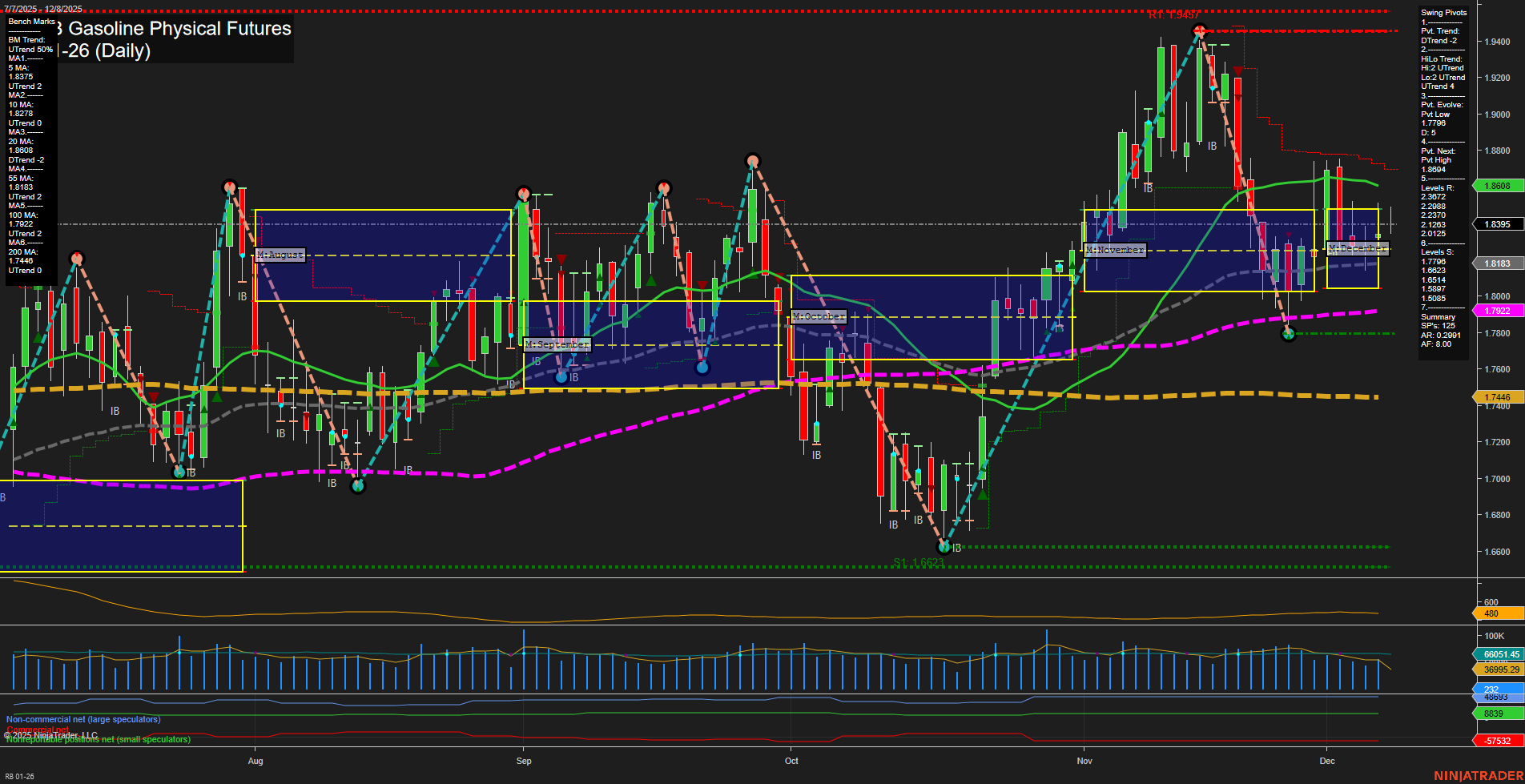

The current daily chart for RB RBOB Gasoline Physical Futures shows a market in transition. Price action is consolidating with medium-sized bars and average momentum, reflecting a lack of strong directional conviction. The short-term WSFG trend is up, with price holding above the weekly NTZ, but the monthly MSFG trend is down, with price below the monthly NTZ, indicating intermediate-term weakness. The long-term YSFG remains up, suggesting the broader trend is still bullish. Swing pivots highlight a short-term downtrend (DTrend) with the most recent pivot low at 1.8291 and the next potential reversal at the pivot high of 1.8804. Resistance levels cluster just above current price, while support is layered below, indicating a range-bound environment. Daily benchmarks show short-term and intermediate-term moving averages trending down, but longer-term averages remain in uptrends, reinforcing the mixed outlook. ATR and volume metrics suggest moderate volatility and steady participation. Recent trade signals reflect this indecision, with both long and short entries triggered in early December. Overall, the market is caught between short-term consolidation and intermediate-term pullback, but the long-term structure remains constructive. This environment favors tactical swing trading, with attention to breakout or breakdown from the current range and respect for both support and resistance clusters.