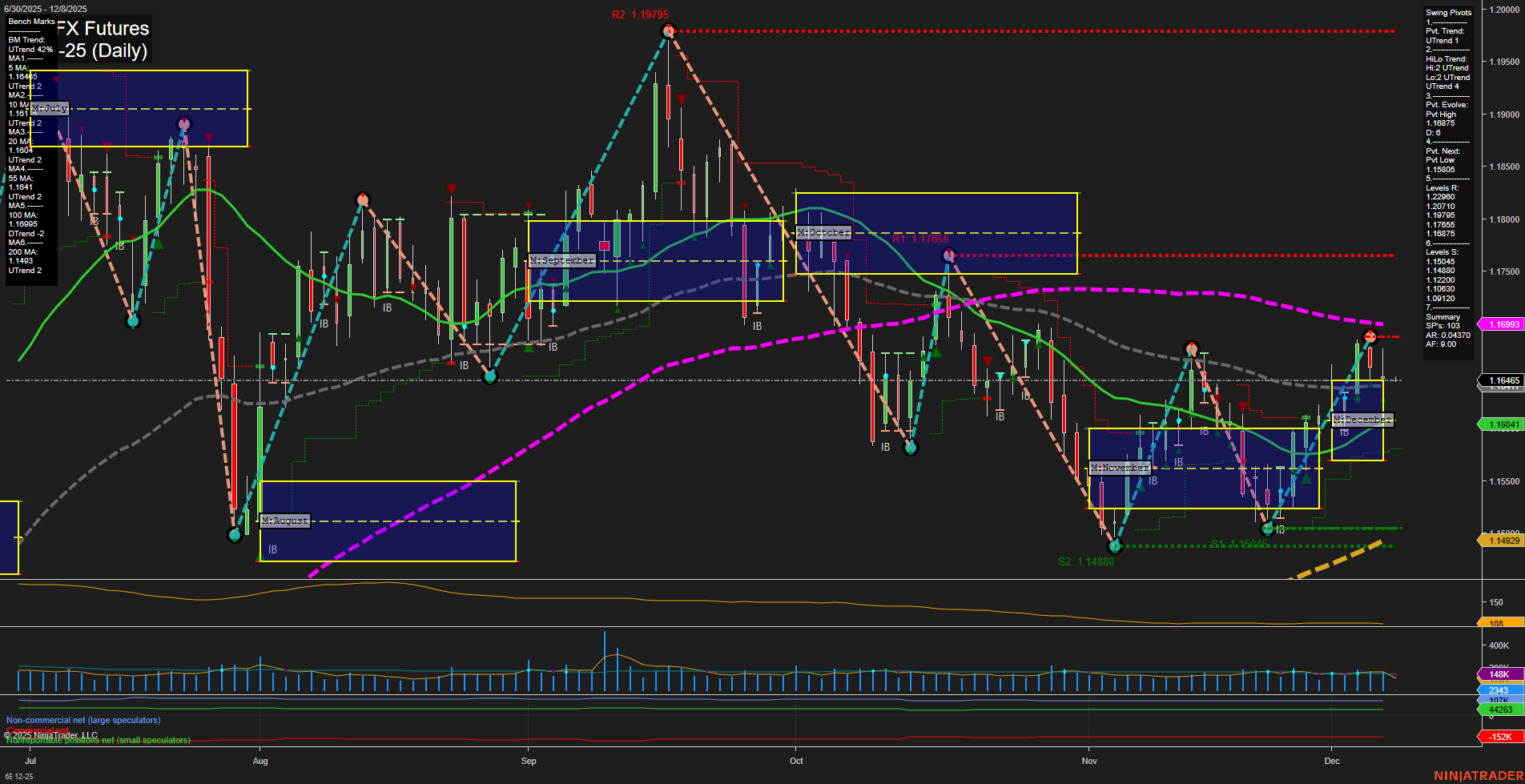

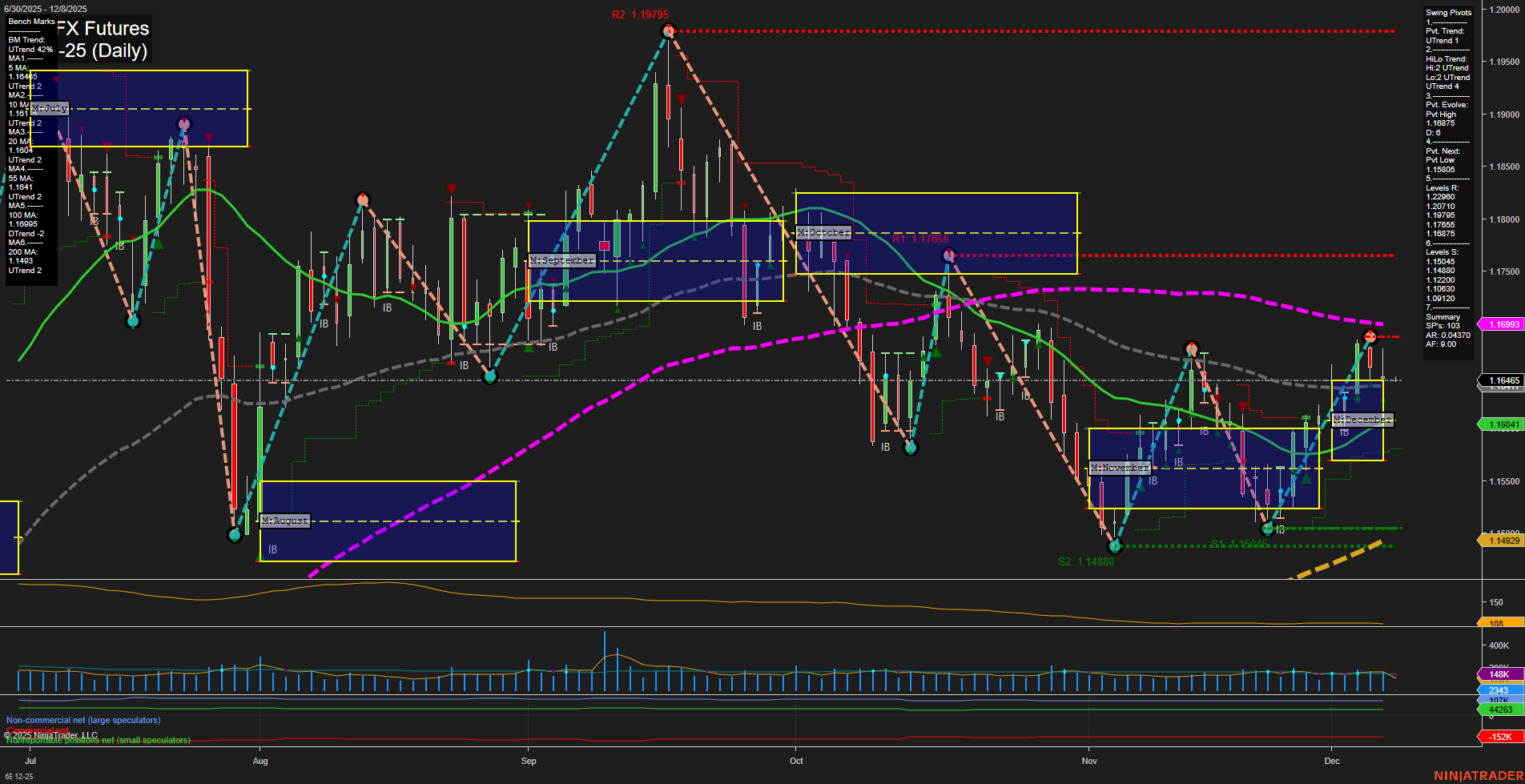

6E Euro FX Futures Daily Chart Analysis: 2025-Dec-07 18:01 CT

Price Action

- Last: 1.16465,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 74%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 1.1687,

- 4. Pvt. Next: Pvt Low 1.1504,

- 5. Levels R: 1.19795, 1.2200, 1.2071, 1.17655, 1.16875,

- 6. Levels S: 1.14880, 1.14504, 1.14299, 1.14000, 1.12920.

Daily Benchmarks

- (Short-Term) 5 Day: 1.16432 Up Trend,

- (Short-Term) 10 Day: 1.16194 Up Trend,

- (Intermediate-Term) 20 Day: 1.16041 Up Trend,

- (Intermediate-Term) 55 Day: 1.16465 Down Trend,

- (Long-Term) 100 Day: 1.16993 Down Trend,

- (Long-Term) 200 Day: 1.16041 Down Trend.

Additional Metrics

Recent Trade Signals

- 05 Dec 2025: Long 6E 12-25 @ 1.16565 Signals.USAR-MSFG

- 01 Dec 2025: Long 6E 12-25 @ 1.16315 Signals.USAR.TR720

- 01 Dec 2025: Long 6E 12-25 @ 1.1631 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures daily chart shows a constructive technical environment for swing traders. Price action is currently in a medium-range bar structure with average momentum, reflecting a recent recovery from November lows. The short-term WSFG trend is down, but price has moved above the monthly and yearly session fib grid centers, indicating intermediate and long-term bullishness. Swing pivots confirm an uptrend in both short and intermediate terms, with the most recent pivot high at 1.1687 and next key support at 1.1504. Daily benchmarks show short-term moving averages trending up, while intermediate and long-term averages are still in a downtrend, suggesting a transitional phase. Recent trade signals have favored the long side, aligning with the prevailing uptrend in pivots and session grids. Volatility and volume are moderate, supporting the potential for continued trend development. Overall, the chart reflects a bullish bias across all timeframes, with the potential for further upside if resistance levels are cleared and the moving averages continue to align upward.

Chart Analysis ATS AI Generated: 2025-12-07 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.