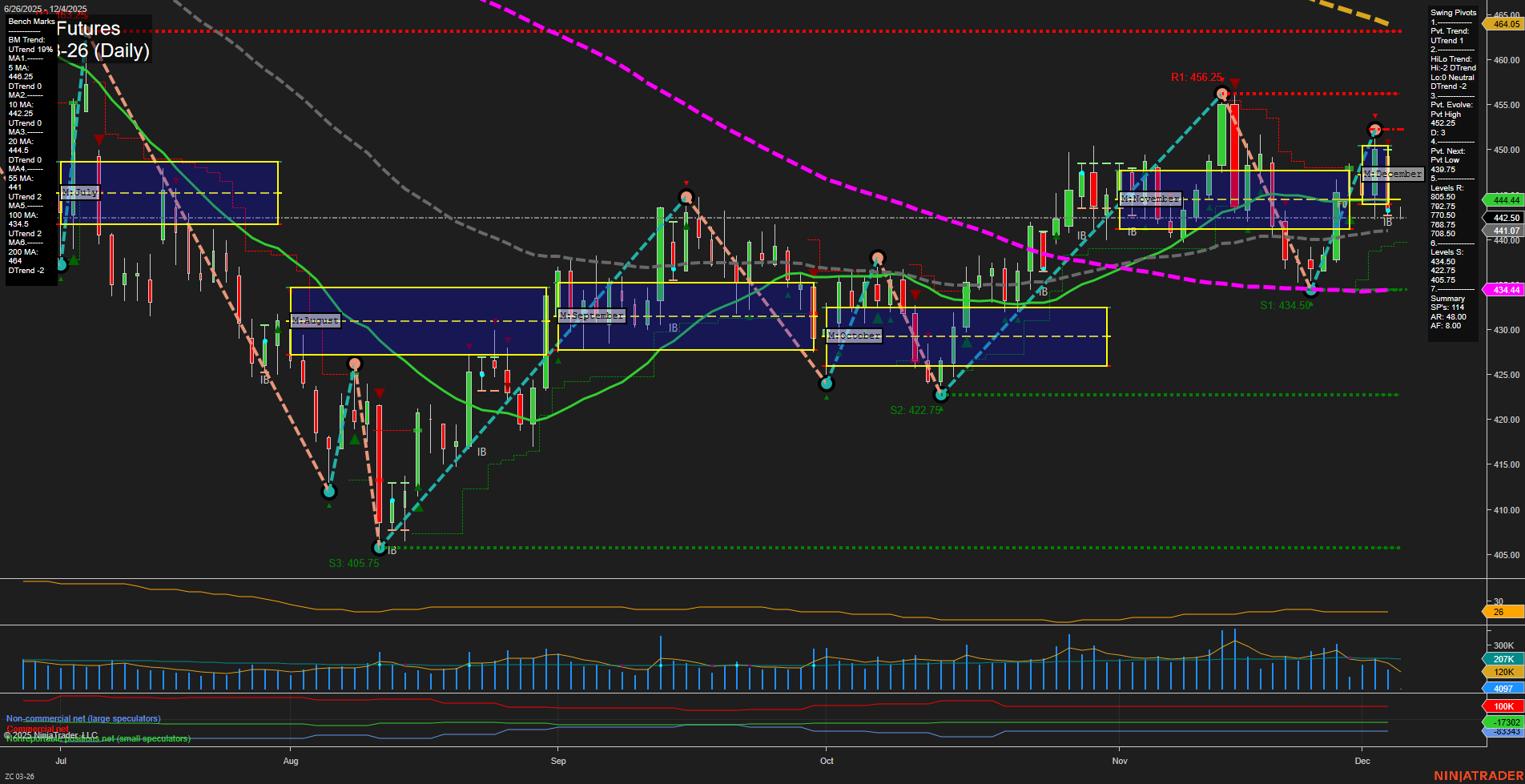

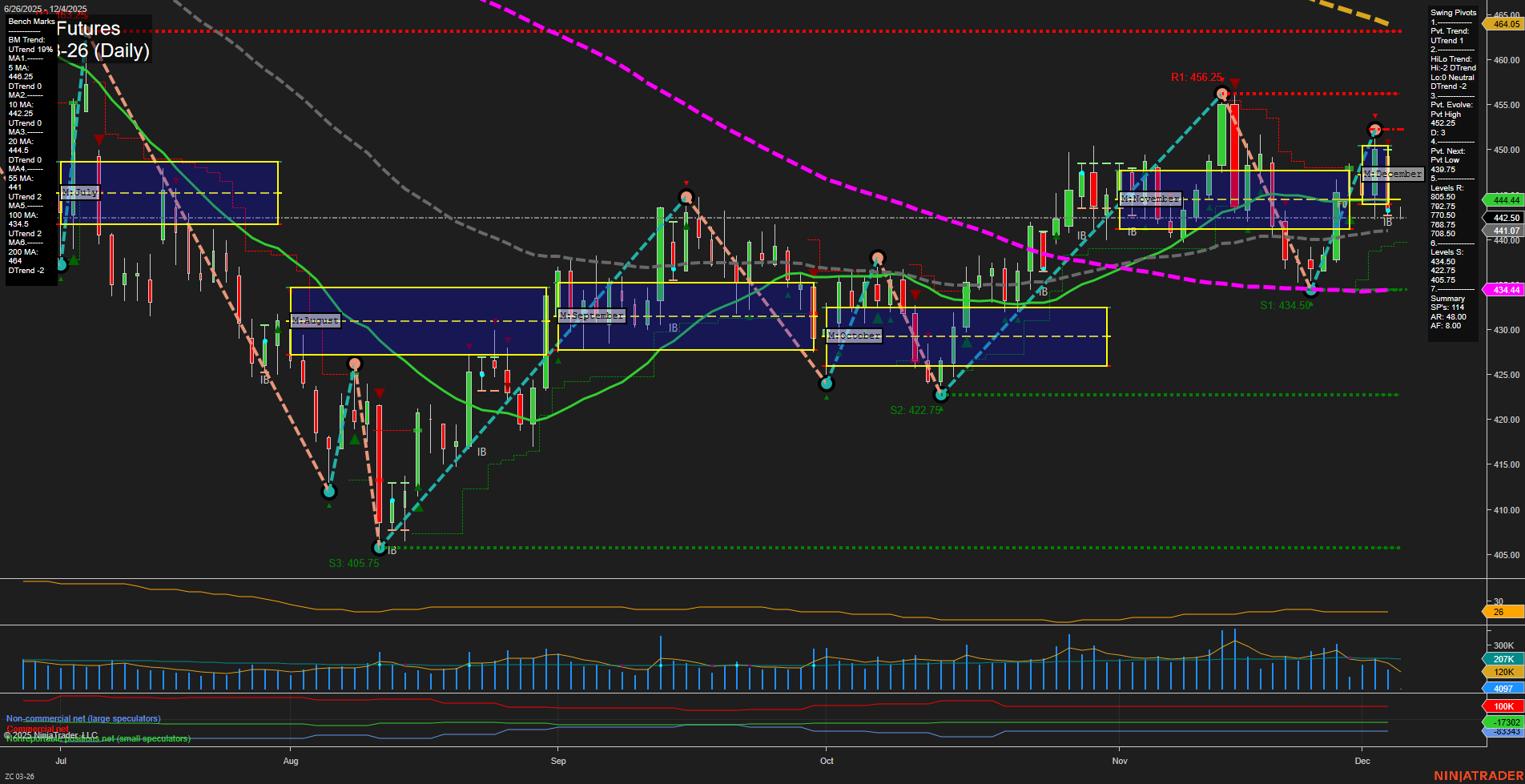

ZC Corn Futures Daily Chart Analysis: 2025-Dec-05 07:20 CT

Price Action

- Last: 444.44,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -9%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -37%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 456.25,

- 4. Pvt. Next: Pvt Low 434.5,

- 5. Levels R: 456.25, 442.25, 440.75, 438.75,

- 6. Levels S: 434.5, 422.75, 405.75.

Daily Benchmarks

- (Short-Term) 5 Day: 445.25 Up Trend,

- (Short-Term) 10 Day: 444.5 Up Trend,

- (Intermediate-Term) 20 Day: 441.07 Up Trend,

- (Intermediate-Term) 55 Day: 434.44 Up Trend,

- (Long-Term) 100 Day: 464 Down Trend,

- (Long-Term) 200 Day: 494 Down Trend.

Additional Metrics

Recent Trade Signals

- 04 Dec 2025: Short ZC 03-26 @ 442.5 Signals.USAR-MSFG

- 03 Dec 2025: Short ZC 03-26 @ 443.5 Signals.USAR.TR120

- 03 Dec 2025: Short ZC 03-26 @ 444.5 Signals.USAR-WSFG

- 02 Dec 2025: Long ZC 03-26 @ 451.25 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

Corn futures are currently exhibiting a mixed technical landscape. Short-term price action is neutral, with the last price near key resistance and recent bars showing average momentum. The weekly session fib grid (WSFG) trend is down, with price below the NTZ, indicating short-term pressure. However, the monthly session fib grid (MSFG) is up, with price above the NTZ, suggesting intermediate-term strength and a possible recovery phase. The swing pivot structure shows a short-term uptrend but an intermediate-term downtrend, with resistance at 456.25 and support at 434.5. Daily benchmarks reveal all short- and intermediate-term moving averages trending up, while long-term averages remain in a downtrend, highlighting a potential transition zone. Recent trade signals have leaned short, reflecting the short-term resistance and possible pullback, but the intermediate-term uptrend remains intact. Volatility is moderate, and volume is healthy. Overall, the market is in a consolidation phase with a bullish intermediate-term bias but faces significant long-term resistance and overhead supply. Traders are likely watching for a decisive breakout above resistance or a failure at support to define the next directional move.

Chart Analysis ATS AI Generated: 2025-12-05 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.