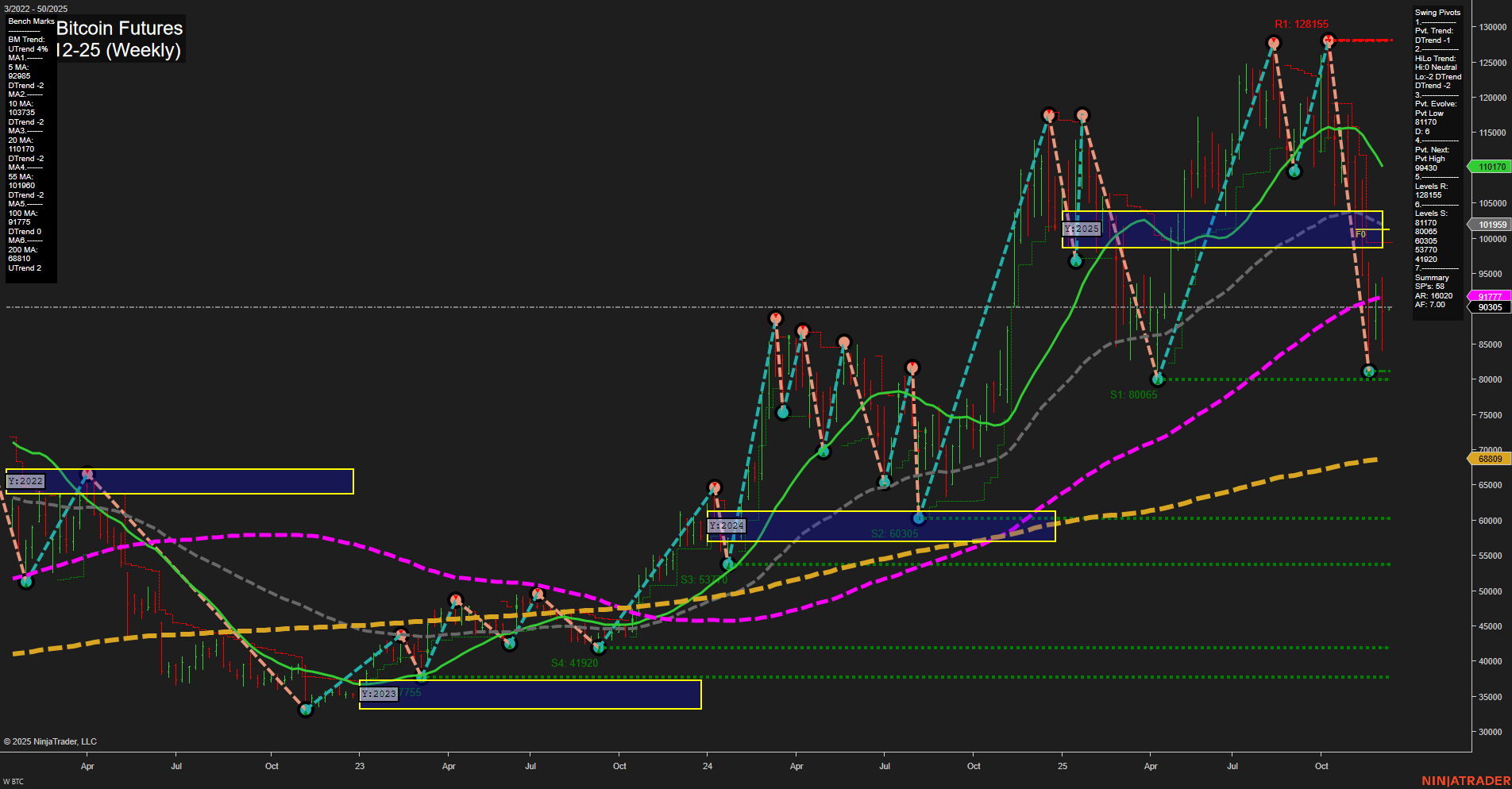

The current weekly chart for BTC CME Bitcoin Futures shows a pronounced shift in momentum, with large bars and fast price action indicating heightened volatility. Short-term and intermediate-term trends have turned bearish, as confirmed by both the swing pivot trends and the recent short trade signals. Price is currently below key moving averages (5, 10, and 20 week), all of which are trending down, reinforcing the bearish bias in the near to intermediate term. However, long-term moving averages (55, 100, and 200 week) remain in an uptrend, suggesting that the broader bullish structure is still intact, though under pressure. The price is trading above the weekly and monthly session fib grid centers (NTZ), but remains below the yearly NTZ, highlighting a divergence between short/intermediate-term strength and long-term weakness. Key resistance levels are clustered above at 94,043, 101,959, and 128,155, while support is found at 80,065 and lower at 60,305 and 53,731. The recent swing low at 80,065 is a critical level to watch for potential downside continuation, while any sustained move above 101,959 could signal a reversal attempt. Overall, the market is in a corrective phase within a larger uptrend, with the potential for further downside or consolidation before a new directional move emerges. Swing traders should be attentive to volatility, the evolving pivot structure, and the interaction with major support and resistance levels as the market seeks direction into year-end.