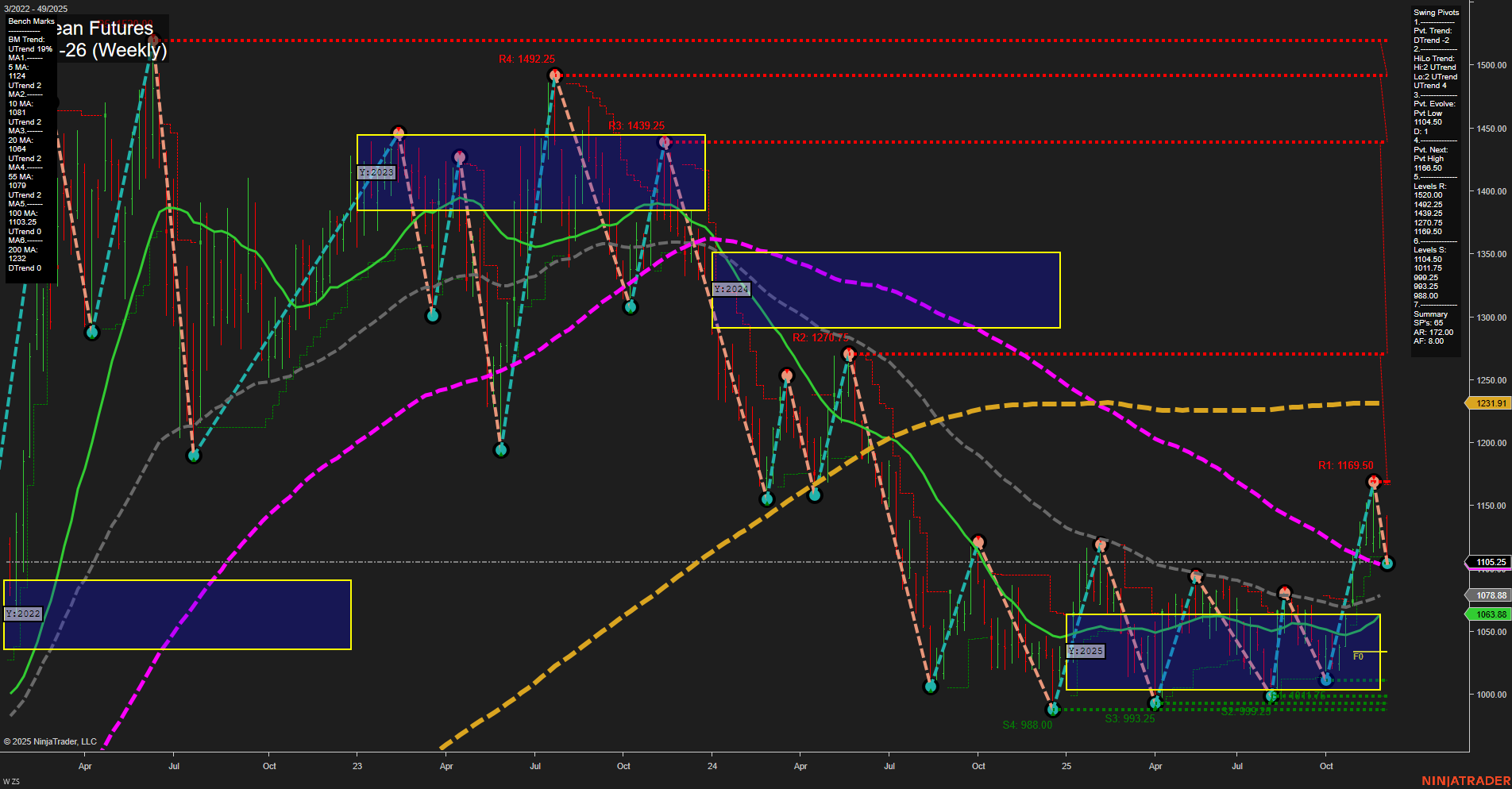

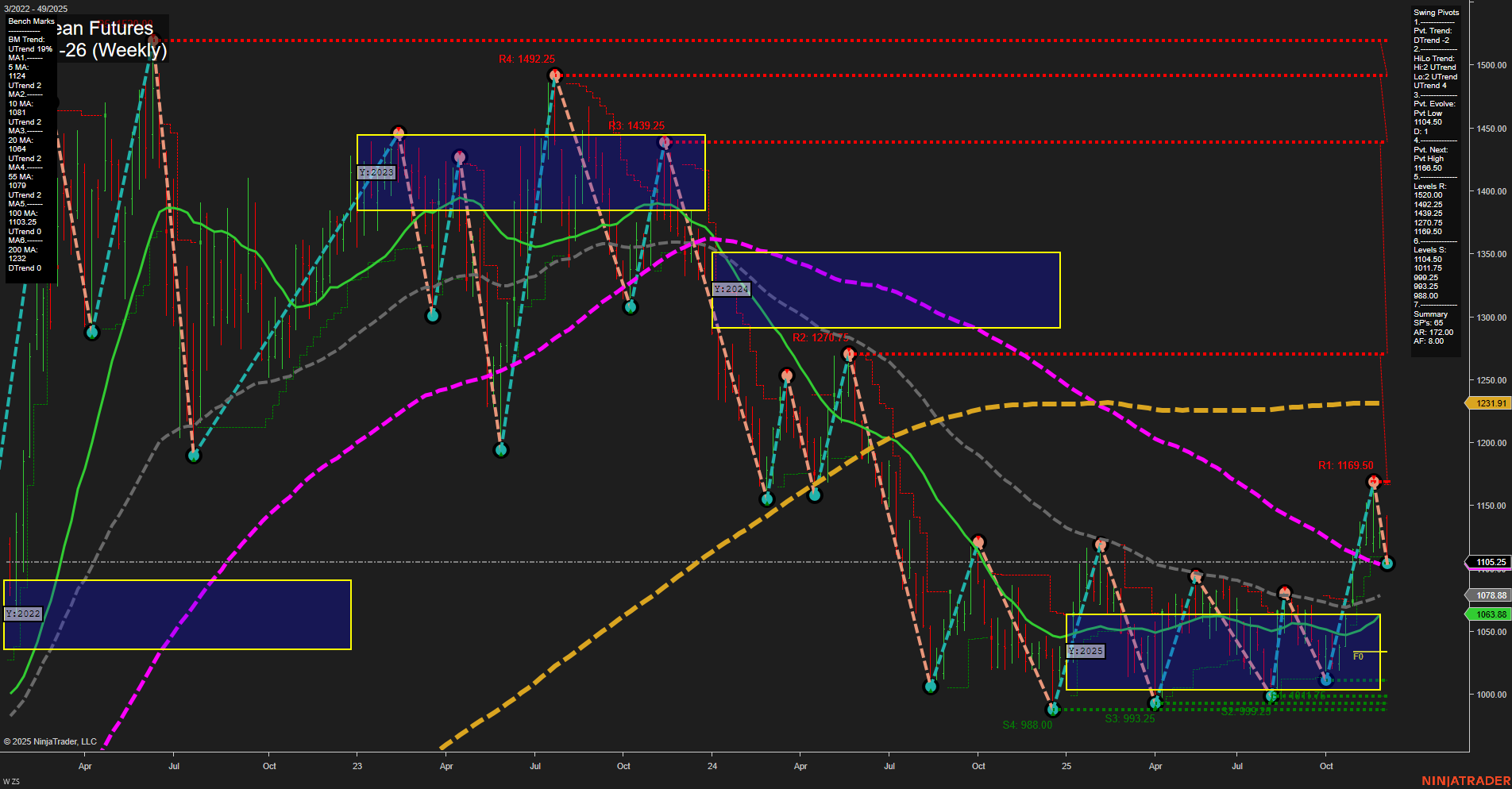

ZS Soybean Futures Weekly Chart Analysis: 2025-Dec-07 18:18 CT

Price Action

- Last: 1116.5,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -94%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: -27%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 5. Levels R: 1420.00, 1439.25, 1492.25, 1270.75, 1169.50,

- 6. Levels S: 1071.75, 993.25, 988.00, 965.00, 900.25, 865.00.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1124 Down Trend,

- (Intermediate-Term) 10 Week: 1081 Down Trend,

- (Long-Term) 20 Week: 1053.88 Up Trend,

- (Long-Term) 55 Week: 1105.25 Down Trend,

- (Long-Term) 100 Week: 1206.43 Down Trend,

- (Long-Term) 200 Week: 1231.91 Down Trend.

Recent Trade Signals

- 05 Dec 2025: Short ZS 01-26 @ 1116.5 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

Soybean futures are currently experiencing a bearish environment in both the short- and intermediate-term, as indicated by the strong downward trends in the WSFG and MSFG, with price action below the NTZ center and negative session grid readings. The most recent swing pivot trend is down, and the 5- and 10-week moving averages confirm this with their downward slopes. However, the intermediate-term HiLo trend is showing some upward movement, suggesting the potential for countertrend rallies or bounces within the broader downtrend. Long-term, the YSFG remains positive, and the 20-week moving average is trending up, but this is offset by the 55-, 100-, and 200-week moving averages, which are all trending down, indicating that the market is still under longer-term pressure. Resistance is stacked above at 1169.50 and higher, while support is clustered in the 900–1070 range. The recent short signal aligns with the prevailing intermediate-term bearishness. Overall, the market is in a corrective or consolidation phase within a larger downtrend, with volatility and potential for sharp countertrend moves, but no clear evidence yet of a sustained reversal.

Chart Analysis ATS AI Generated: 2025-12-07 18:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.