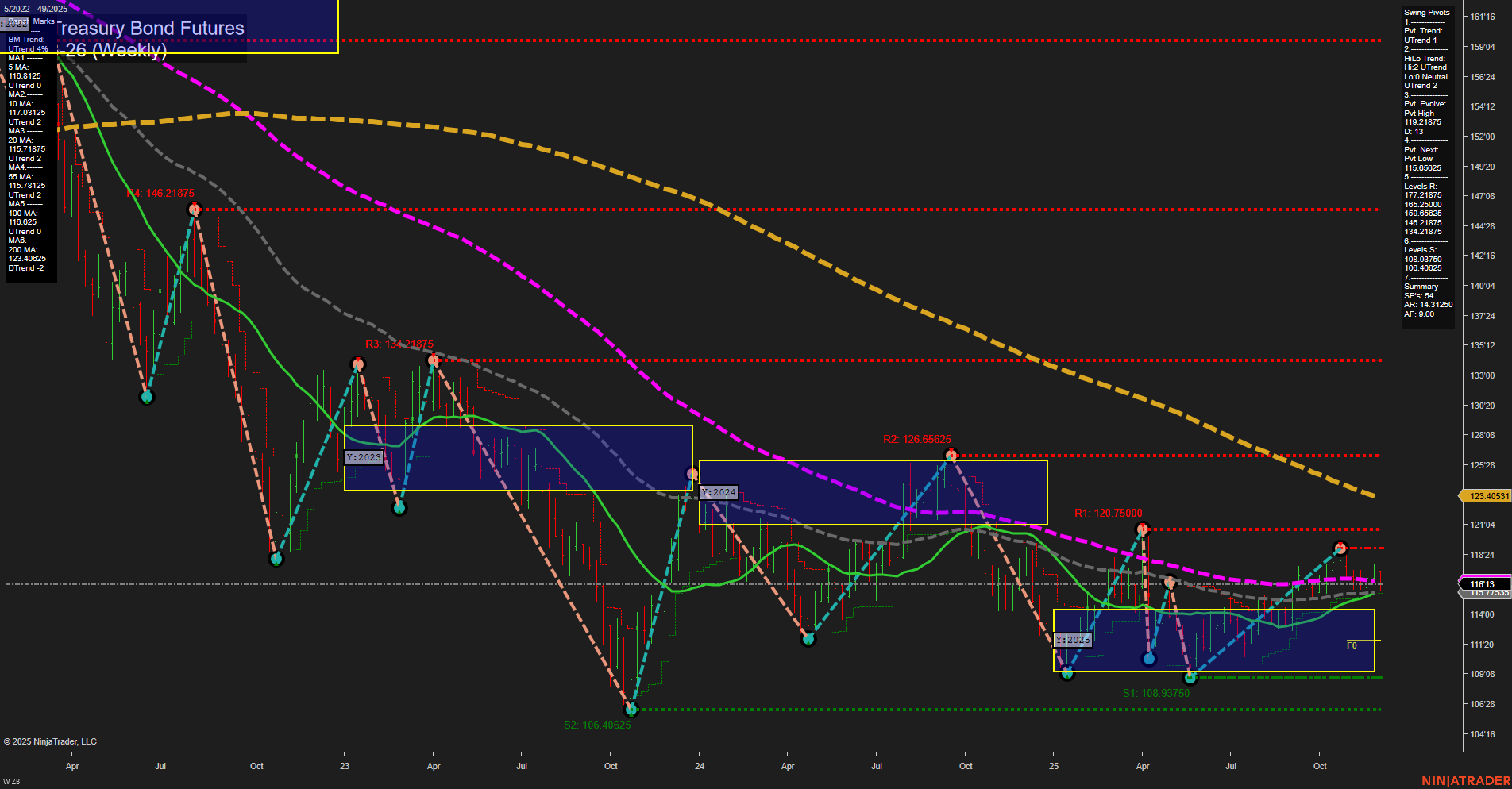

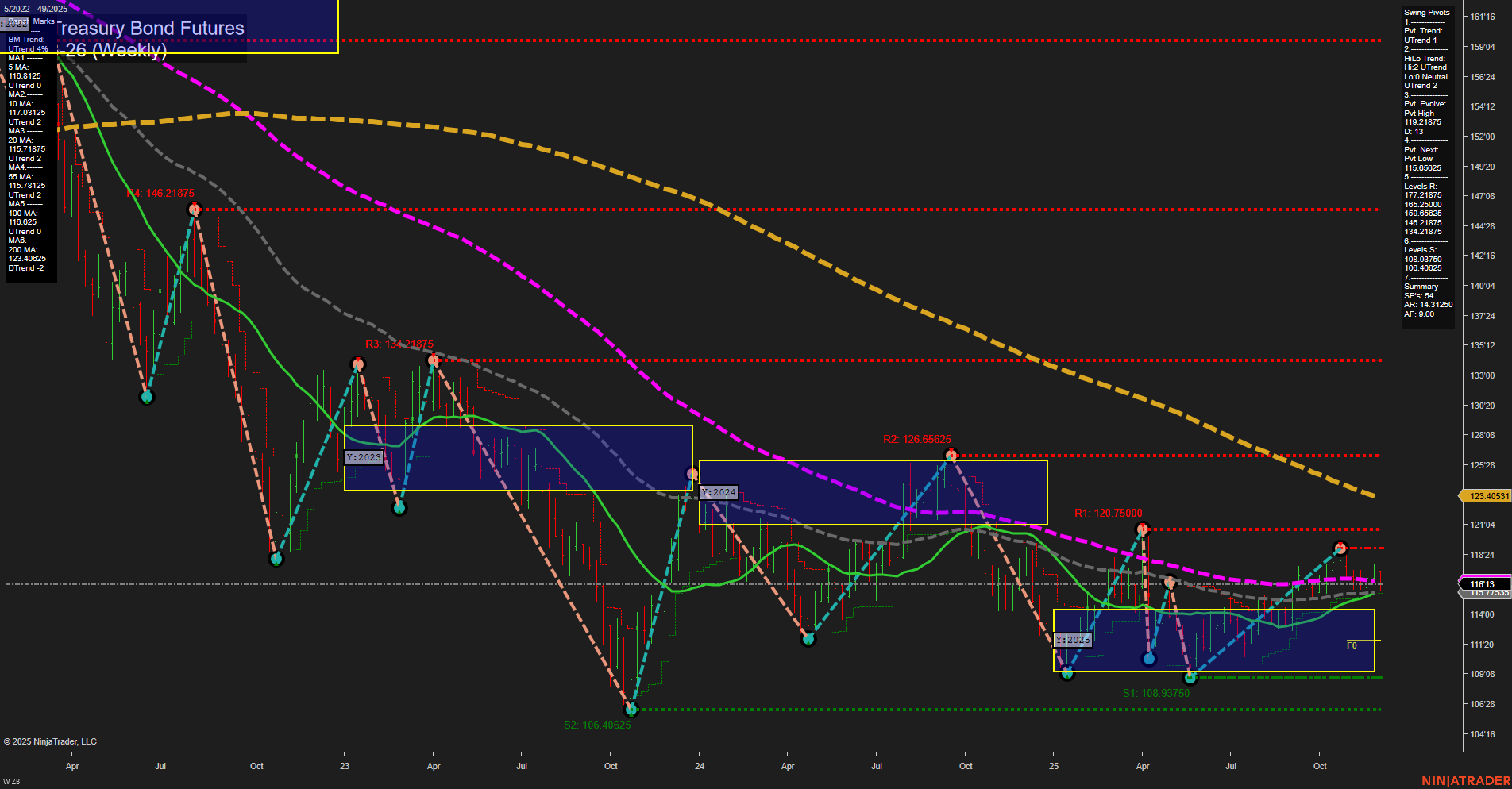

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Dec-05 07:19 CT

Price Action

- Last: 116'13.5,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 119'21.875,

- 4. Pvt. Next: Pvt low 115'06.625,

- 5. Levels R: 126'65.625, 124'21.875, 120'75.000, 119'21.875, 116'21.625,

- 6. Levels S: 108'93.750, 108'40.625, 106'40.625.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 116'18.25 Up Trend,

- (Intermediate-Term) 10 Week: 117'01.25 Up Trend,

- (Long-Term) 20 Week: 118'17.25 Up Trend,

- (Long-Term) 55 Week: 119'18.75 Down Trend,

- (Long-Term) 100 Week: 123'04.25 Down Trend,

- (Long-Term) 200 Week: 132'30.0 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is consolidating with medium-sized bars and slow momentum, indicating a pause after recent moves. Both short-term and intermediate-term swing pivot trends are up, supported by the 5, 10, and 20-week moving averages all trending higher. However, the long-term picture remains bearish, as the 55, 100, and 200-week moving averages are still in downtrends, and price is trading below these key levels. Resistance is layered above at 116'21.625, 119'21.875, and 120'75.000, while support is well-defined at 108'93.750 and 108'40.625. The market is currently neutral within the yearly and monthly session fib grids, suggesting a lack of strong directional conviction. This environment is typical of a market in the process of forming a base or preparing for a larger move, with potential for further consolidation or a breakout as the new year approaches. Swing traders will note the higher lows and the challenge of overhead resistance, with the overall structure favoring short- to intermediate-term bullishness within a longer-term bearish context.

Chart Analysis ATS AI Generated: 2025-12-05 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.