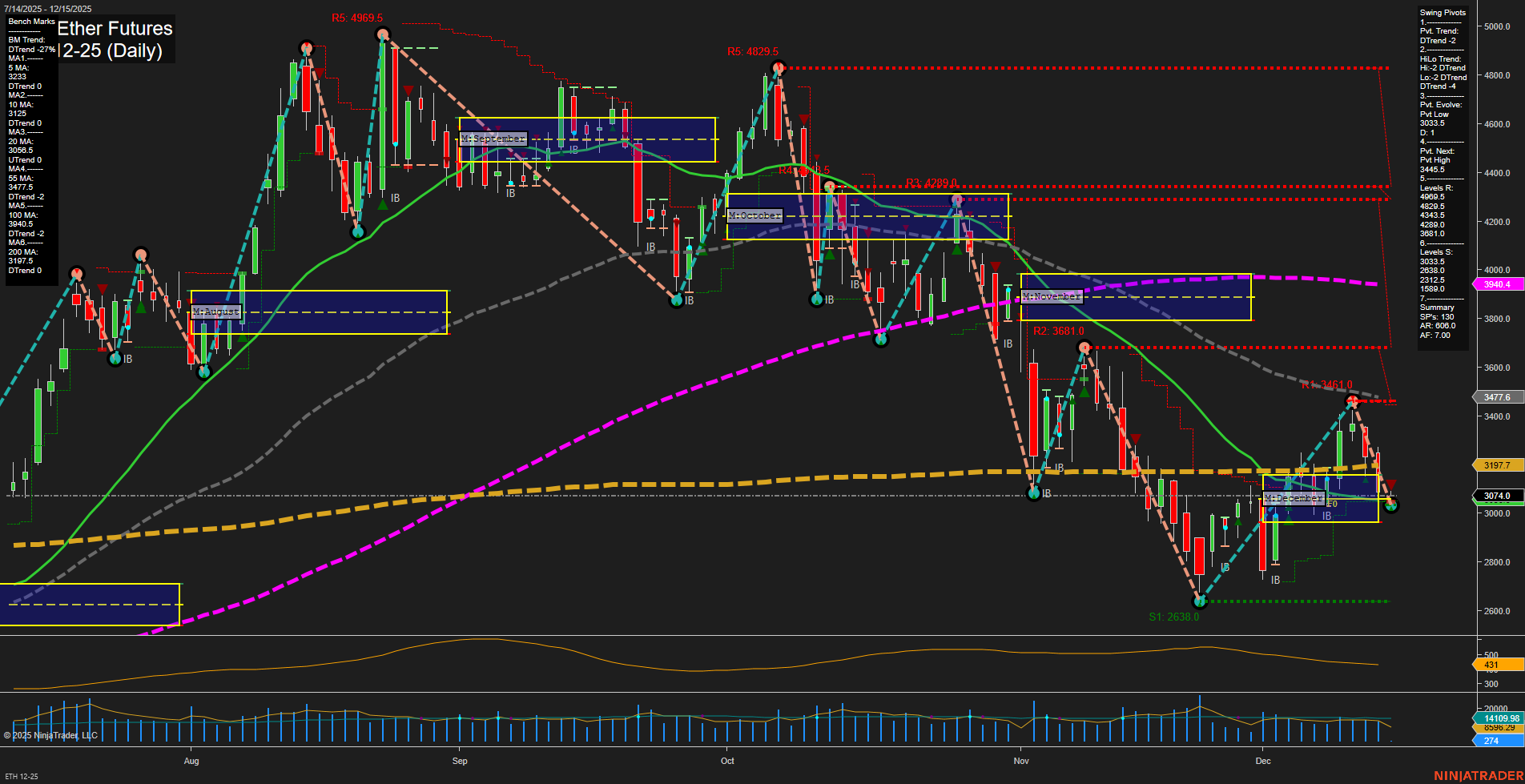

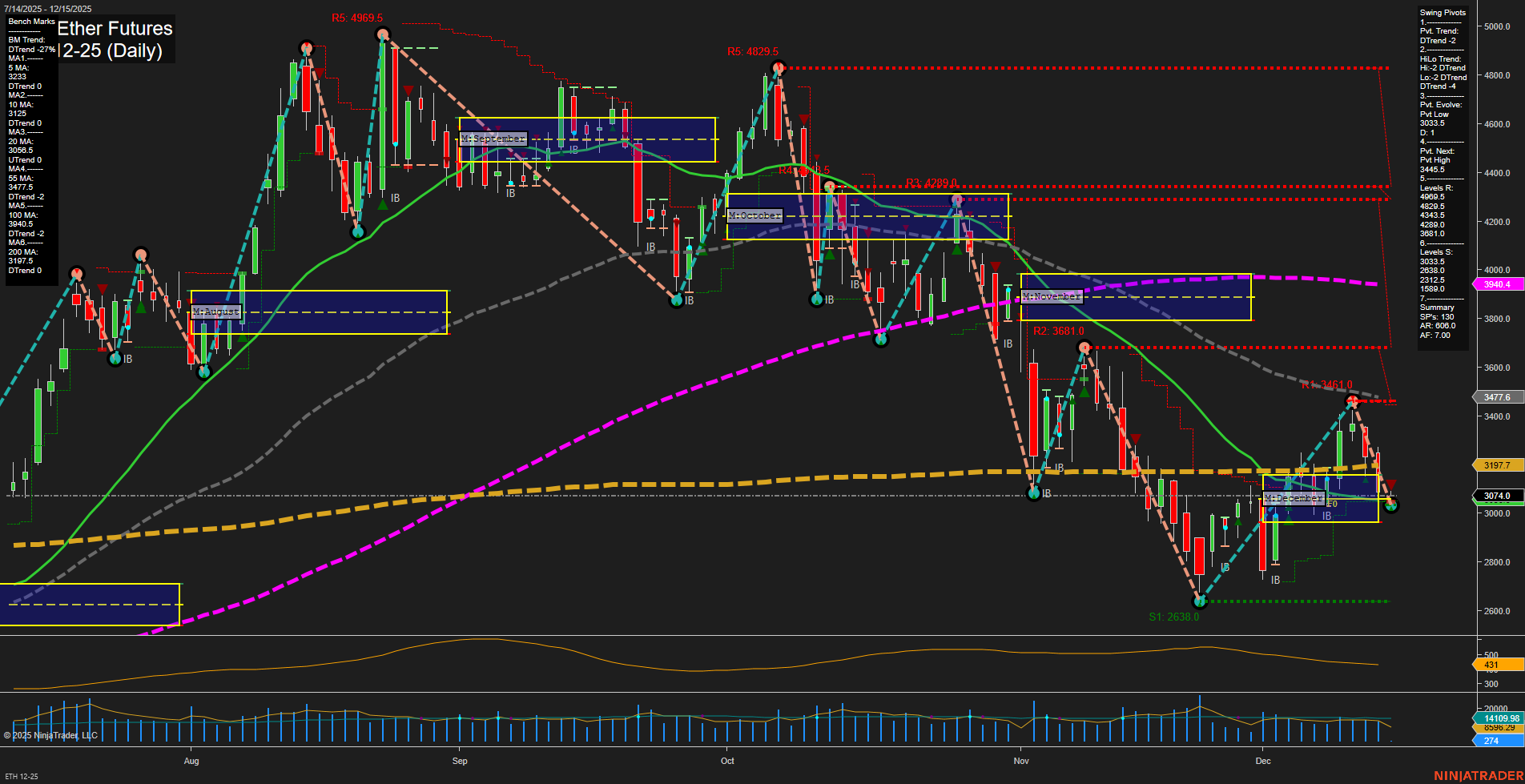

ETH CME Ether Futures Daily Chart Analysis: 2025-Dec-14 18:07 CT

Price Action

- Last: 3074.0,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 18%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -23%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 2638.0,

- 4. Pvt. Next: Pvt high 3461.0,

- 5. Levels R: 3461.0, 3681.0, 4289.4, 4829.5, 4969.5,

- 6. Levels S: 2638.0, 2383.6, 2318.5, 1590.0.

Daily Benchmarks

- (Short-Term) 5 Day: 3233 Down Trend,

- (Short-Term) 10 Day: 3174 Down Trend,

- (Intermediate-Term) 20 Day: 3197.7 Down Trend,

- (Intermediate-Term) 55 Day: 3477.6 Down Trend,

- (Long-Term) 100 Day: 3944.0 Down Trend,

- (Long-Term) 200 Day: 4010.9 Down Trend.

Additional Metrics

Recent Trade Signals

- 09 Dec 2025: Long ETH 12-25 @ 3379 Signals.USAR.TR120

- 09 Dec 2025: Long ETH 12-25 @ 3379 Signals.USAR.TR720

- 09 Dec 2025: Long ETH 12-25 @ 3120.5 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The current ETH CME Ether Futures daily chart shows a market in a corrective phase after a recent rally attempt. Price has pulled back from the December swing high (3461.0) and is now trading near 3074.0, below all key moving averages, which are trending down across short, intermediate, and long-term timeframes. Both the short-term and intermediate-term swing pivot trends are down, with the most recent pivot low at 2638.0 acting as a key support, and resistance levels stacked above at 3461.0 and higher. Despite the WSFG and MSFG showing price above their respective NTZ centers and trending up, the broader context remains bearish due to the dominant downtrend in moving averages and the yearly SFG trend. Volatility (ATR) is moderate, and volume is steady but not elevated. Recent trade signals indicate some attempts at long entries, but the prevailing technical structure suggests the market is still in a retracement or consolidation phase within a larger downtrend. Swing traders may observe for potential tests of support or further lower highs, as the market has yet to confirm a sustained reversal.

Chart Analysis ATS AI Generated: 2025-12-14 18:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.