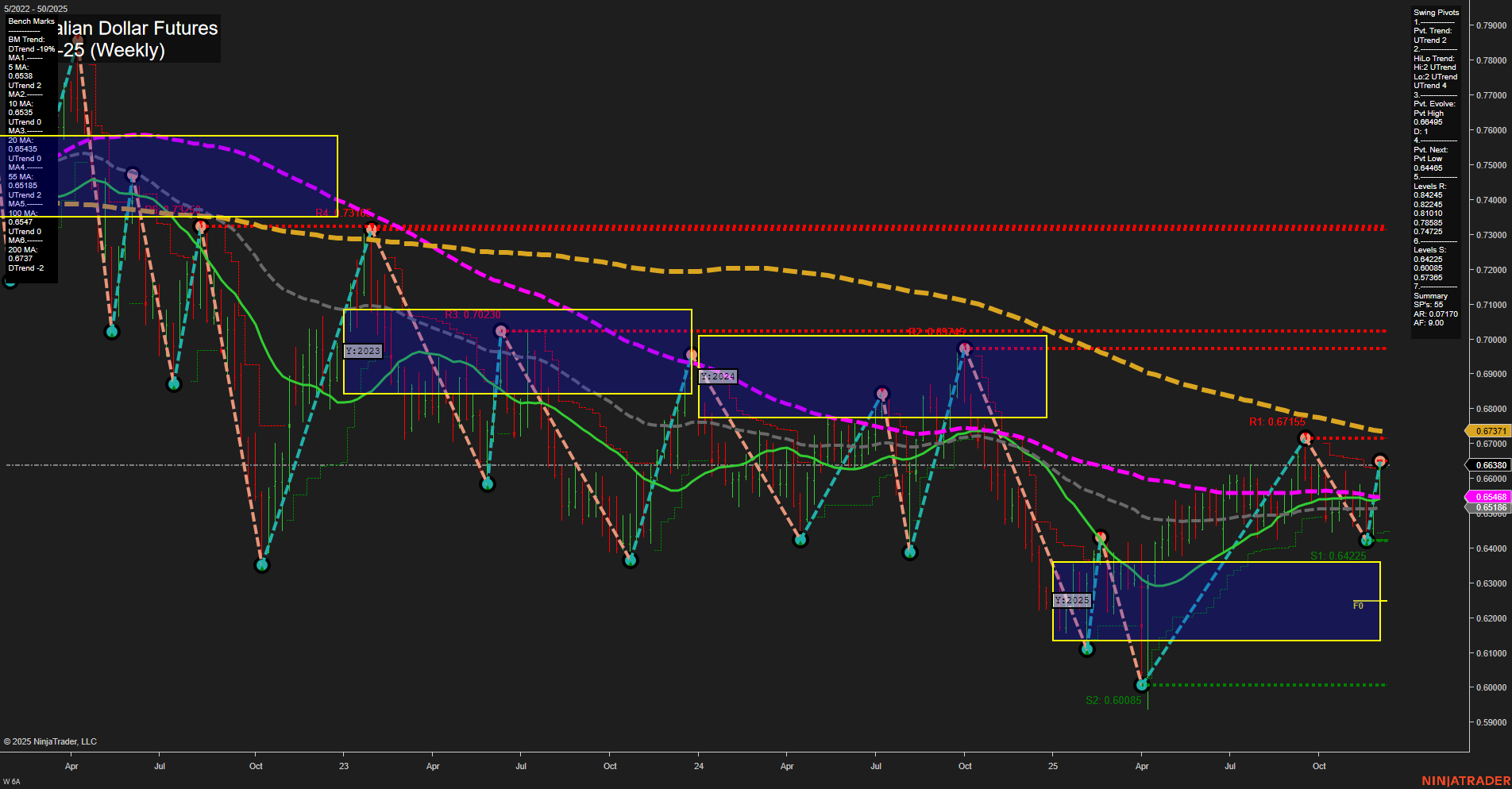

The 6A Australian Dollar Futures weekly chart shows a market that has recently shifted to an upward swing, with both short-term and intermediate-term swing pivot trends in an uptrend. Price is currently trading near 0.66380, with medium-sized bars and average momentum, indicating a steady but not aggressive move. The price is above most intermediate and long-term moving averages, all of which are in uptrends except for the 100 and 200-week MAs, which remain in a downtrend, suggesting that while the recent rally is strong, the longer-term structure is still neutral and has not fully reversed. Resistance is clustered around 0.66405–0.67371, with support at 0.64225 and further below at 0.60085. The neutral bias across all session fib grids (weekly, monthly, yearly) and the lack of a clear breakout above major resistance levels suggest the market is in a consolidation phase within a broader recovery. The overall technical picture points to a bullish short- and intermediate-term outlook, but the long-term remains neutral until a decisive move above the 100 and 200-week benchmarks occurs. This environment is typical of a market transitioning from a base-building phase to a potential new trend, with volatility likely to persist as price tests key resistance and support levels.