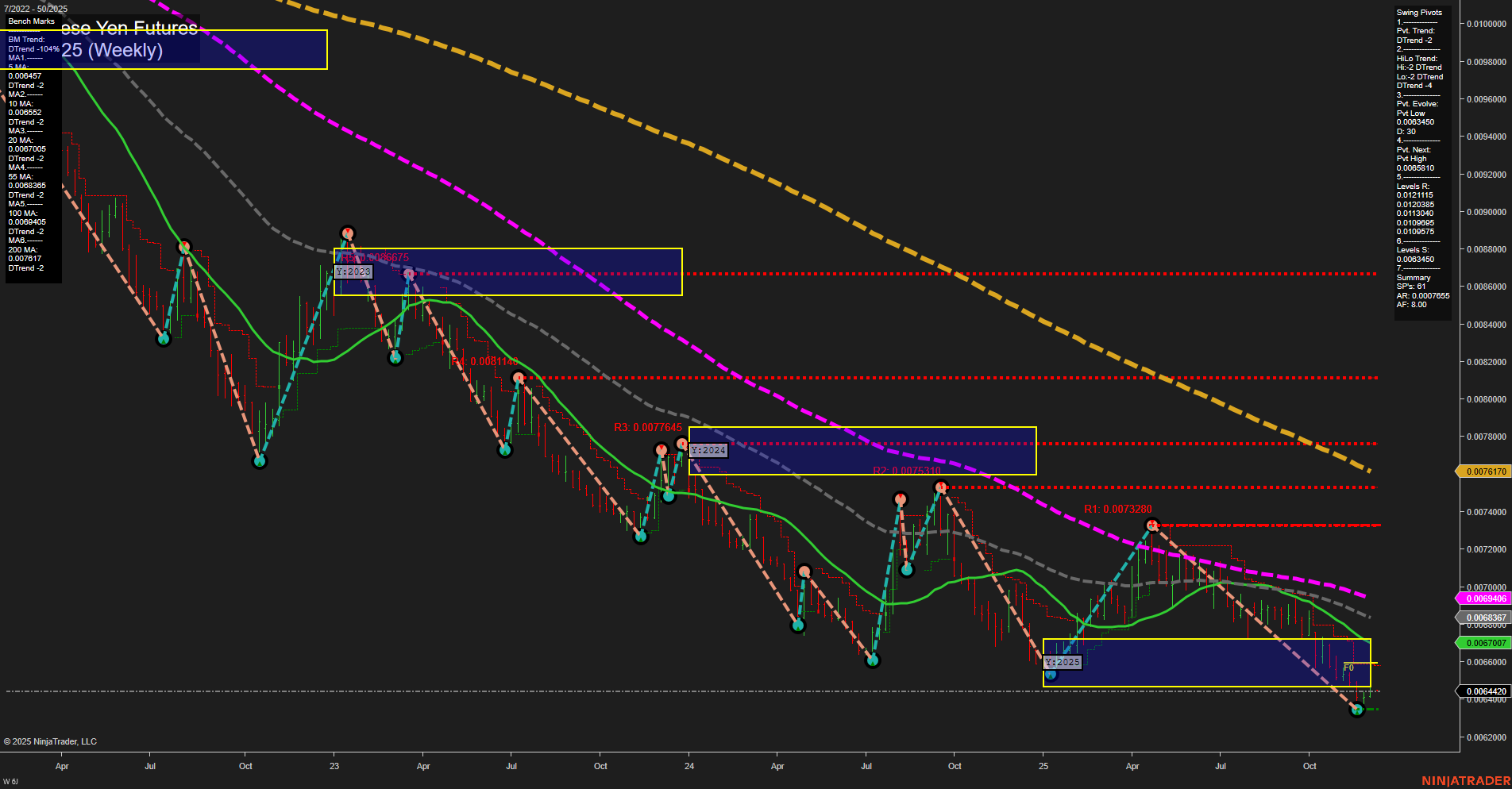

The 6J Japanese Yen Futures weekly chart shows a market in a prolonged downtrend, with all major long-term moving averages (20, 55, 100, 200 week) trending lower and price trading below these benchmarks. The yearly session fib grid (YSFG) confirms a persistent bearish bias, with price well below the yearly NTZ and F0% levels. However, both the weekly and monthly session fib grids (WSFG, MSFG) indicate a short-term and intermediate-term attempt at a bounce, as price is currently above their respective F0%/NTZ levels and recent trade signals have triggered long entries. Despite this, swing pivot analysis highlights that both short-term and intermediate-term trends remain down, with the most recent pivot being a new low at 0.0064420 and the next resistance pivots significantly higher. The market is currently consolidating near support, with slow momentum and medium-sized bars, suggesting a pause or potential basing phase after a strong selloff. Overall, the structure remains bearish on the long-term, but short-term and intermediate-term traders are watching for signs of a reversal or a more sustained bounce, especially if price can reclaim higher resistance levels and moving averages. Volatility remains moderate, and the market is at a technical crossroads between further downside continuation and a possible recovery attempt.