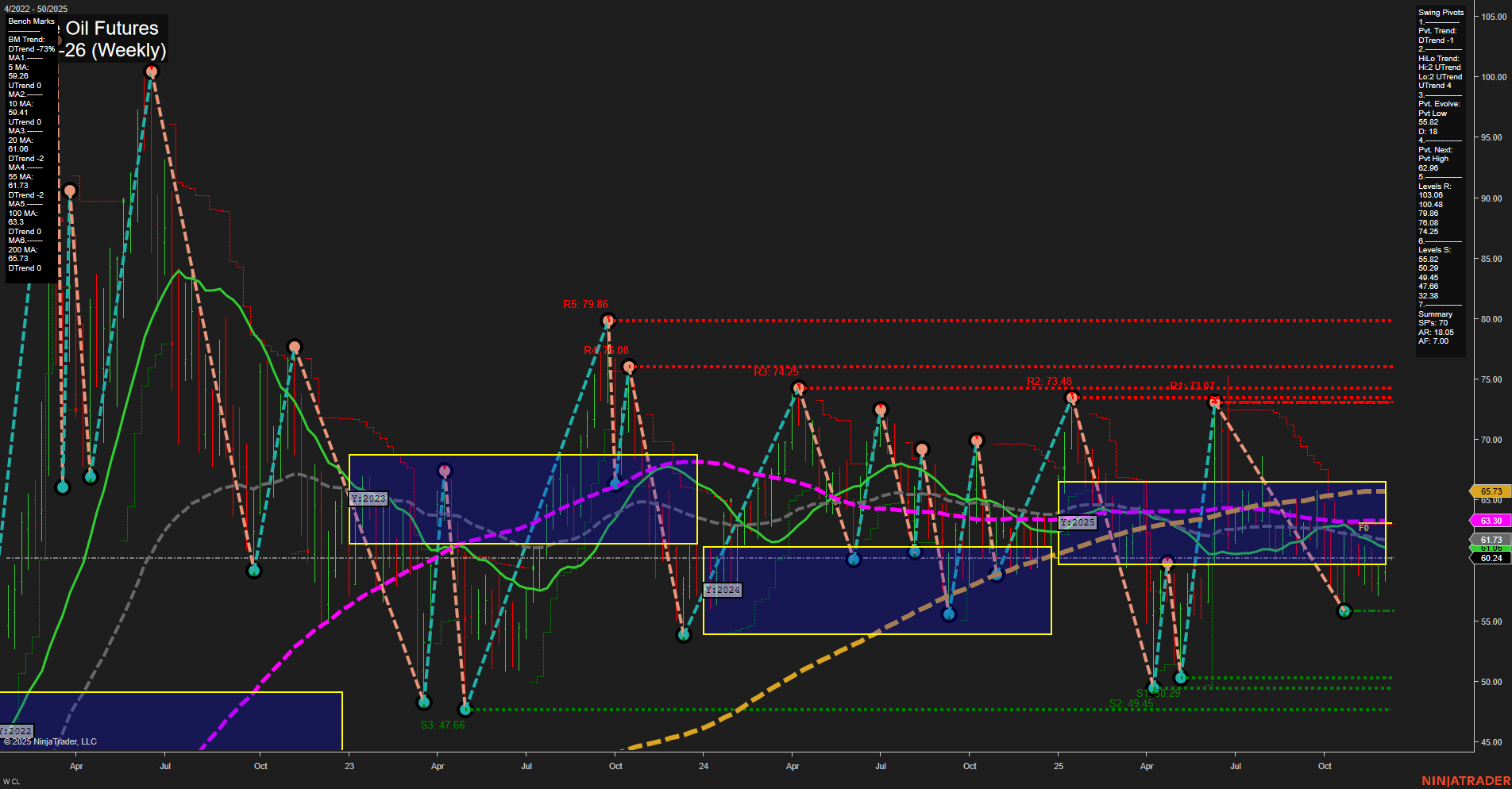

Crude oil futures are currently trading in a medium-range bar environment with slow momentum, reflecting a market that is consolidating after recent volatility. The short-term WSFG and intermediate-term MSFG both show price above their respective NTZ/F0% levels and are trending up, suggesting a potential for further upside in the near to intermediate term. However, the yearly YSFG trend remains down, with price below the annual NTZ, indicating that the broader long-term structure is still bearish. Swing pivots highlight a short-term downtrend but an intermediate-term uptrend, with the most recent pivot low at 52.49 and the next key resistance at 62.96. Major resistance levels cluster in the 70s and 100s, while support is found in the low 60s and mid-50s. All major weekly moving averages (5, 10, 20, 55, 100, 200) are trending down, reinforcing the longer-term bearish bias despite recent short-term buy signals. Recent trade signals show mixed activity, with both long and short entries triggered in early December, reflecting the choppy and indecisive nature of the current market. Overall, the market is in a transitional phase: short-term action is neutral, intermediate-term is showing bullish recovery potential, but the long-term outlook remains bearish until a sustained move above key resistance and moving averages occurs. This environment favors swing traders who can adapt to both range-bound and breakout conditions, watching for confirmation of trend continuation or reversal.