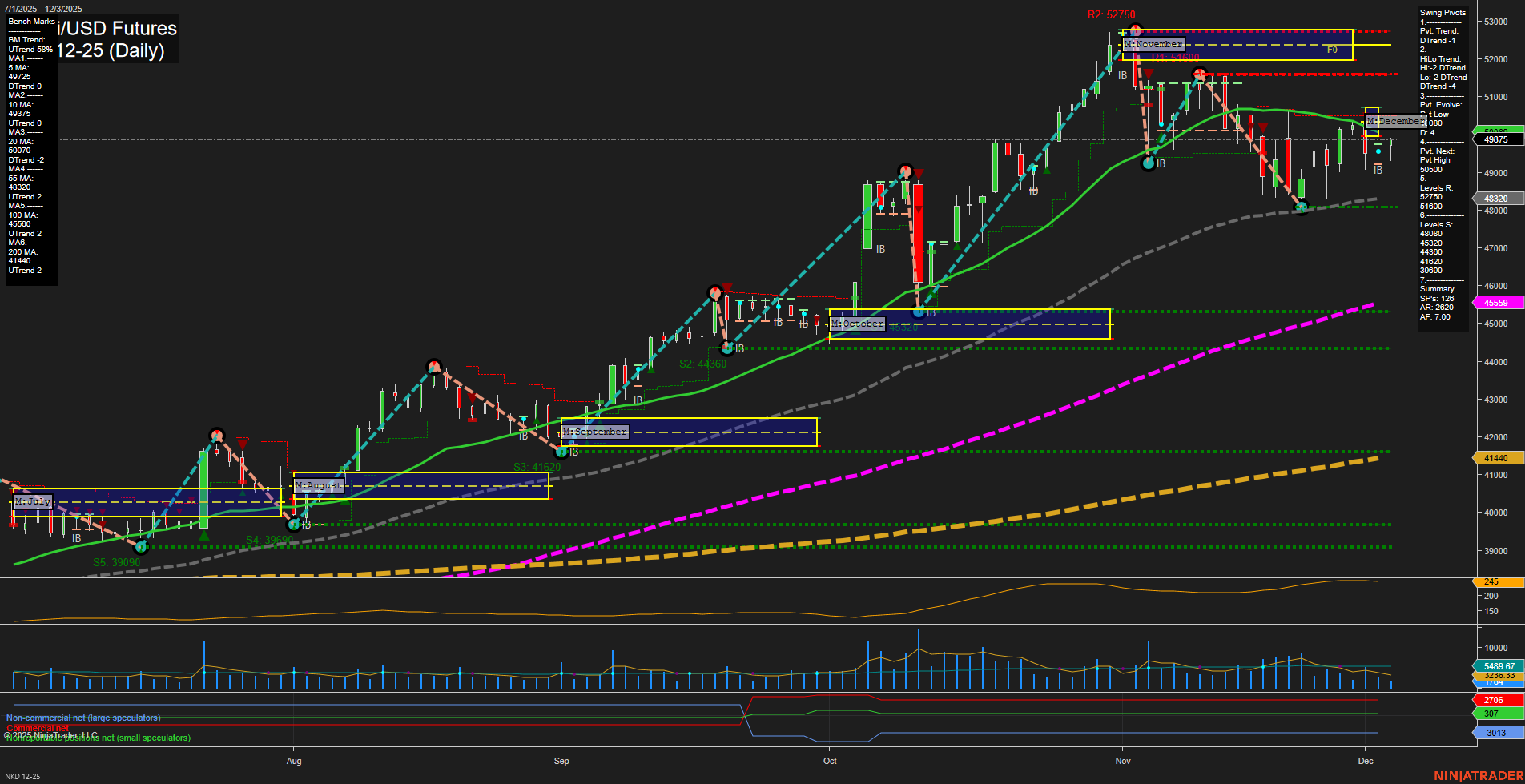

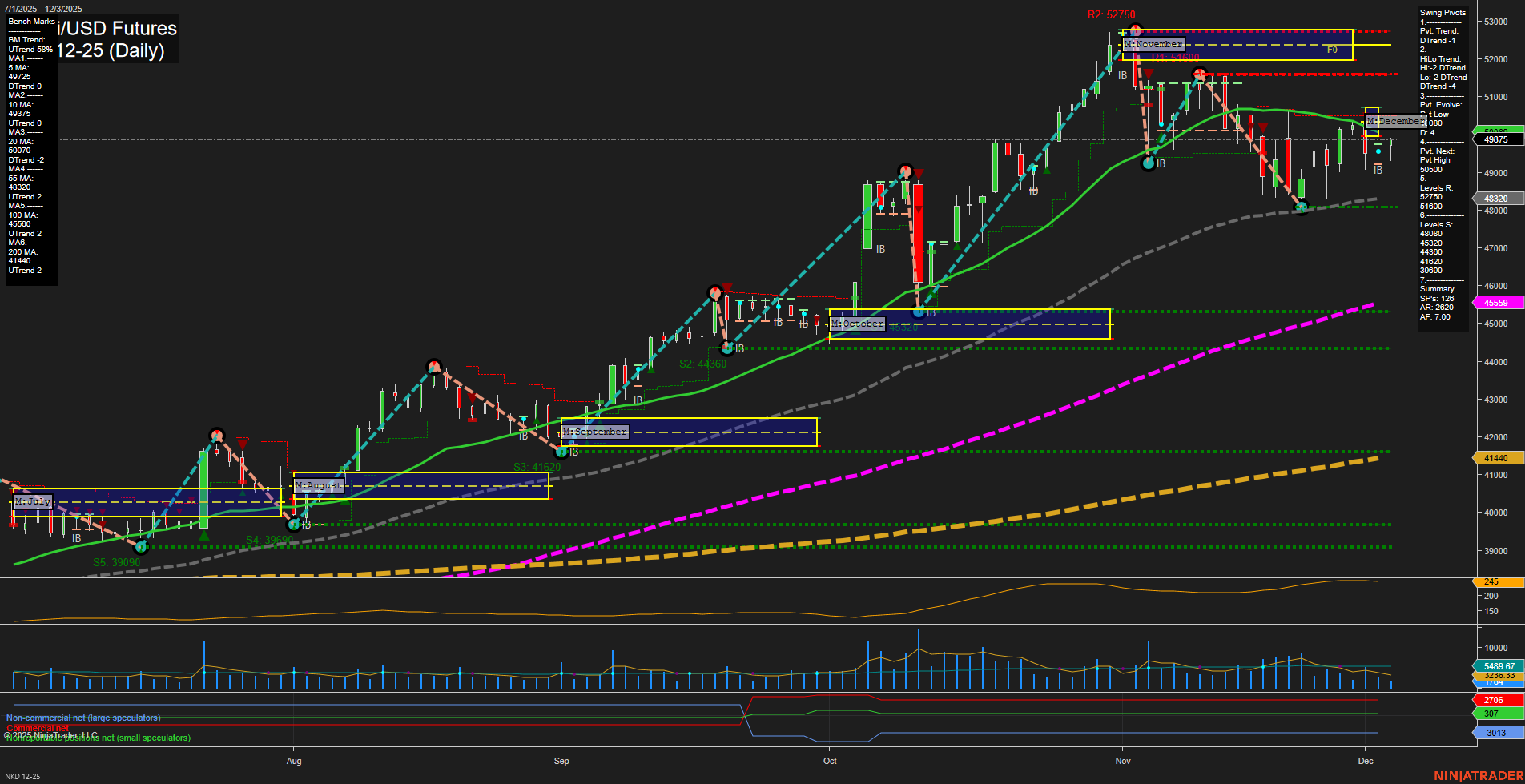

NKD Nikkei/USD Futures Daily Chart Analysis: 2025-Dec-05 07:11 CT

Price Action

- Last: 49875,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 19%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 28%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 152%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 48320,

- 4. Pvt. Next: Pvt high 50500,

- 5. Levels R: 52750, 50500, 50000, 49500, 48320,

- 6. Levels S: 45559, 41640, 39090.

Daily Benchmarks

- (Short-Term) 5 Day: 49725 Down Trend,

- (Short-Term) 10 Day: 49776 Down Trend,

- (Intermediate-Term) 20 Day: 50700 Down Trend,

- (Intermediate-Term) 55 Day: 51600 Up Trend,

- (Long-Term) 100 Day: 48320 Up Trend,

- (Long-Term) 200 Day: 41640 Up Trend.

Additional Metrics

Recent Trade Signals

- 05 Dec 2025: Long NKD 12-25 @ 50455 Signals.USAR-MSFG

- 04 Dec 2025: Long NKD 12-25 @ 50645 Signals.USAR-WSFG

- 01 Dec 2025: Short NKD 12-25 @ 49390 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD futures daily chart shows a market that has recently experienced a corrective phase, with short-term swing pivots and moving averages indicating a downtrend, while intermediate and long-term trends remain firmly up. Price is currently above all key session fib grid levels (weekly, monthly, yearly), suggesting underlying bullish structure. The most recent swing low at 48320 has held, and price is consolidating just below resistance at 50500, with momentum slow and volatility moderate (ATR 140). Volume is steady but not elevated, indicating a lack of strong conviction in either direction. Recent trade signals show mixed short-term action but a bias toward long entries in the last two sessions, aligning with the broader uptrend. The market is in a consolidation phase after a pullback, with potential for trend continuation if resistance levels are cleared, but short-term signals remain neutral until a decisive breakout or breakdown occurs.

Chart Analysis ATS AI Generated: 2025-12-05 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.