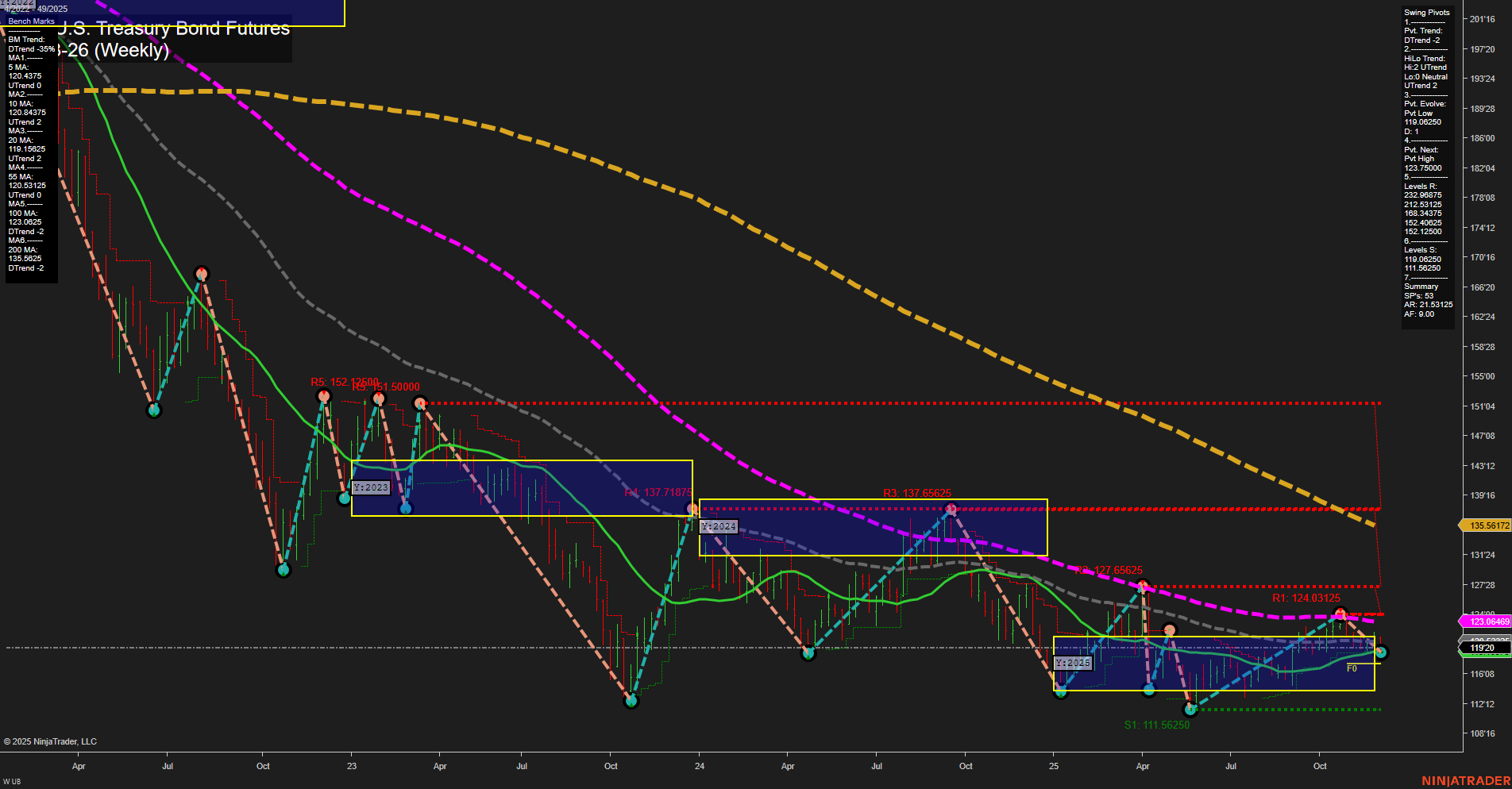

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market under persistent downward pressure, with price action characterized by medium-sized bars and slow momentum. The short-term and intermediate-term Fib grid trends (WSFG and MSFG) are both down, with price trading below their respective NTZ/F0% levels, confirming a bearish bias in these timeframes. The long-term yearly grid (YSFG) is slightly positive, but price remains well below all major moving averages, which are trending down across the board, reinforcing a dominant bearish structure. Swing pivot analysis highlights a short-term downtrend, while the intermediate-term HiLo trend is up, suggesting some underlying support or a potential for a counter-trend bounce. However, the most recent pivots show the market evolving around a low at 119.06250, with the next significant resistance at 123.79688 and major resistance levels much higher, indicating substantial overhead supply. Support is thin, with the next key level at 111.56250. Recent trade signals have triggered new short positions, aligning with the prevailing downtrend. The overall technical landscape points to continued bearishness in the short term, a neutral stance in the intermediate term due to mixed pivot and trend signals, and a bearish long-term outlook given the persistent downtrend in all major moving averages. The market appears to be in a prolonged corrective phase, with any rallies likely to face strong resistance and the risk of further downside if support levels are breached.