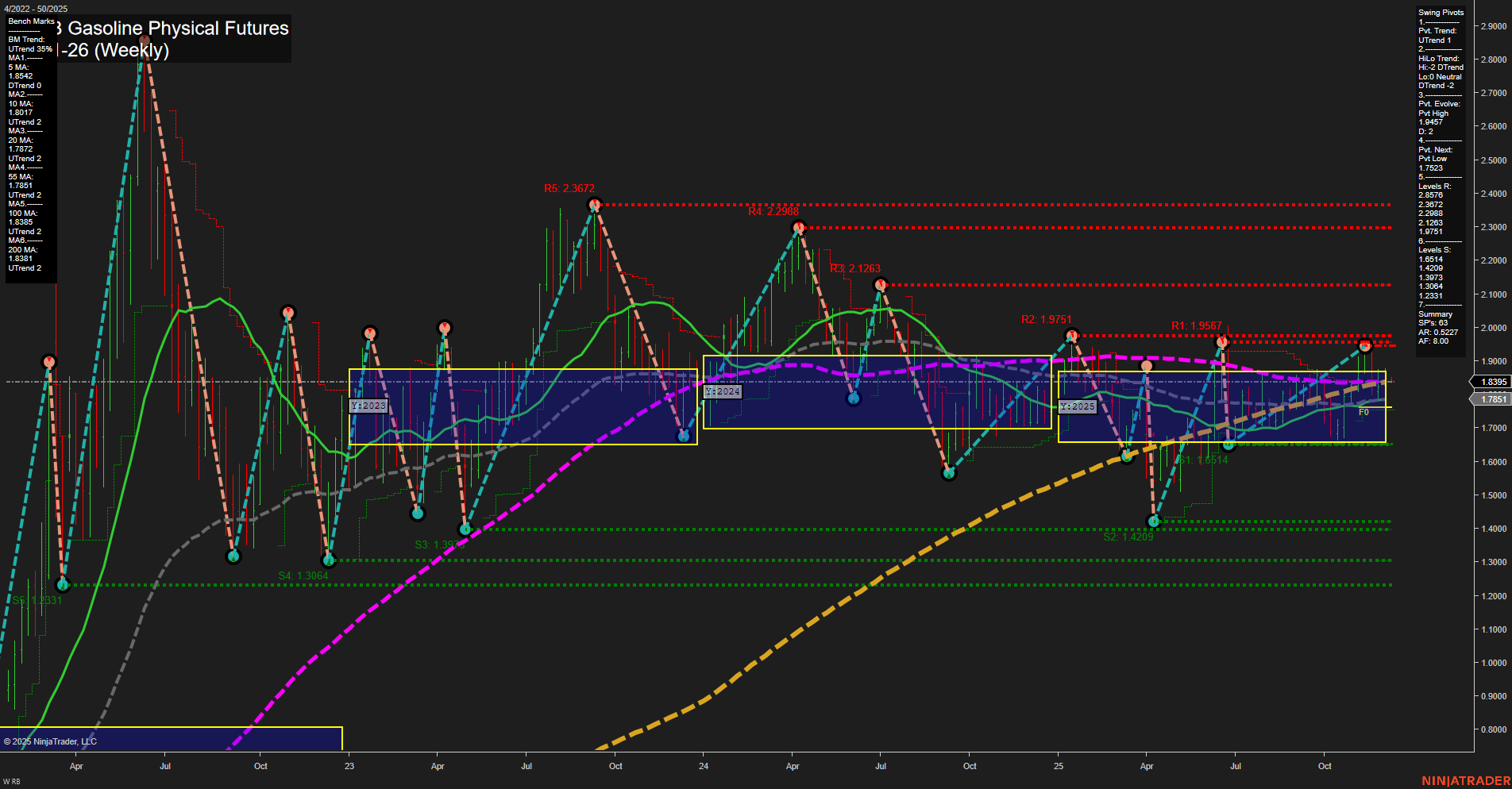

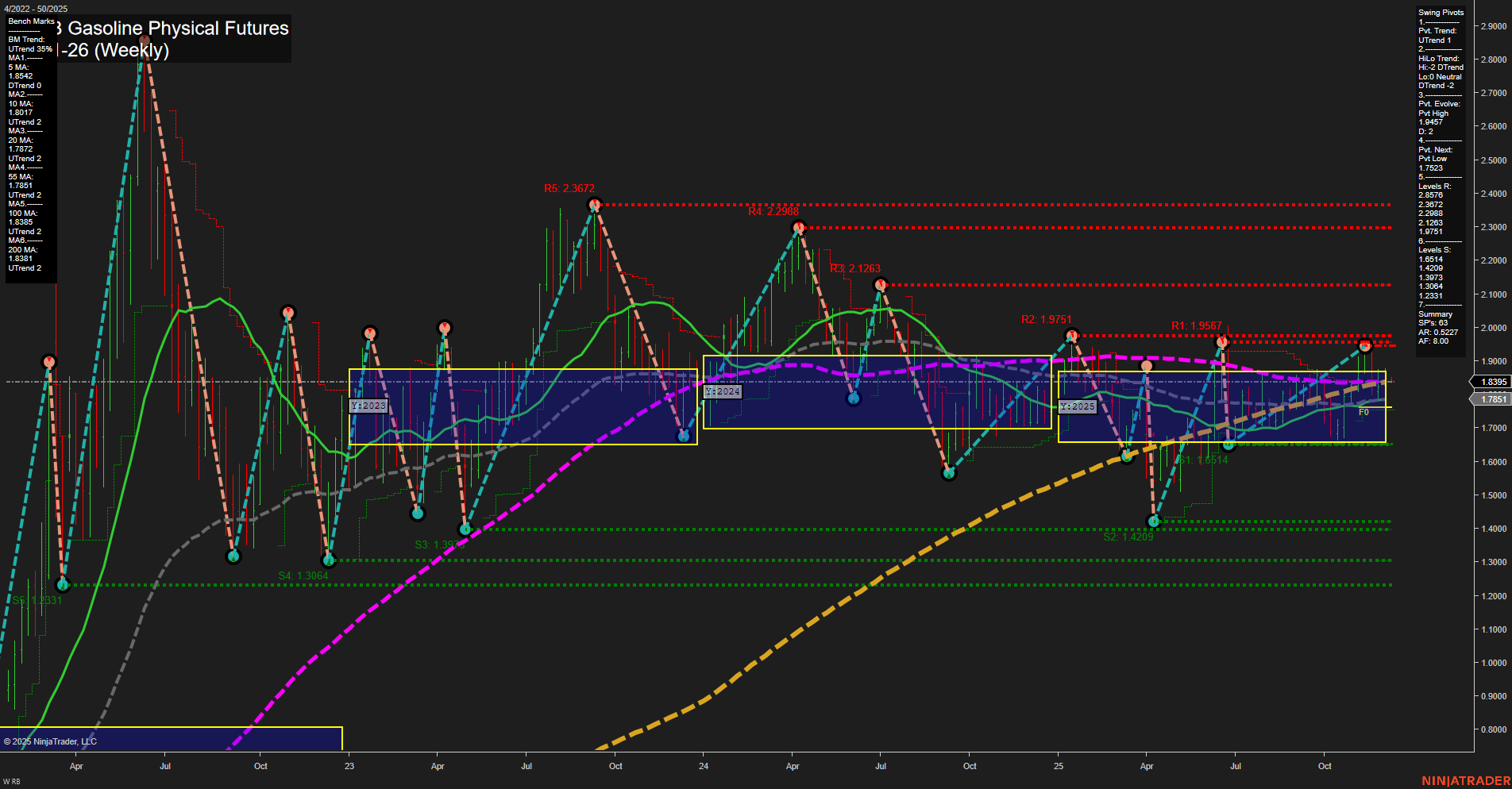

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Dec-07 18:12 CT

Price Action

- Last: 1.8395,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1.9497,

- 4. Pvt. Next: Pvt low 1.7523,

- 5. Levels R: 2.3672, 2.2568, 2.1263, 1.9751, 1.9567,

- 6. Levels S: 1.4209, 1.3311, 1.3204, 1.3074, 1.2331.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.8424 Up Trend,

- (Intermediate-Term) 10 Week: 1.8172 Up Trend,

- (Long-Term) 20 Week: 1.8017 Up Trend,

- (Long-Term) 55 Week: 1.7854 Up Trend,

- (Long-Term) 100 Week: 1.8585 Down Trend,

- (Long-Term) 200 Week: 1.3881 Up Trend.

Recent Trade Signals

- 05 Dec 2025: Long RB 01-26 @ 1.8448 Signals.USAR-WSFG

- 05 Dec 2025: Short RB 01-26 @ 1.8295 Signals.USAR-MSFG

- 01 Dec 2025: Long RB 01-26 @ 1.8704 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The weekly chart for RB RBOB Gasoline Physical Futures shows a mixed but evolving landscape. Short-term momentum is average, with price action holding above the WSFG F0% and the NTZ, indicating a bullish short-term bias. The swing pivot trend is up in the short-term, supported by recent long trade signals and a cluster of moving averages trending higher. However, the intermediate-term picture is less constructive, with the MSFG trend down and price below the monthly NTZ, confirmed by a recent short signal and a downtrend in the HiLo swing pivot metric. Long-term structure remains bullish, as the yearly session grid and most long-term moving averages are trending up, with price above key yearly levels. Resistance is layered above at 1.95–2.36, while support is well established below 1.75 and down to 1.23. The market is currently in a consolidation phase, with a slight upward bias, but faces overhead resistance and a potential for further range-bound action unless a breakout occurs. The interplay between short-term bullishness and intermediate-term weakness suggests a choppy environment, with the long-term uptrend still intact.

Chart Analysis ATS AI Generated: 2025-12-07 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.