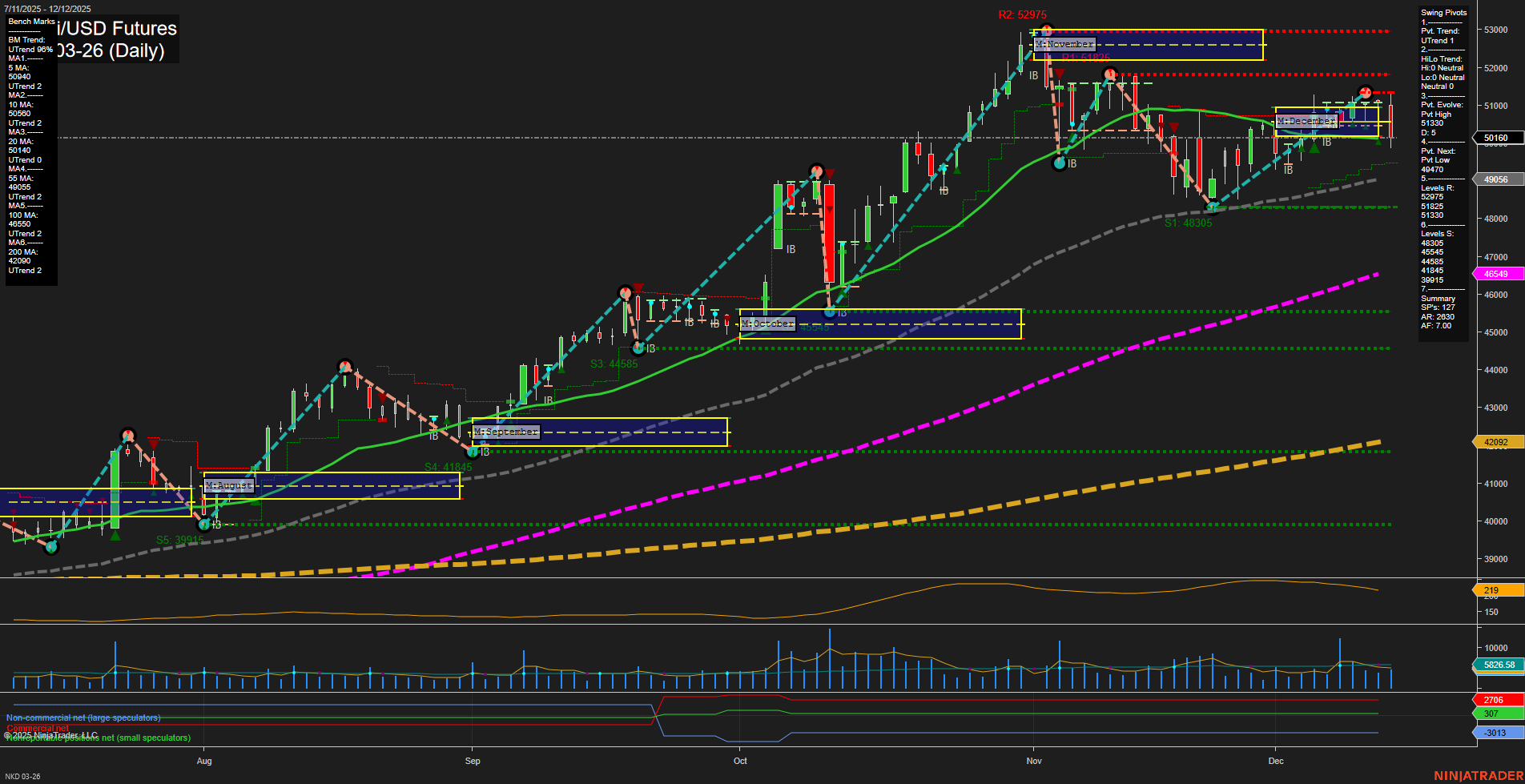

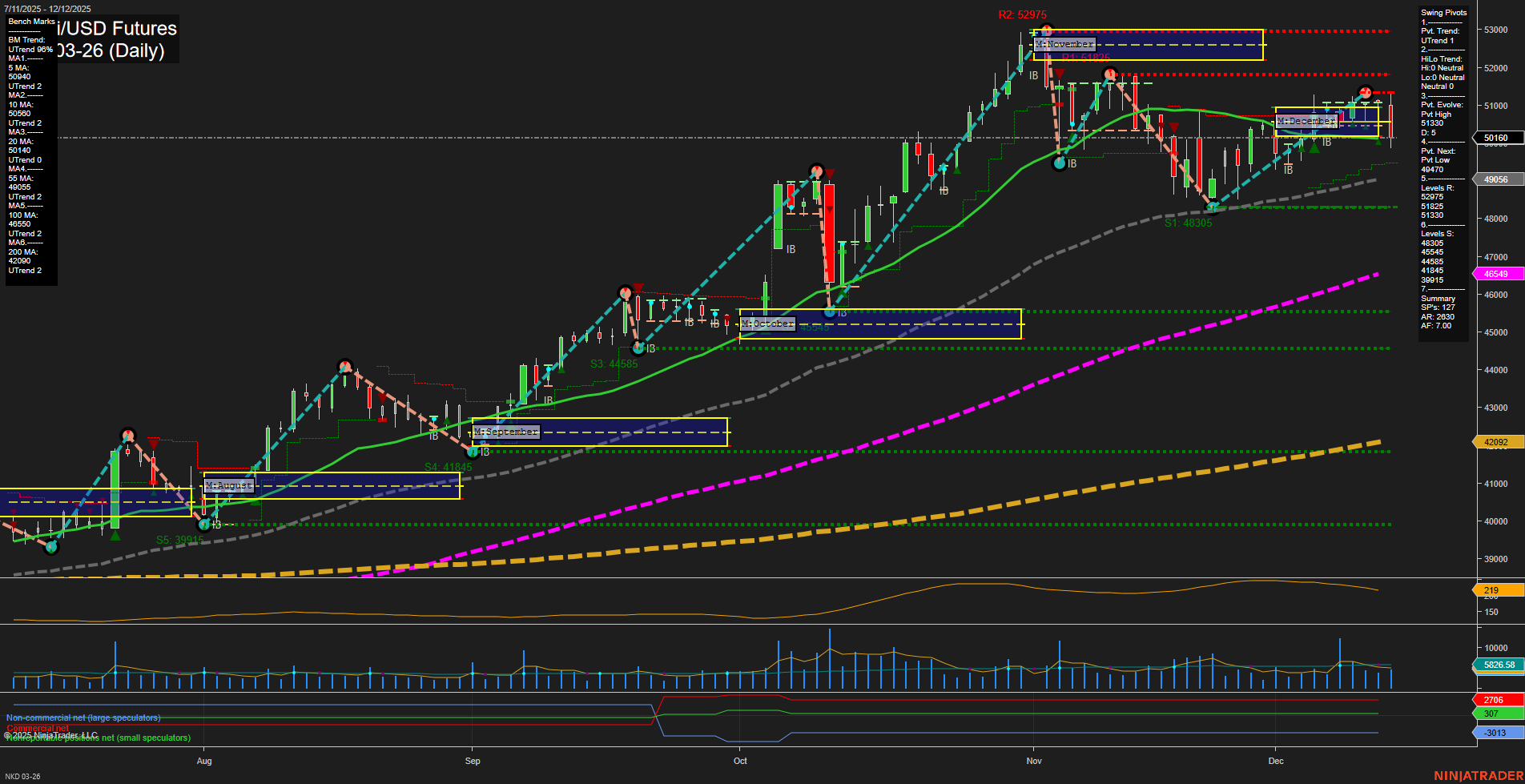

NKD Nikkei/USD Futures Daily Chart Analysis: 2025-Dec-14 18:10 CT

Price Action

- Last: 50160,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -9%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 141%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 51330,

- 4. Pvt. Next: Pvt Low 49470,

- 5. Levels R: 52975, 51330, 51225, 51135,

- 6. Levels S: 48305, 44585, 41845, 39015.

Daily Benchmarks

- (Short-Term) 5 Day: 50400 Up Trend,

- (Short-Term) 10 Day: 50580 Up Trend,

- (Intermediate-Term) 20 Day: 50140 Up Trend,

- (Intermediate-Term) 55 Day: 49096 Up Trend,

- (Long-Term) 100 Day: 46549 Up Trend,

- (Long-Term) 200 Day: 42092 Up Trend.

Additional Metrics

Recent Trade Signals

- 12 Dec 2025: Short NKD 03-26 @ 50220 Signals.USAR.TR120

- 12 Dec 2025: Long NKD 03-26 @ 51065 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD futures daily chart shows a market that has maintained a strong upward bias over the intermediate and long-term horizons, as evidenced by the MSFG and YSFG trends both pointing up and price holding above their respective F0%/NTZ levels. All benchmark moving averages from short to long-term are in uptrends, confirming broad-based bullish momentum. However, the short-term picture is more mixed: the WSFG trend is down with price below the weekly NTZ, and recent trade signals have triggered both a short and a long within a narrow range, reflecting choppy, indecisive action. The swing pivot structure shows the current trend as up, but with a neutral intermediate-term HiLo trend and resistance clustering just above (51330–52975), suggesting the market is testing upper bounds and may be consolidating after a strong rally. Support is well-defined below at 48305 and lower. Volatility (ATR) and volume (VOLMA) are moderate, indicating neither a breakout nor a collapse in participation. Overall, the market is in a consolidation phase short-term, but the underlying structure remains bullish for swing traders on intermediate and long-term timeframes, with the potential for further upside if resistance is cleared.

Chart Analysis ATS AI Generated: 2025-12-14 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.