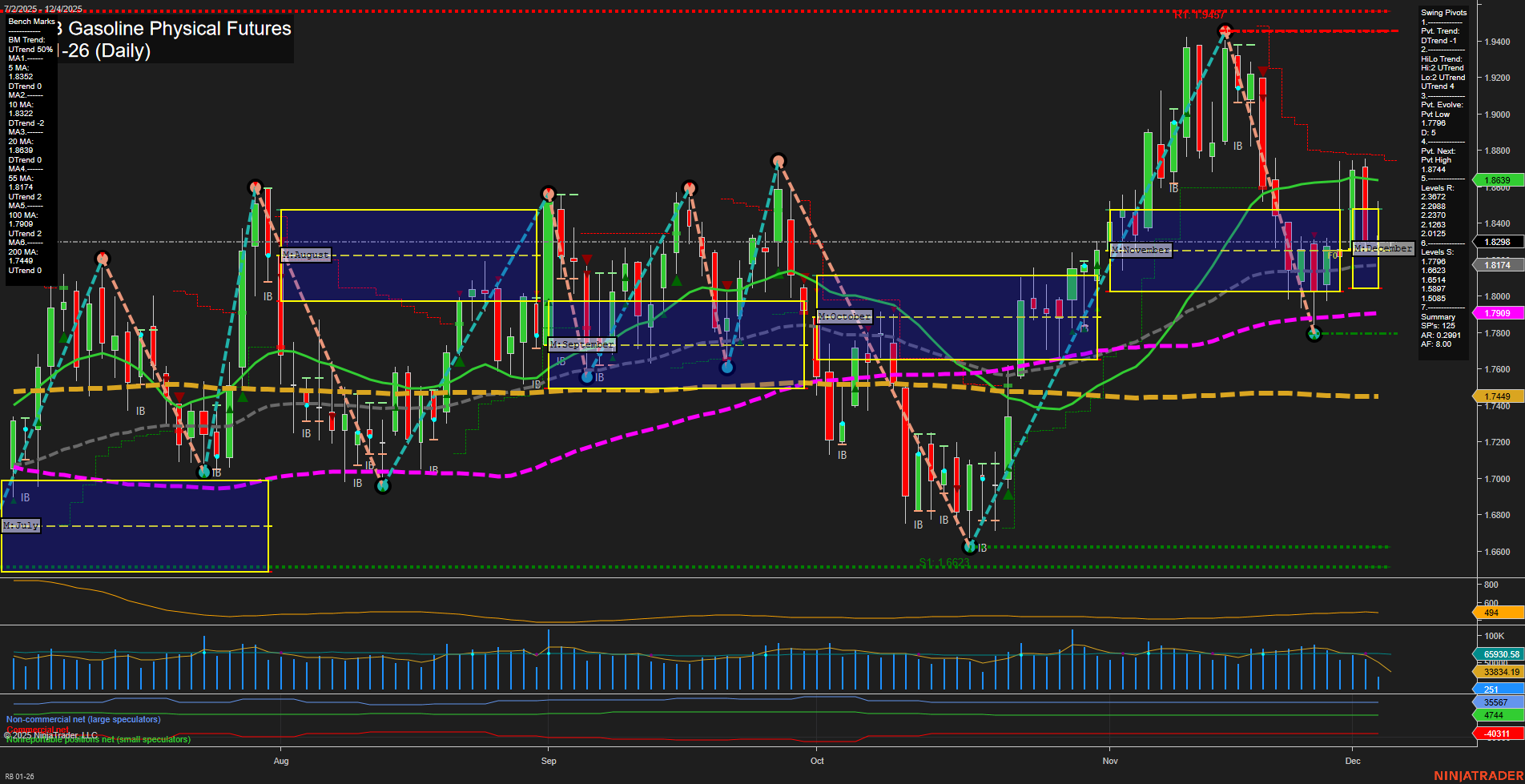

The current daily chart for RBOB Gasoline Physical Futures shows a market in transition. Price action is consolidating with medium-sized bars and slow momentum, indicating a lack of strong directional conviction in the very short term. Both the weekly and monthly session fib grids (WSFG and MSFG) are trending down, with price below their respective NTZ zones, reinforcing a bearish short- and intermediate-term outlook. The swing pivot structure confirms this, with a short-term downtrend (DTrend) and the next key resistance at 1.8774, while support is clustered just below the current price at 1.8093 and 1.8025. Short-term and intermediate-term moving averages (5, 10, 20-day) are all in downtrends, further supporting the bearish bias for swing traders. However, the longer-term (100 and 200-day) moving averages remain in uptrends, and the yearly session fib grid (YSFG) is still up, suggesting the broader trend is intact to the upside. Volatility (ATR) is moderate, and volume is steady, indicating no major shakeouts or breakouts at this time. Recent trade signals have flipped from long to short, reflecting the recent pivot low and the market's struggle to regain higher levels. Overall, the market is experiencing a corrective phase within a longer-term uptrend, with the potential for further downside in the short to intermediate term unless key resistance levels are reclaimed. Swing traders will note the importance of the 1.8093 support and 1.8774 resistance for near-term price action, as a break of either could set the tone for the next directional move.