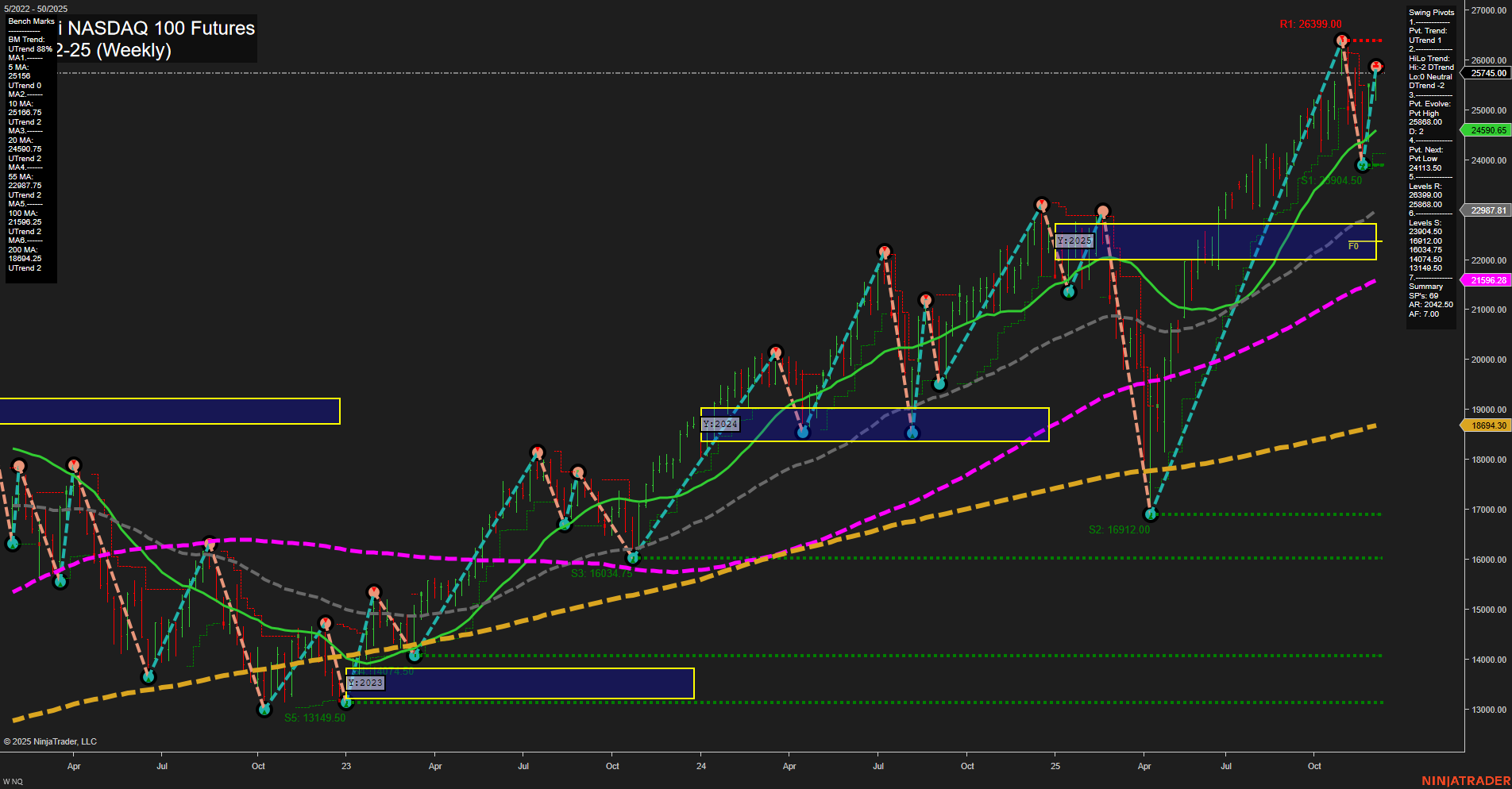

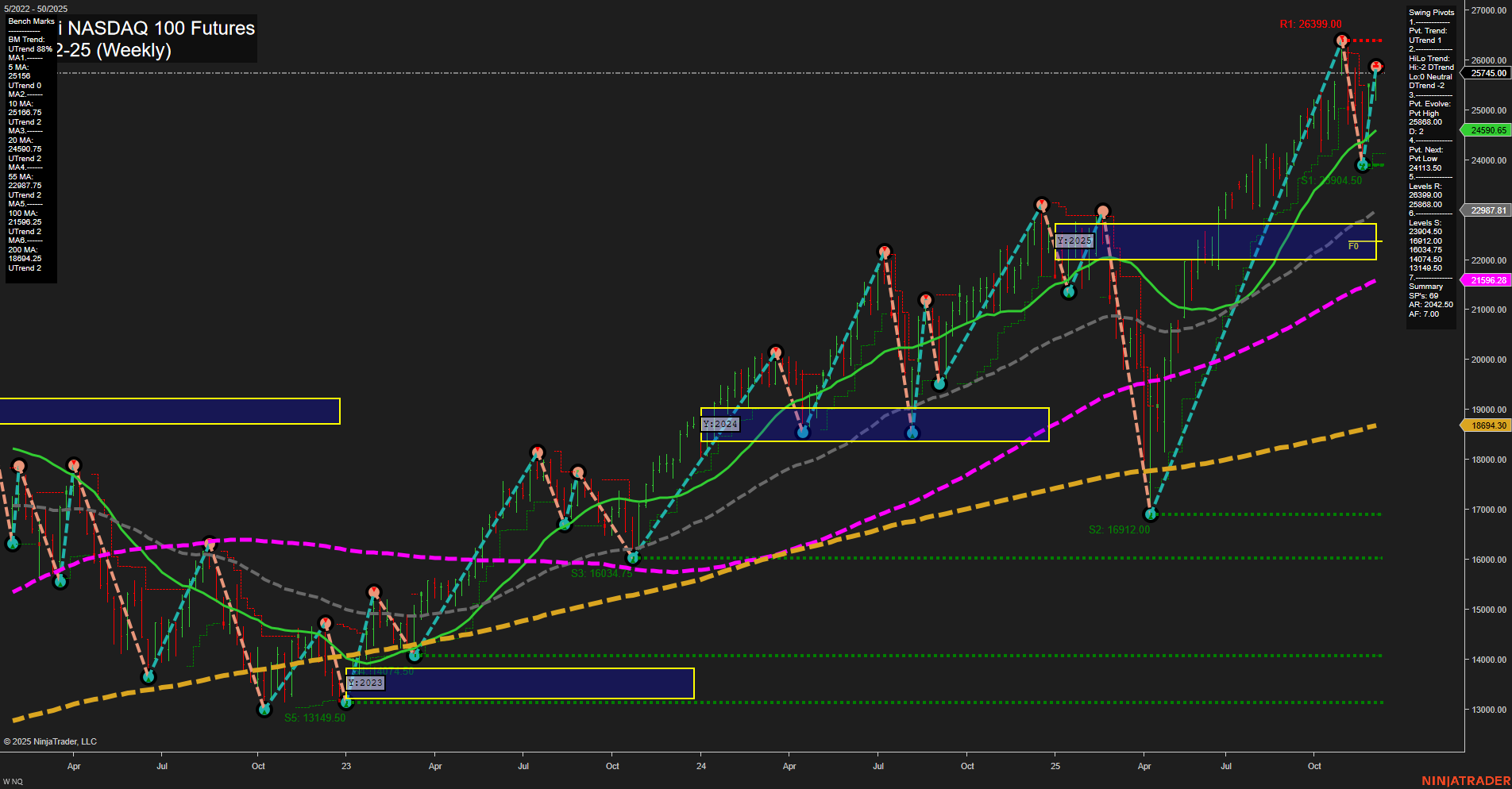

NQ E-mini NASDAQ 100 Futures Weekly Chart Analysis: 2025-Dec-07 18:11 CT

Price Action

- Last: 24590.65,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 29%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 87%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 25808.00,

- 4. Pvt. Next: Pvt high 26399.00,

- 5. Levels R: 26399.00, 25808.00,

- 6. Levels S: 21113.50, 18014.25, 16912.00, 16034.75, 13149.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 25745.00 Up Trend,

- (Intermediate-Term) 10 Week: 24960.75 Up Trend,

- (Long-Term) 20 Week: 23987.81 Up Trend,

- (Long-Term) 55 Week: 21596.28 Up Trend,

- (Long-Term) 100 Week: 18694.30 Up Trend,

- (Long-Term) 200 Week: 18014.25 Up Trend.

Recent Trade Signals

- 05 Dec 2025: Long NQ 12-25 @ 25729.75 Signals.USAR-WSFG

- 04 Dec 2025: Long NQ 12-25 @ 25641.75 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The NQ E-mini NASDAQ 100 Futures weekly chart shows a strong bullish structure in both the short- and long-term timeframes, with price action maintaining above all major moving averages and the yearly, monthly, and weekly session fib grids. The most recent bars are large and momentum is fast, indicating heightened volatility and strong directional conviction. The short-term swing pivot trend is up, but the intermediate-term HiLo trend is down, suggesting a recent pullback or correction within a broader uptrend. Resistance is defined at 26399.00 and 25808.00, while support is layered much lower, indicating a wide range for potential retracements. All benchmark moving averages are trending up, reinforcing the underlying bullish bias. Recent trade signals confirm renewed long entries, aligning with the prevailing uptrend. The market appears to be in a trend continuation phase after a sharp pullback, with the potential for further upside if resistance levels are overcome, but with room for volatility and possible retests of lower support zones.

Chart Analysis ATS AI Generated: 2025-12-07 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.