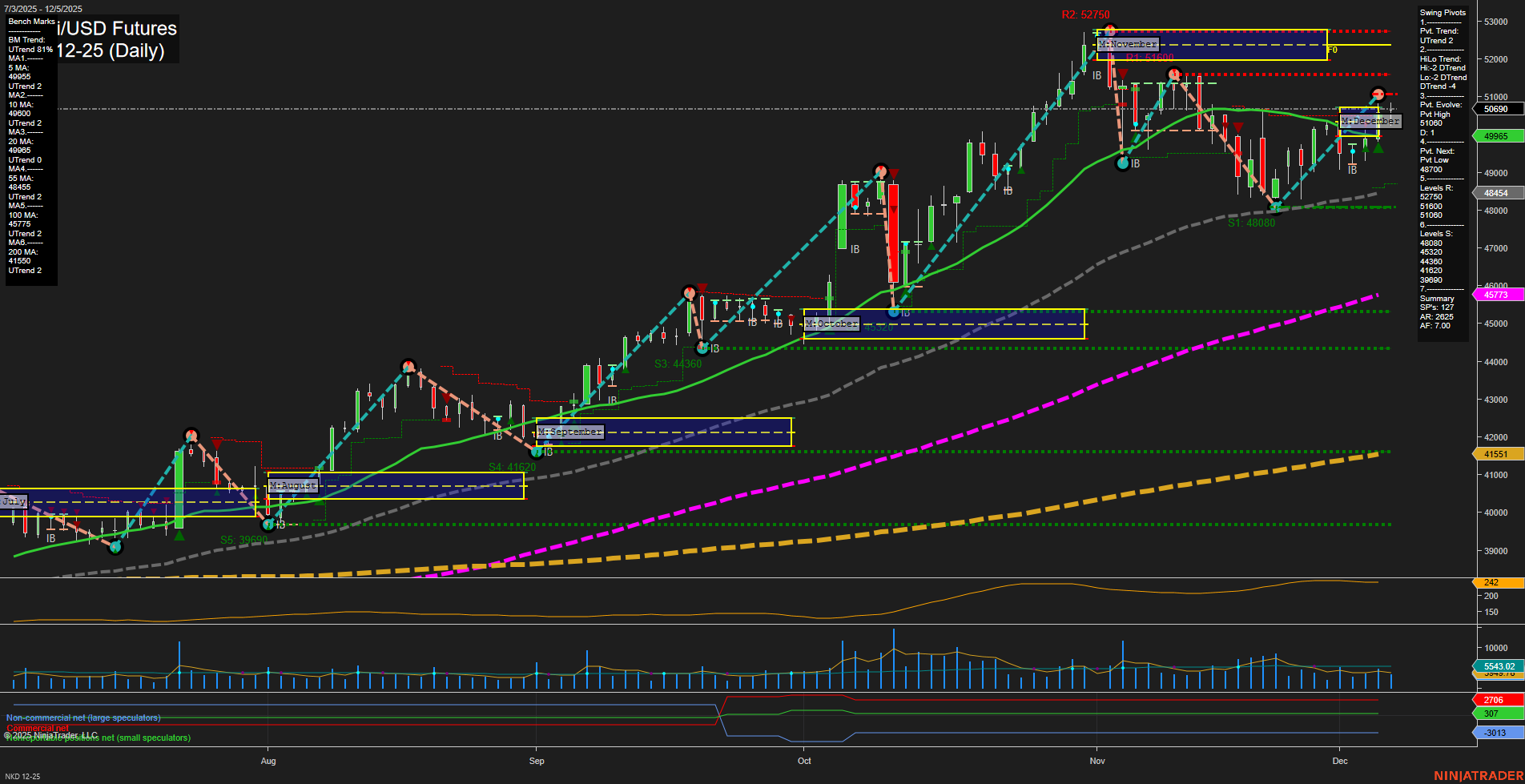

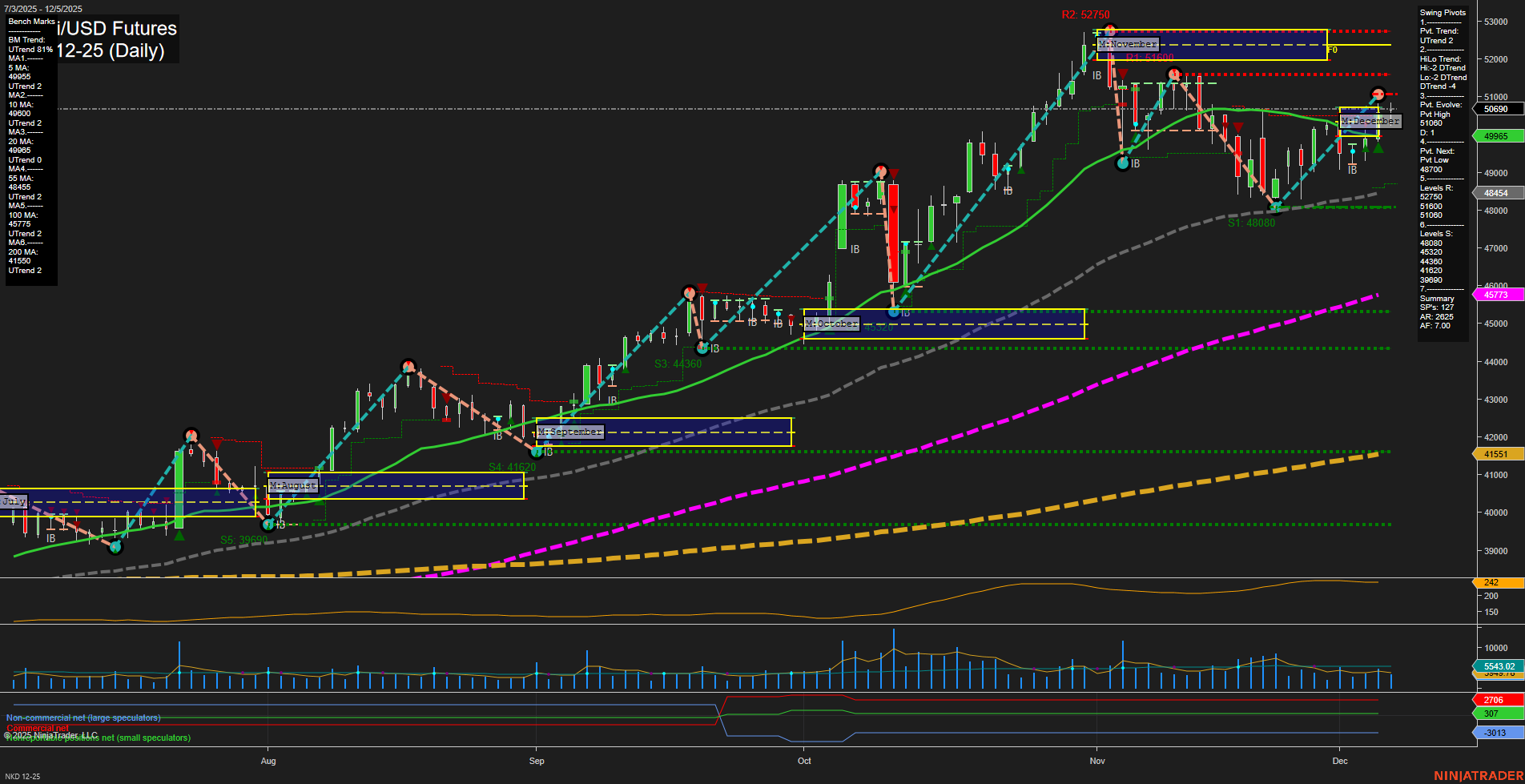

NKD Nikkei/USD Futures Daily Chart Analysis: 2025-Dec-07 18:10 CT

Price Action

- Last: 49985,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 29%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 151%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 51010,

- 4. Pvt. Next: Pvt Low 48700,

- 5. Levels R: 52750, 51700, 51010, 50690,

- 6. Levels S: 48845, 48080, 45773, 41551.

Daily Benchmarks

- (Short-Term) 5 Day: 49955 Up Trend,

- (Short-Term) 10 Day: 49695 Up Trend,

- (Intermediate-Term) 20 Day: 49265 Up Trend,

- (Intermediate-Term) 55 Day: 48545 Up Trend,

- (Long-Term) 100 Day: 45773 Up Trend,

- (Long-Term) 200 Day: 41551 Up Trend.

Additional Metrics

Recent Trade Signals

- 05 Dec 2025: Long NKD 12-25 @ 50455 Signals.USAR-MSFG

- 04 Dec 2025: Long NKD 12-25 @ 50645 Signals.USAR-WSFG

- 01 Dec 2025: Short NKD 12-25 @ 49390 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD futures daily chart shows a market in a strong uptrend across most timeframes, with price action holding above all key moving averages and session fib grid levels. The short-term trend is bullish, supported by recent long trade signals and a series of higher lows, while the intermediate-term trend is more neutral due to a recent swing high and a potential pivot reversal level at 48700. Resistance is layered above at 50690, 51010, 51700, and 52750, with support at 48845 and 48080. Volatility is moderate (ATR 140), and volume remains steady. The market has recently bounced from support and is testing resistance, suggesting a consolidation phase within a broader uptrend. The overall structure favors trend continuation, but the presence of both recent long and short signals highlights the potential for short-term pullbacks or choppy price action before a decisive breakout or further rally.

Chart Analysis ATS AI Generated: 2025-12-07 18:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.