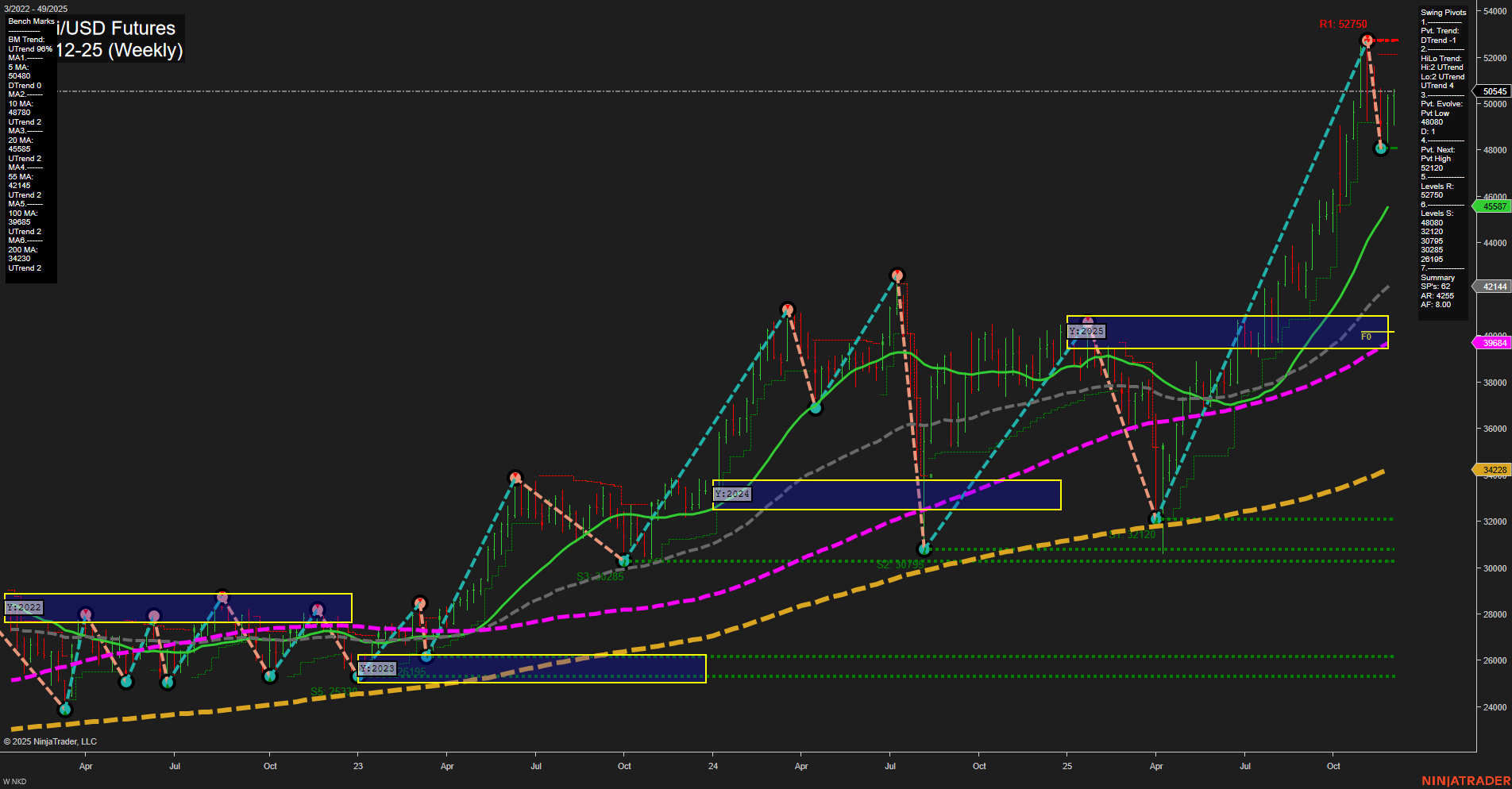

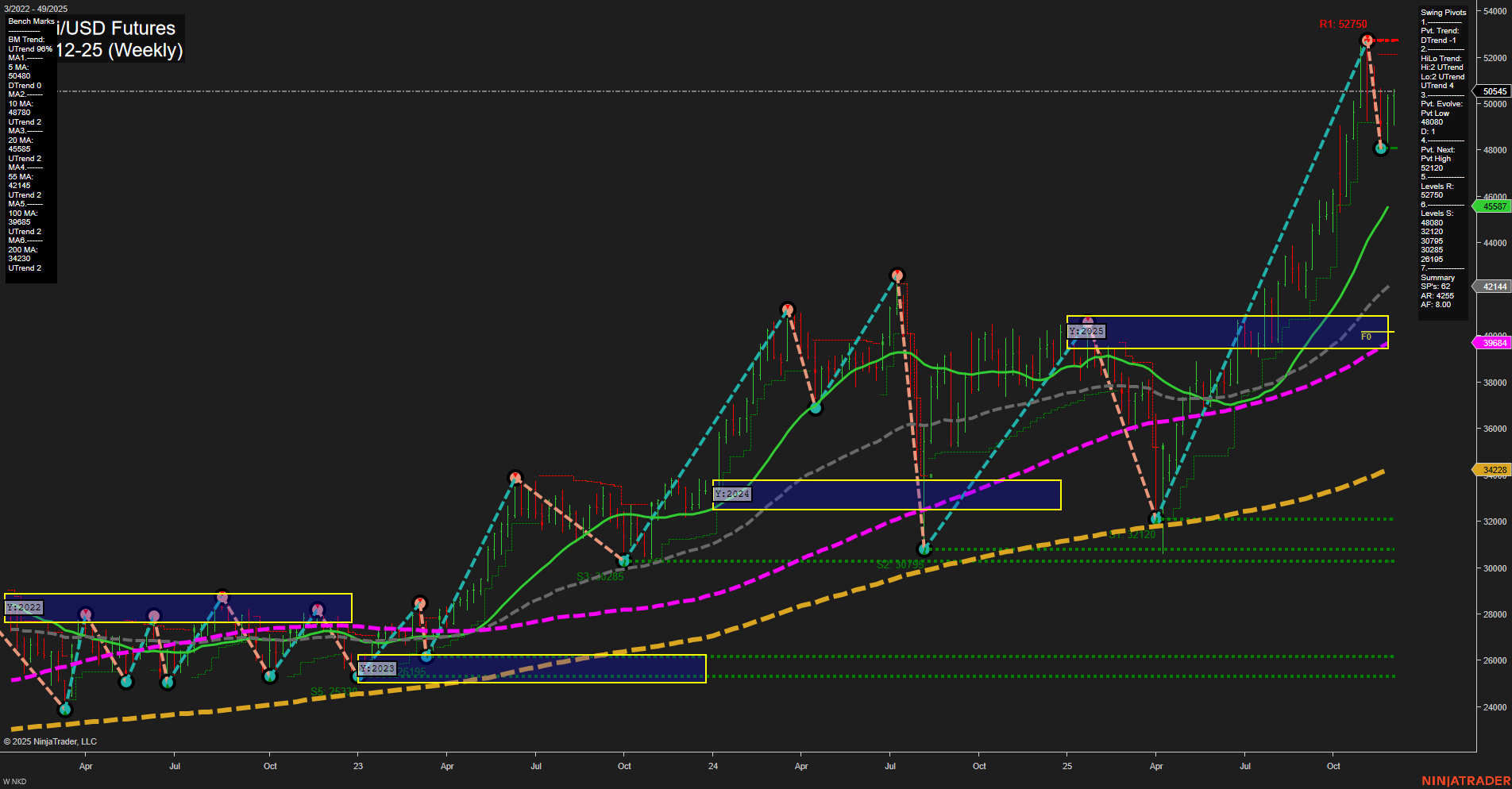

NKD Nikkei/USD Futures Weekly Chart Analysis: 2025-Dec-05 07:12 CT

Price Action

- Last: 50,455,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 19%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 28%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 152%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 48,080,

- 4. Pvt. Next: Pvt high 52,750,

- 5. Levels R: 52,750,

- 6. Levels S: 48,080, 41,214, 39,654, 34,228.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 50,540 Up Trend,

- (Intermediate-Term) 10 Week: 47,870 Up Trend,

- (Long-Term) 20 Week: 45,587 Up Trend,

- (Long-Term) 55 Week: 41,214 Up Trend,

- (Long-Term) 100 Week: 39,654 Up Trend,

- (Long-Term) 200 Week: 34,228 Up Trend.

Recent Trade Signals

- 05 Dec 2025: Long NKD 12-25 @ 50,455 Signals.USAR-MSFG

- 04 Dec 2025: Long NKD 12-25 @ 50,645 Signals.USAR-WSFG

- 01 Dec 2025: Short NKD 12-25 @ 49,390 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD futures weekly chart shows a strong upward momentum, with price action characterized by large bars and fast momentum, indicating heightened volatility and active participation. All major session fib grid trends (weekly, monthly, yearly) are aligned to the upside, with price holding above their respective NTZ/F0% levels, confirming a persistent bullish bias across timeframes. The swing pivot structure reveals a short-term corrective move (DTrend) following a recent high at 52,750, but the intermediate-term HiLo trend remains upward, suggesting the broader uptrend is intact. Support levels are well-defined and rising, with the nearest at 48,080 and deeper supports at 41,214, 39,654, and 34,228, while resistance is marked at the recent swing high. All benchmark moving averages from 5-week to 200-week are trending up, reinforcing the strength of the long-term trend. Recent trade signals show a mix of short-term tactical shifts but a dominant intermediate-term and short-term long bias, reflecting active trend-following strategies. Overall, the market is in a strong uptrend with occasional pullbacks, and the technical structure supports a bullish outlook for intermediate and long-term horizons, while the short-term may be experiencing a pause or minor retracement within the broader trend.

Chart Analysis ATS AI Generated: 2025-12-05 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.