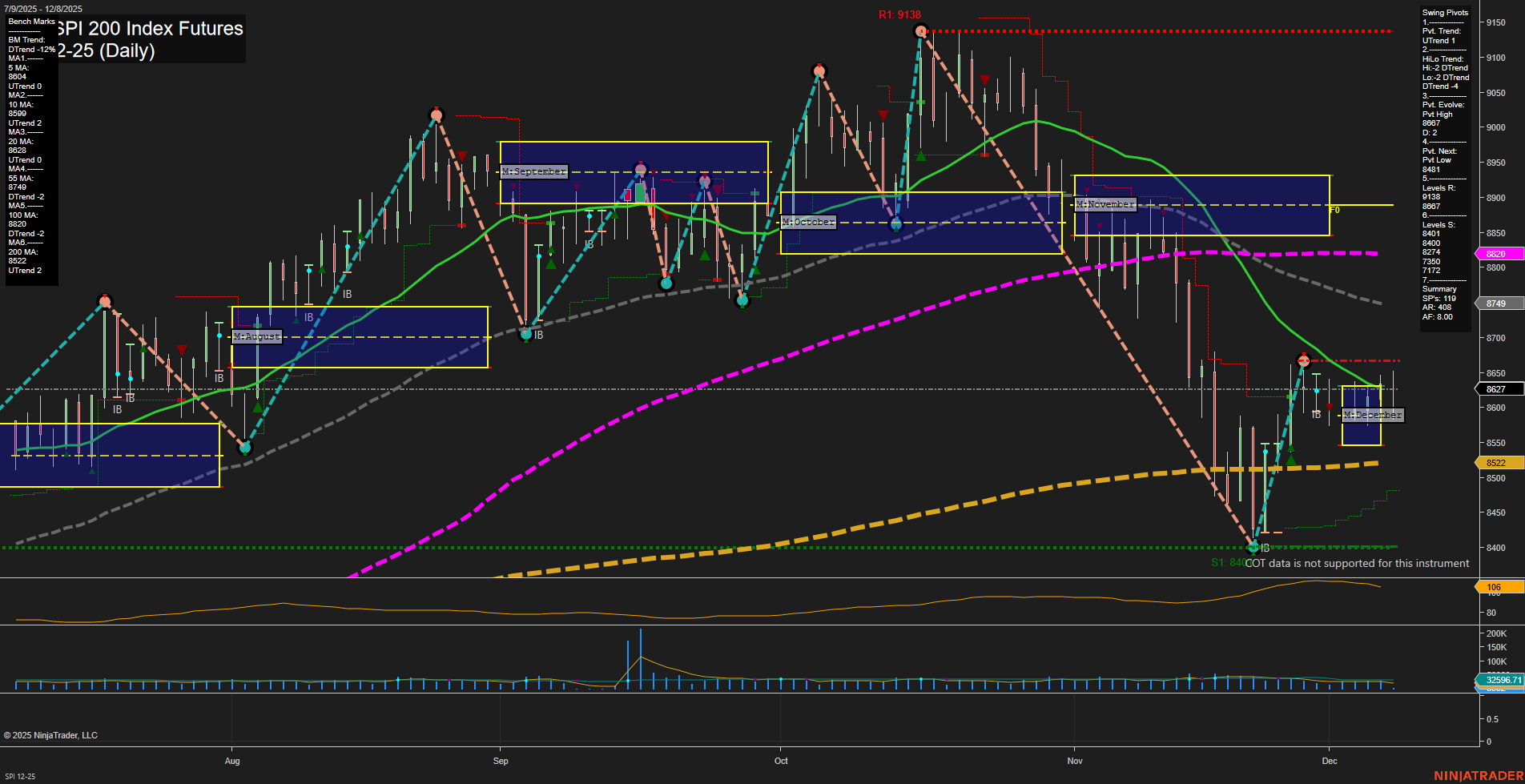

The SPI 200 Index Futures is currently exhibiting a mixed technical landscape. Price action has stabilized after a sharp sell-off in November, with the last price at 8820 and average momentum. The short-term swing pivot trend has shifted to an uptrend, but the intermediate-term HiLo trend remains in a downtrend, reflecting the recent recovery bounce within a broader corrective phase. Resistance is seen at 8967 and 8820, while support is clustered at 8491 and 8401, with deeper levels at 8200 and below, indicating a wide trading range. Benchmark moving averages show short-term uptrends (5 and 10 day MAs), but the 20, 55, and 100 day MAs are still in downtrends, suggesting the market is in a transitional phase. The 200 day MA is rising, providing a longer-term support base near 8522. Volatility (ATR) remains moderate, and volume is steady, indicating neither panic nor exuberance. Overall, the short-term outlook is neutral as the market consolidates above recent lows, while the intermediate-term remains bearish due to prevailing downtrends in key moving averages and swing structure. The long-term view is neutral, with price oscillating around major moving averages. The market is in a recovery phase, but has yet to confirm a sustained reversal, with potential for further consolidation or retest of support if resistance levels hold.