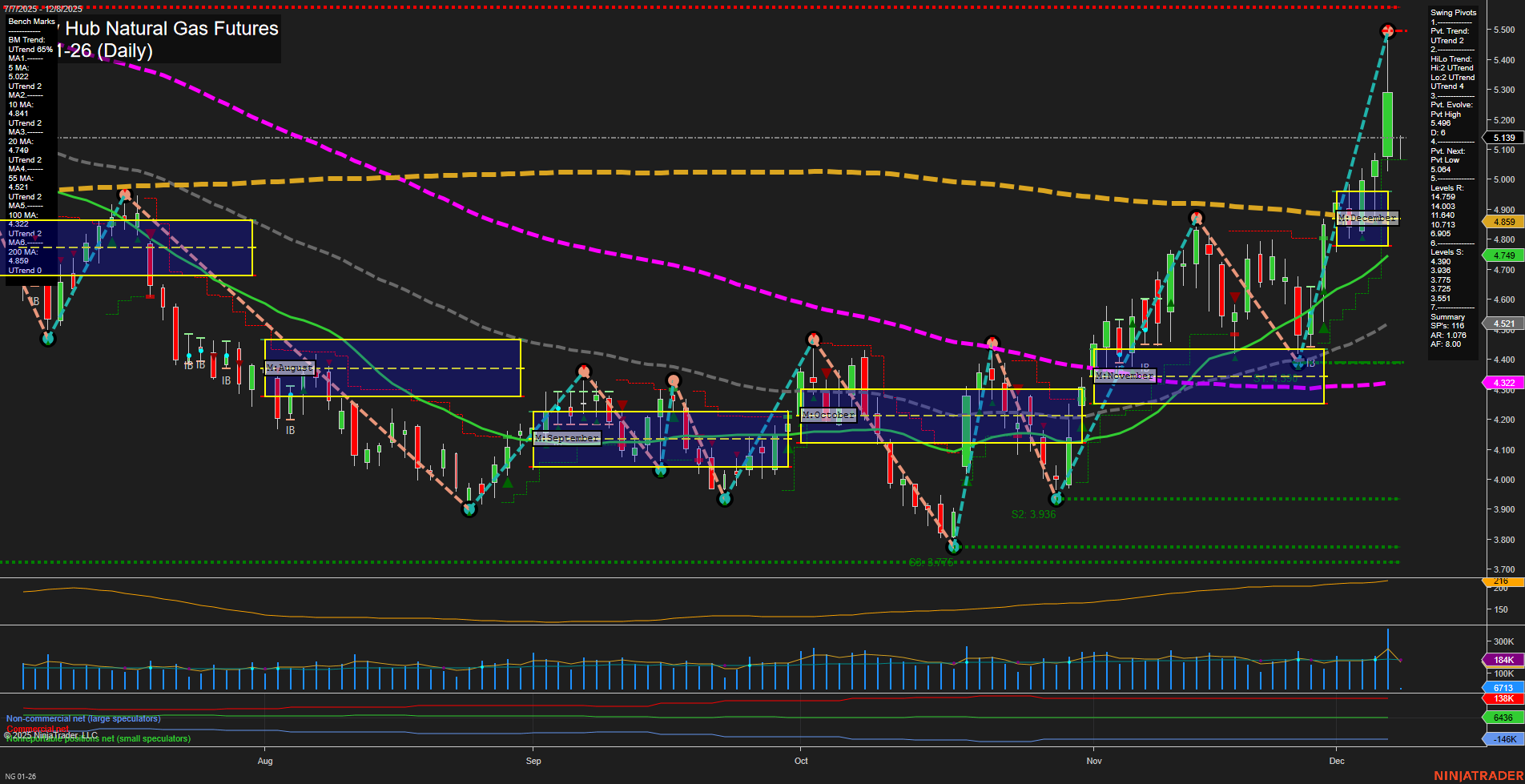

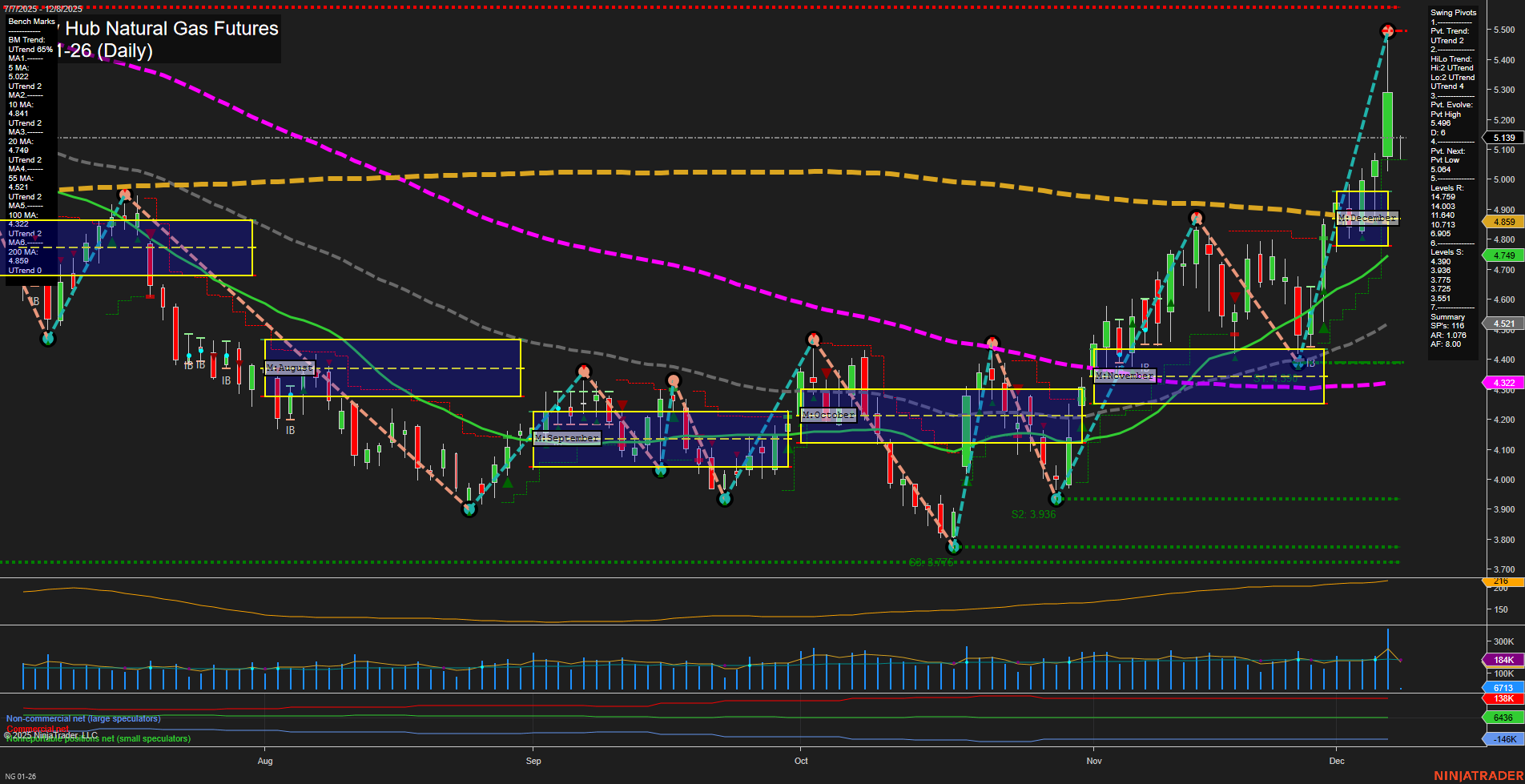

NG Henry Hub Natural Gas Futures Daily Chart Analysis: 2025-Dec-07 18:09 CT

Price Action

- Last: 5.139,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -46%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 45%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 5.486,

- 4. Pvt. Next: Pvt low 5.064,

- 5. Levels R: 5.486, 5.064, 4.859, 4.800,

- 6. Levels S: 4.521, 4.393, 3.936.

Daily Benchmarks

- (Short-Term) 5 Day: 4.841 Up Trend,

- (Short-Term) 10 Day: 4.714 Up Trend,

- (Intermediate-Term) 20 Day: 4.322 Up Trend,

- (Intermediate-Term) 55 Day: 4.009 Up Trend,

- (Long-Term) 100 Day: 4.143 Up Trend,

- (Long-Term) 200 Day: 4.890 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

Natural gas futures have surged with strong momentum, as evidenced by large bars and a fast-moving price action, pushing the last price to 5.139. The short-term swing pivot trend has shifted decisively to an uptrend, with the most recent pivot high at 5.486 and the next potential pivot low at 5.064, indicating a market in breakout mode. All benchmark moving averages across short, intermediate, and long-term horizons are trending upward, confirming broad-based strength. The intermediate and long-term session fib grids (MSFG and YSFG) both show price above their respective NTZ/F0% levels, reinforcing the bullish structure, while the weekly grid (WSFG) remains in a downtrend, suggesting the recent rally is still overcoming prior resistance. Volatility is elevated (ATR 285) and volume is robust (VOLMA 171211), supporting the conviction behind the move. The market is currently testing multi-month highs, with resistance levels above and a cluster of support below, reflecting a strong trend continuation environment. This setup is characteristic of a powerful rally phase, with the potential for further upside as long as the uptrend structure holds.

Chart Analysis ATS AI Generated: 2025-12-07 18:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.