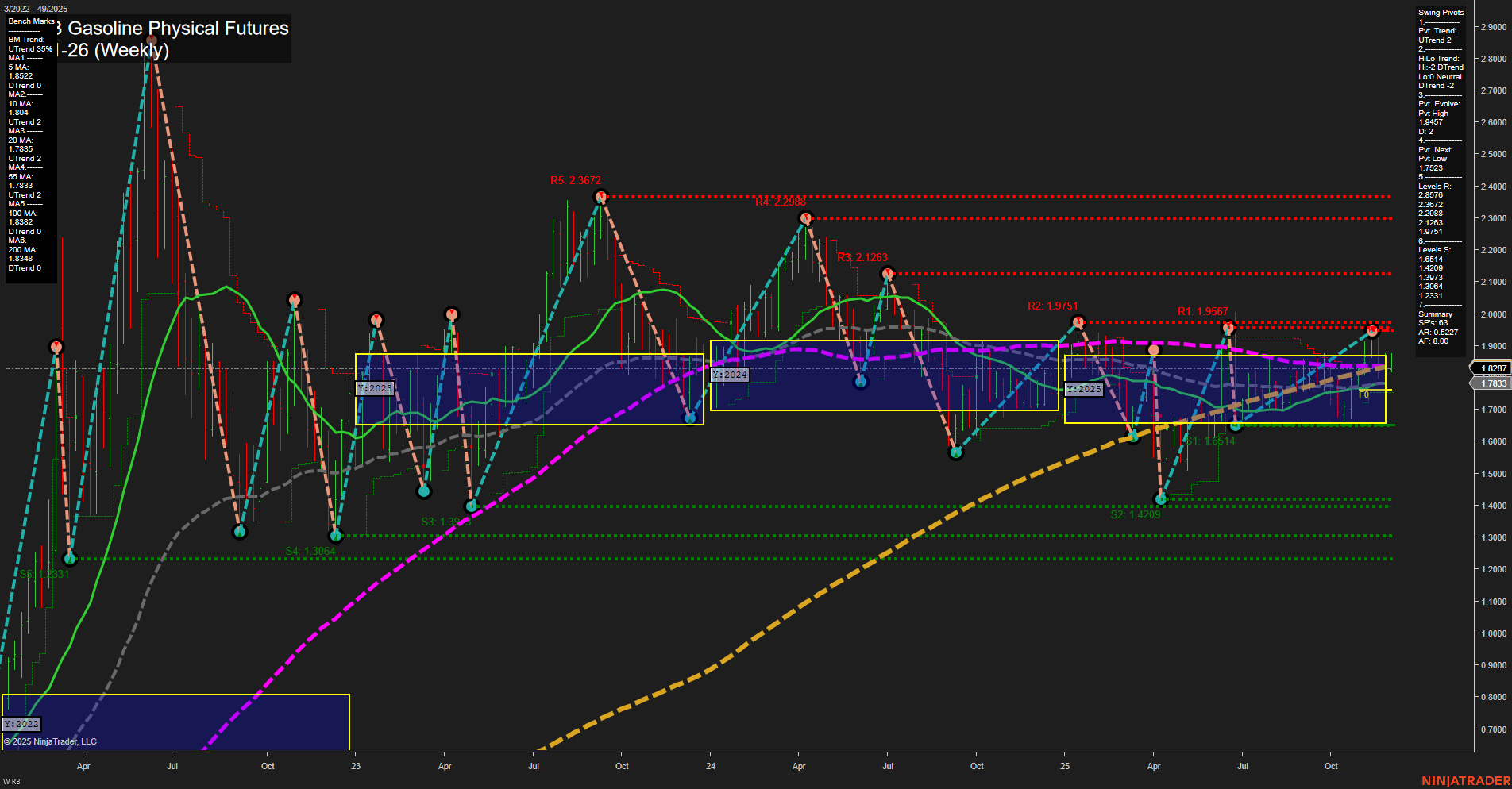

The weekly chart for RB RBOB Gasoline Physical Futures as of early December 2025 shows a market in transition. Price action is currently near the 1.83 level, with medium-sized bars and average momentum, suggesting neither strong conviction nor extreme volatility. Short-term (WSFG) and intermediate-term (MSFG) session fib grid trends are both down, with price below their respective NTZ/F0% levels, indicating recent weakness and a lack of upward momentum in the near term. The swing pivot structure shows a short-term uptrend but an intermediate-term downtrend, highlighting a possible countertrend bounce within a broader corrective phase. Resistance levels are clustered above 1.95 and 2.12, while support is well below at 1.65 and lower, suggesting a wide trading range and potential for volatility if key levels are tested. Benchmark moving averages show a mixed picture: short-term averages (5 and 10 week) are in a downtrend, but all long-term averages (20, 55, 100, 200 week) are in an uptrend, with price currently above most of these longer-term benchmarks. This points to underlying long-term strength despite recent pullbacks. Recent trade signals reflect this choppiness, with both long and short entries triggered in the past week, underscoring indecision and a lack of clear direction in the short run. Overall, the market is consolidating after a corrective move, with short-term neutrality, intermediate-term bearishness, and long-term bullishness. The technical setup suggests a market at a crossroads, with the potential for either a resumption of the long-term uptrend or further consolidation and testing of lower support levels if selling pressure persists.