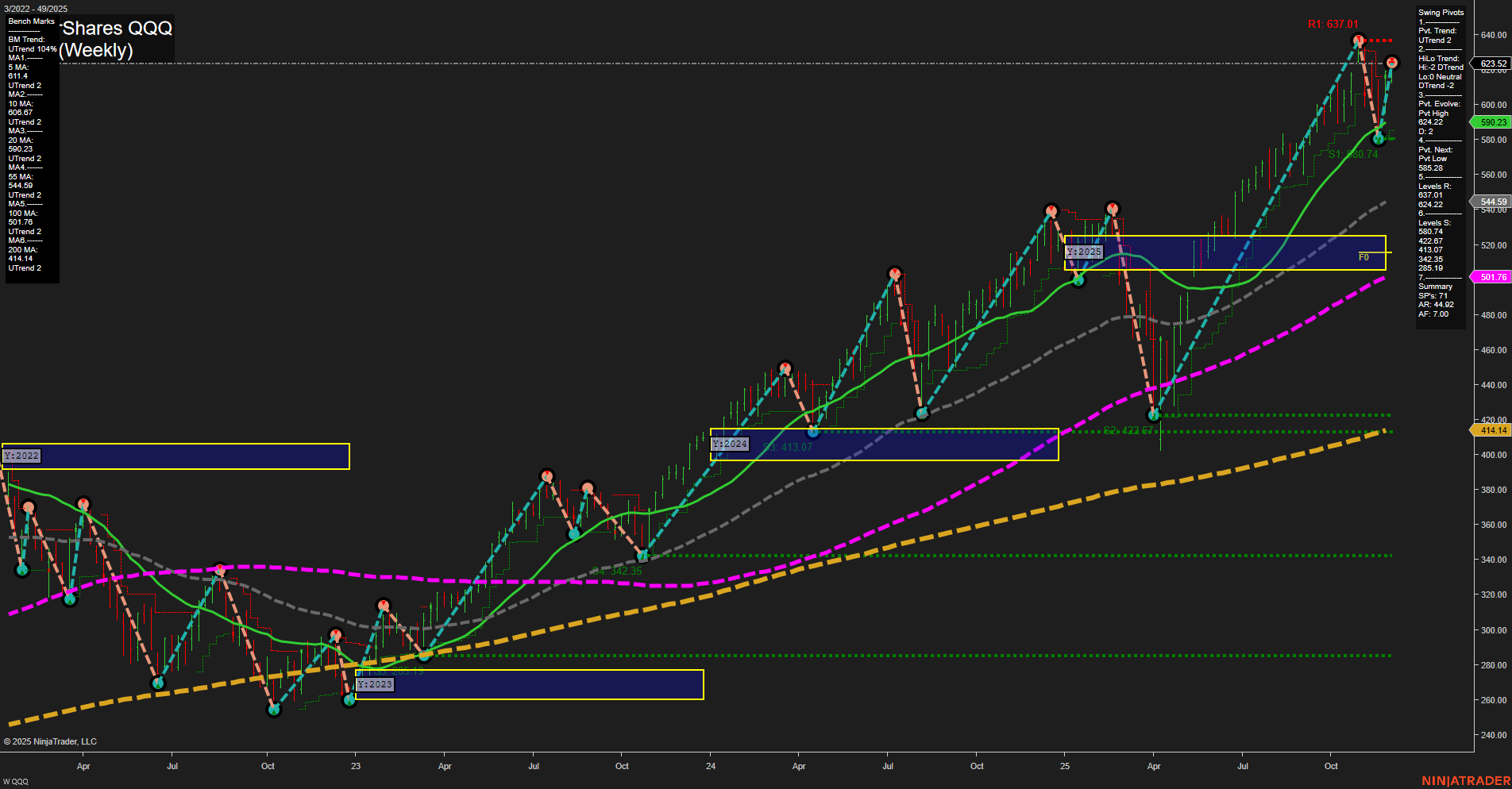

The QQQ weekly chart shows a strong bullish momentum in the short term, with price recently making a new swing high at 624.29 and currently trading just below key resistance at 603.52. The large bars and fast momentum reflect heightened volatility, likely driven by recent market catalysts or news flow. All major moving averages (5, 10, 20, 55, 100, 200 week) are in uptrends, confirming robust underlying strength across timeframes. However, the intermediate-term HiLo trend has shifted to a downtrend, suggesting some caution as the market may be entering a consolidation or corrective phase after a strong rally. Key resistance levels are stacked above, with 637.01 as the next major upside target, while support is well-defined at 560.74 and lower at 472.67. The neutral bias in the session fib grids (WSFG, MSFG, YSFG) indicates the market is at a potential inflection point, with neither buyers nor sellers in clear control at these higher timeframes. Overall, the structure favors trend continuation in the long term, but the intermediate-term signals a possible pause or pullback, typical of a market digesting gains after a breakout. Swing traders should note the potential for choppy price action as the market tests and retests recent highs and support zones.