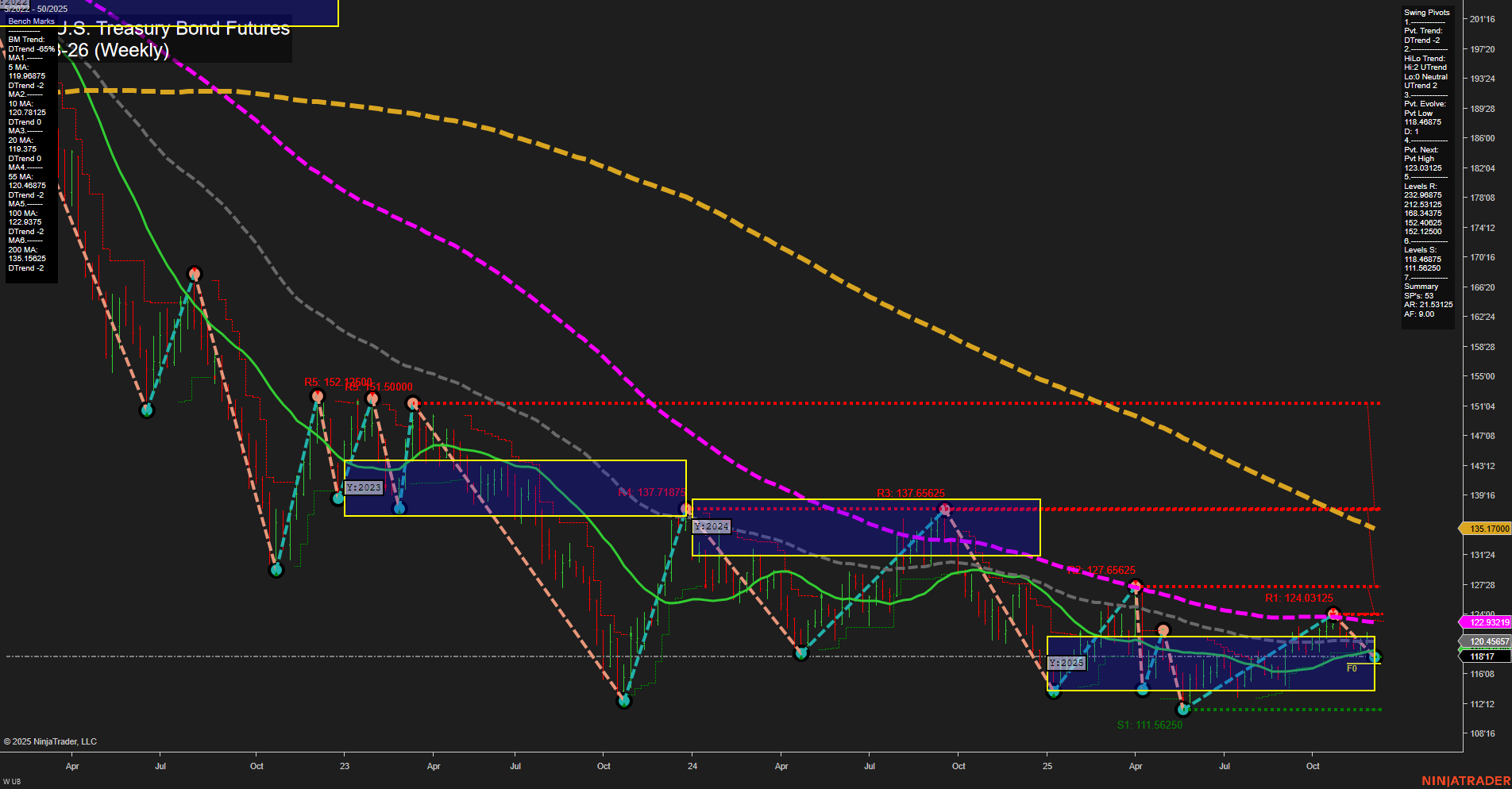

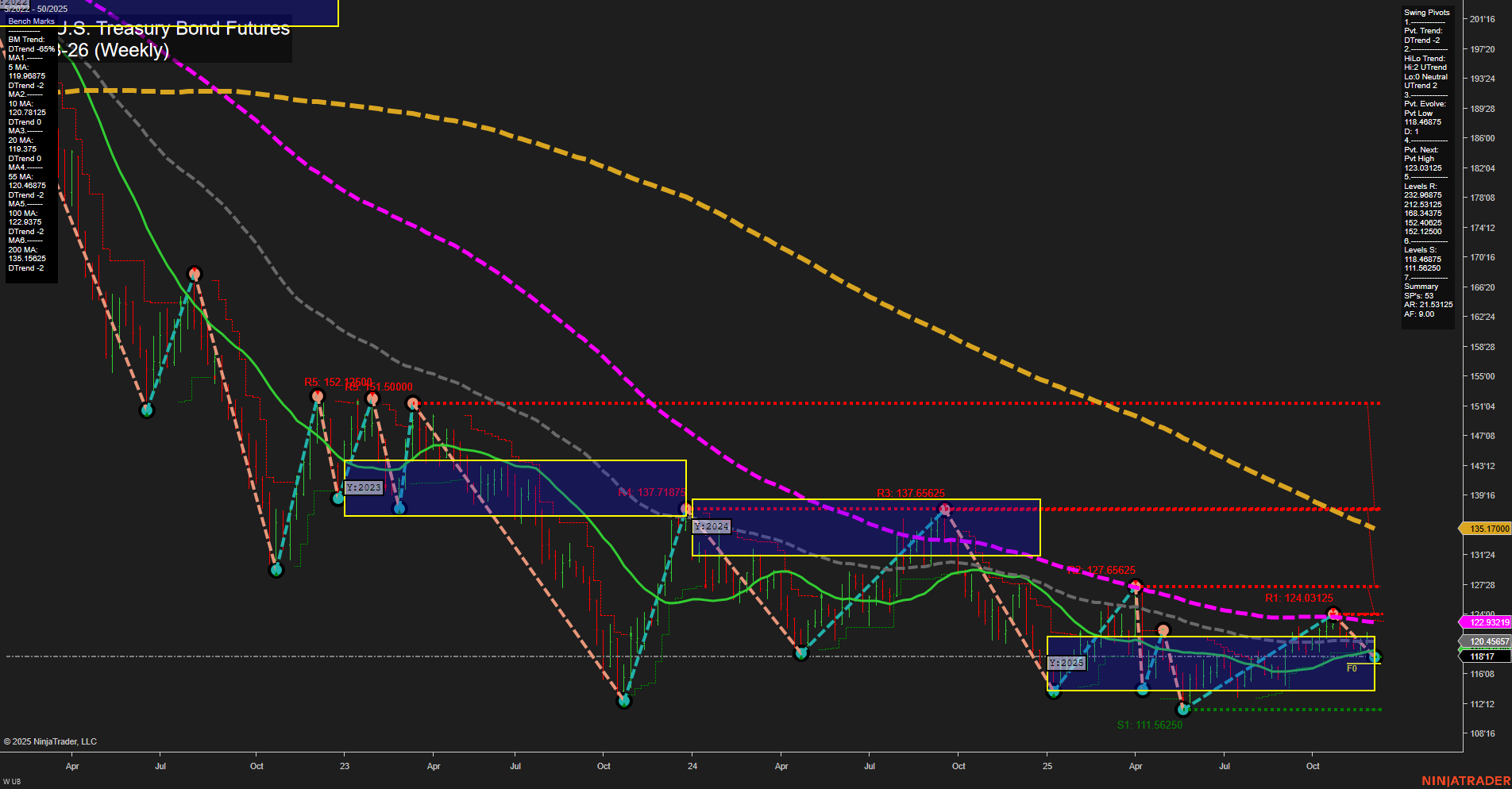

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Dec-07 18:15 CT

Price Action

- Last: 119.5625,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: -35%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 118.4875,

- 4. Pvt. Next: Pvt High 124.03125,

- 5. Levels R: 137.65625, 127.65625, 124.03125, 122.3425, 119.5,

- 6. Levels S: 111.5625, 118.4875.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 119.04875 Down Trend,

- (Intermediate-Term) 10 Week: 120.718125 Down Trend,

- (Long-Term) 20 Week: 122.3425 Down Trend,

- (Long-Term) 55 Week: 127.40625 Down Trend,

- (Long-Term) 100 Week: 135.17000 Down Trend,

- (Long-Term) 200 Week: 139.1625 Down Trend.

Recent Trade Signals

- 04 Dec 2025: Short UB 03-26 @ 119.5625 Signals.USAR-MSFG

- 01 Dec 2025: Short UB 03-26 @ 120.75 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart reflects a market under persistent downward pressure in both the short- and intermediate-term timeframes, as indicated by the negative WSFG and MSFG trends, slow momentum, and a series of lower highs and lower lows. The most recent swing pivot trend is down, with the next key resistance at 124.03125 and support at 118.4875 and 111.5625. All benchmark moving averages from 5 to 200 weeks are trending down, reinforcing the prevailing bearish sentiment. However, the yearly session fib grid (YSFG) shows a slight positive bias, suggesting some stabilization or potential for a longer-term base, but this is not yet confirmed by price action or moving averages. Recent trade signals have favored the short side, aligning with the dominant trend. The market appears to be in a broad consolidation phase after a significant selloff, with volatility compressing and price action hovering near key support. Swing traders should note the potential for further downside if support levels break, while any sustained move above resistance could signal a shift in the longer-term structure.

Chart Analysis ATS AI Generated: 2025-12-07 18:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.