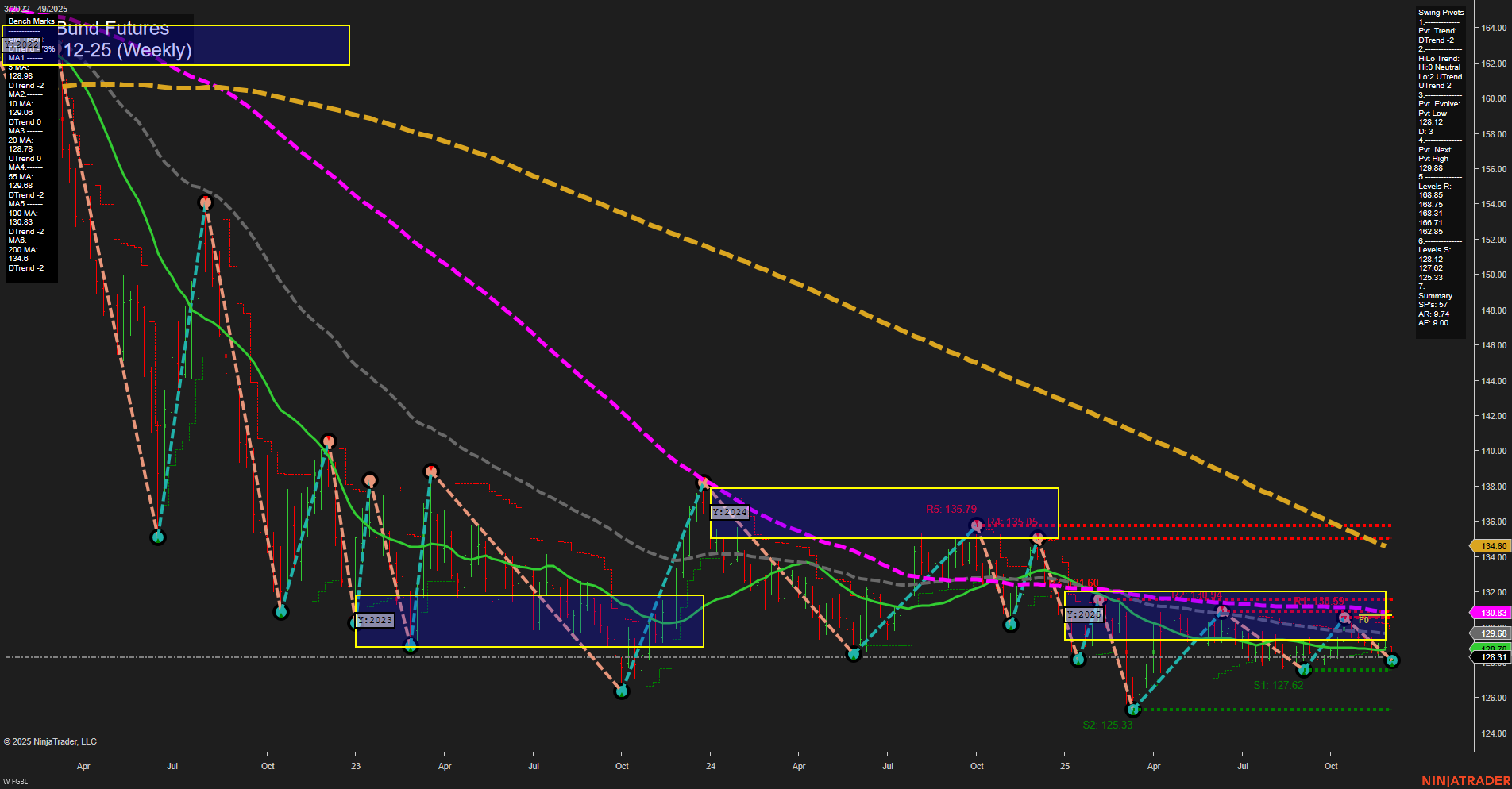

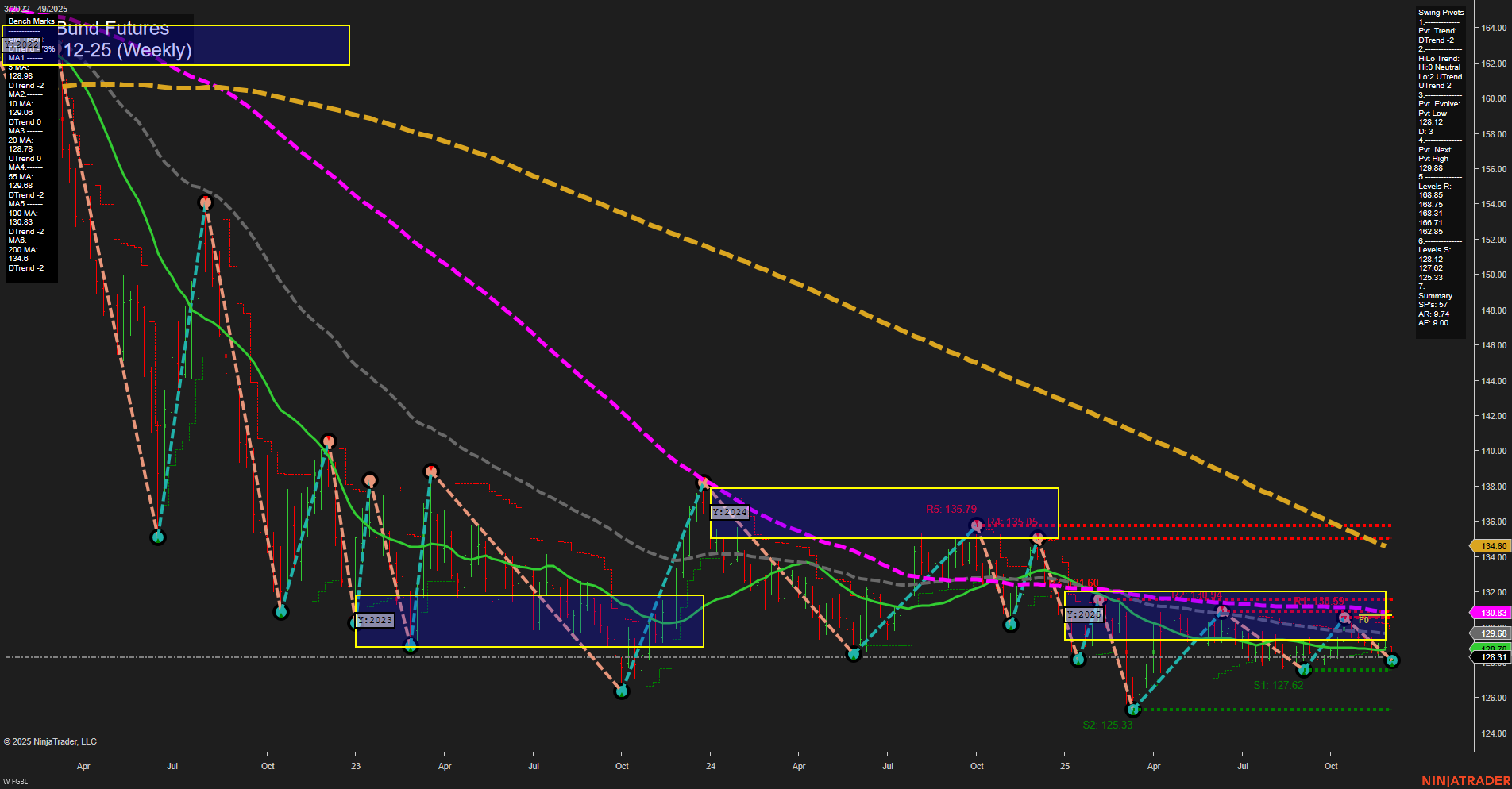

FGBL Euro-Bund Futures Weekly Chart Analysis: 2025-Dec-05 07:09 CT

Price Action

- Last: 128.31,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -143%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: -40%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -20%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 128.31,

- 4. Pvt. Next: Pvt high 130.83,

- 5. Levels R: 135.79, 134.60, 131.60, 130.83,

- 6. Levels S: 127.62, 125.33.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 128.68 Down Trend,

- (Intermediate-Term) 10 Week: 129.04 Down Trend,

- (Long-Term) 20 Week: 129.68 Down Trend,

- (Long-Term) 55 Week: 134.60 Down Trend,

- (Long-Term) 100 Week: 139.62 Down Trend,

- (Long-Term) 200 Week: 149.34 Down Trend.

Recent Trade Signals

- 03 Dec 2025: Short FGBL 12-25 @ 128.34 Signals.USAR-MSFG

- 01 Dec 2025: Short FGBL 12-25 @ 128.83 Signals.USAR-WSFG

- 28 Nov 2025: Short FGBL 12-25 @ 128.9 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The FGBL Euro-Bund Futures weekly chart shows a persistent bearish environment across most timeframes. Price action is subdued, with small bars and slow momentum, indicating a lack of strong directional conviction but a clear absence of bullish pressure. All major session Fib Grid trends (weekly, monthly, yearly) are down, with price consistently below their respective NTZ/F0% levels, reinforcing the prevailing downward bias.

Swing pivots highlight a short-term downtrend, though the intermediate-term HiLo trend is showing early signs of an uptrend, suggesting some potential for a counter-trend bounce or consolidation phase. However, resistance levels remain stacked above, with the nearest at 130.83 and significant overhead at 131.60, 134.60, and 135.79, while support is found at 127.62 and 125.33.

All benchmark moving averages from short to long-term are trending down, confirming the dominant bearish structure. Recent trade signals have all been to the short side, aligning with the technical backdrop.

Overall, the market is in a well-established downtrend, but with some intermediate-term stabilization or potential for a minor retracement. The environment remains challenging for bullish setups, with sellers in control and rallies likely to encounter resistance.

Chart Analysis ATS AI Generated: 2025-12-05 07:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.