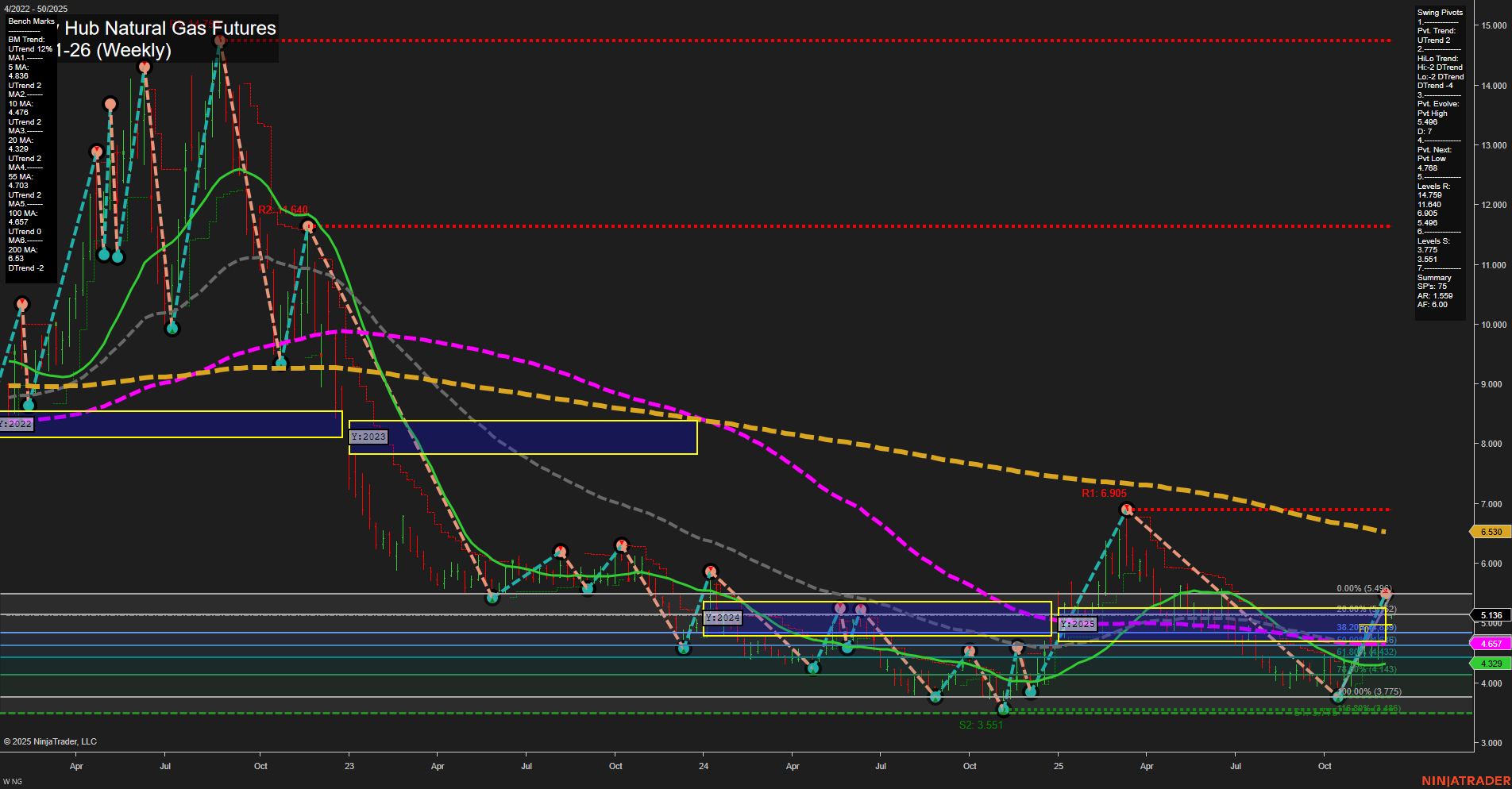

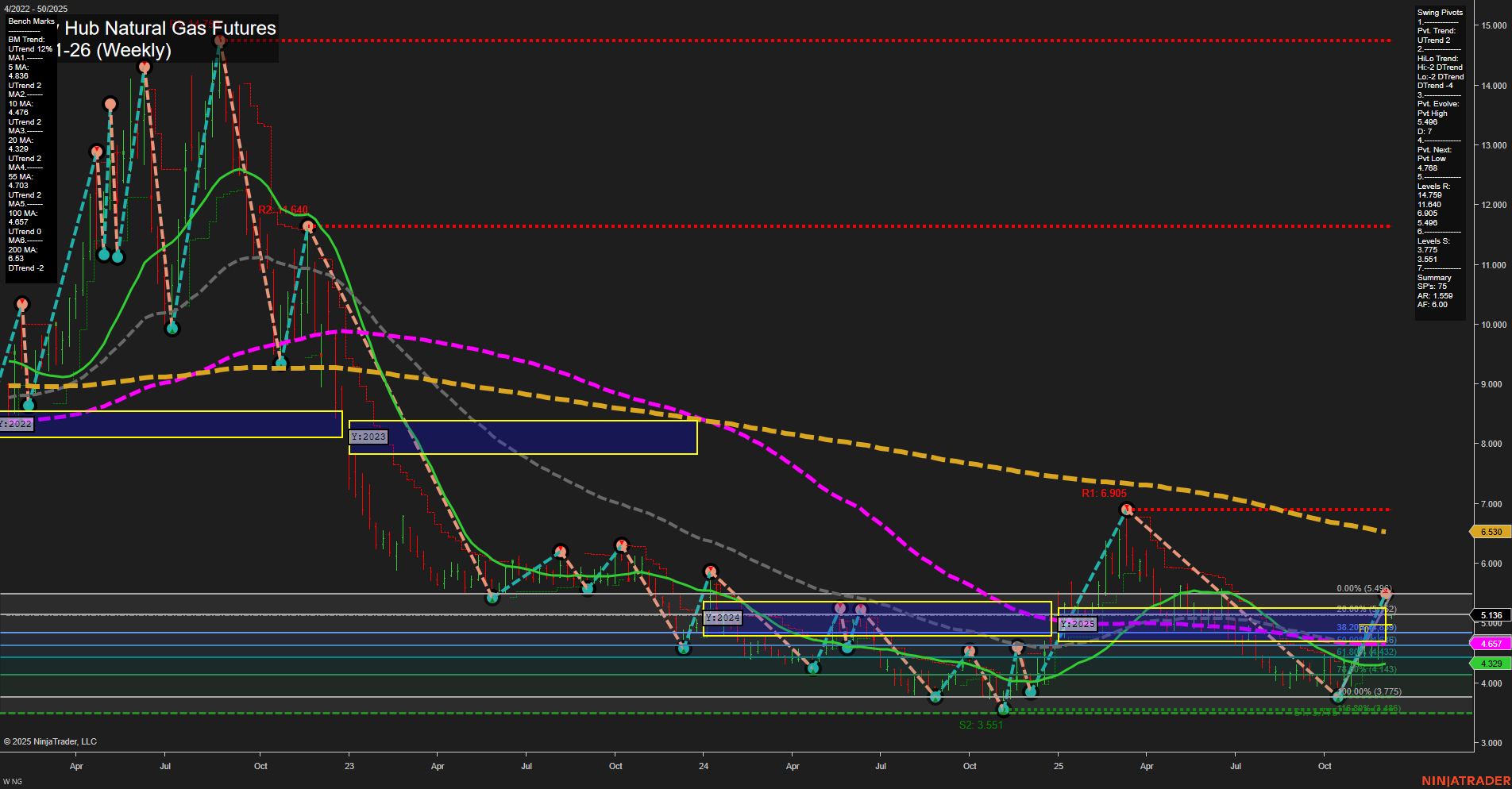

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2025-Dec-07 18:09 CT

Price Action

- Last: 5.496,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -46%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 45%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 5.409,

- 4. Pvt. Next: Pvt Low 4.789,

- 5. Levels R: 14.769, 11.849, 6.905, 5.409,

- 6. Levels S: 3.775, 3.671, 3.551.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 4.384 Up Trend,

- (Intermediate-Term) 10 Week: 4.478 Up Trend,

- (Long-Term) 20 Week: 4.329 Up Trend,

- (Long-Term) 55 Week: 4.657 Down Trend,

- (Long-Term) 100 Week: 6.530 Down Trend,

- (Long-Term) 200 Week: 7.443 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Natural Gas futures have recently shown a strong upward move, with price momentum accelerating and large weekly bars pushing the market above key intermediate and long-term moving averages. The short-term swing pivot trend has shifted to an uptrend, but the intermediate-term HiLo trend remains down, suggesting the recent rally is still counter to the broader trend. Price is currently above the monthly and yearly session fib grid centers, indicating a potential shift in sentiment, but remains below the weekly session fib grid, highlighting short-term resistance. Major resistance levels are clustered above, with 5.409 as the nearest, and significant support is found in the 3.55–3.77 range. The long-term moving averages are still trending down, reflecting a bearish backdrop despite the recent rally. The market appears to be in a recovery phase, possibly a retracement or bounce within a larger downtrend, with volatility elevated and potential for further tests of resistance or consolidation if the rally stalls.

Chart Analysis ATS AI Generated: 2025-12-07 18:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.