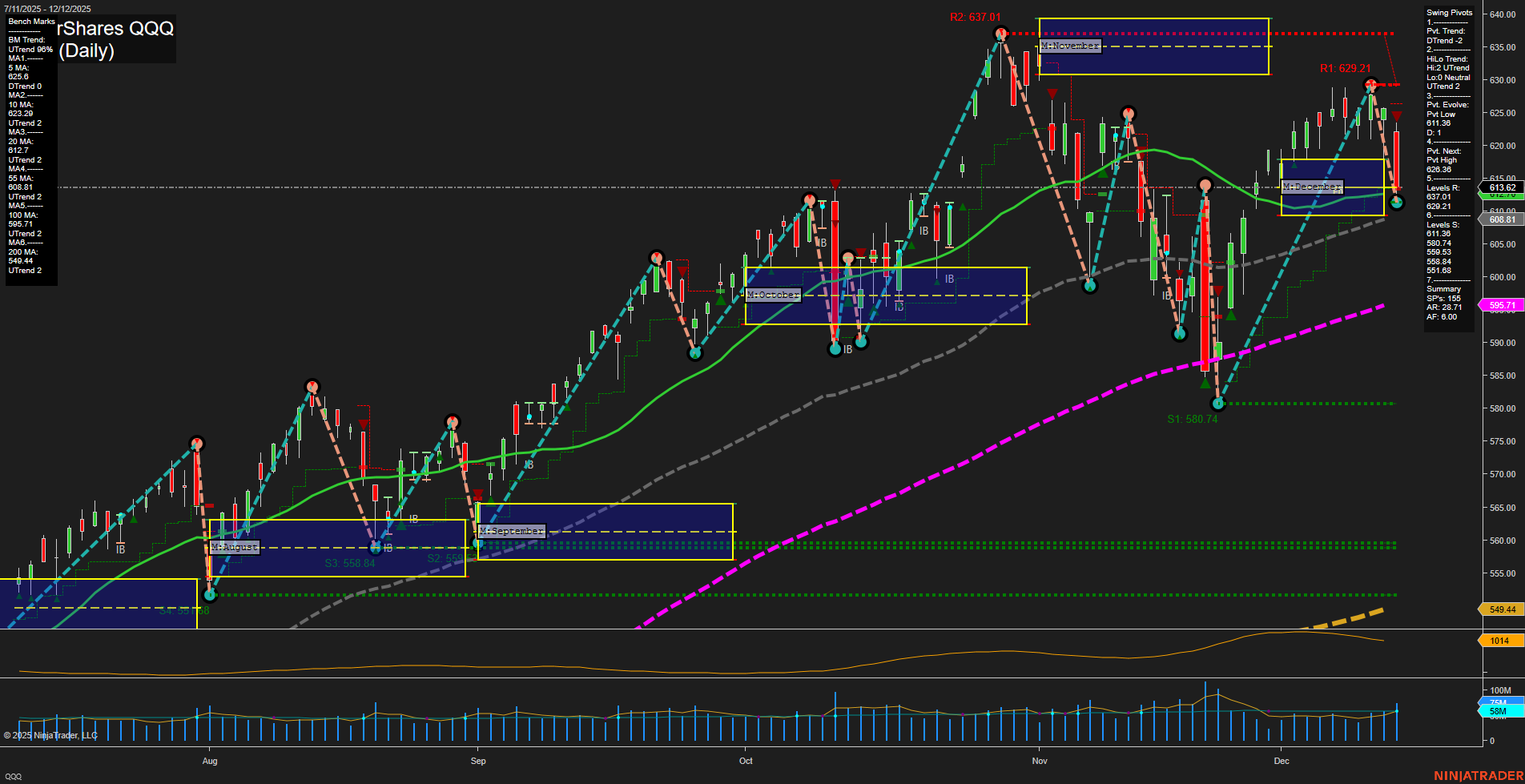

The QQQ daily chart currently reflects a mixed environment for swing traders. Short-term momentum has shifted to the downside, as indicated by the recent pivot to a DTrend, with price closing below the 5, 10, and 20-day moving averages, all of which are trending down. The most recent swing pivot is a low at 611.31, with the next potential resistance at 629.21 and 637.01, while support levels are layered below at 611.31, 580.74, and further down. Intermediate-term structure remains neutral, with the 55-day moving average still in an uptrend, suggesting underlying strength, but the market is currently consolidating after a recent pullback. Long-term trends remain bullish, as both the 100 and 200-day moving averages are rising, and price is well above these levels. Volatility, as measured by ATR, is elevated, and volume is steady, indicating active participation. The overall setup suggests a short-term corrective phase within a broader bullish context, with the market digesting gains and potentially setting up for the next directional move. Swing traders should note the current choppy and consolidative nature, with a focus on how price reacts at key support and resistance levels for clues on the next trend development.