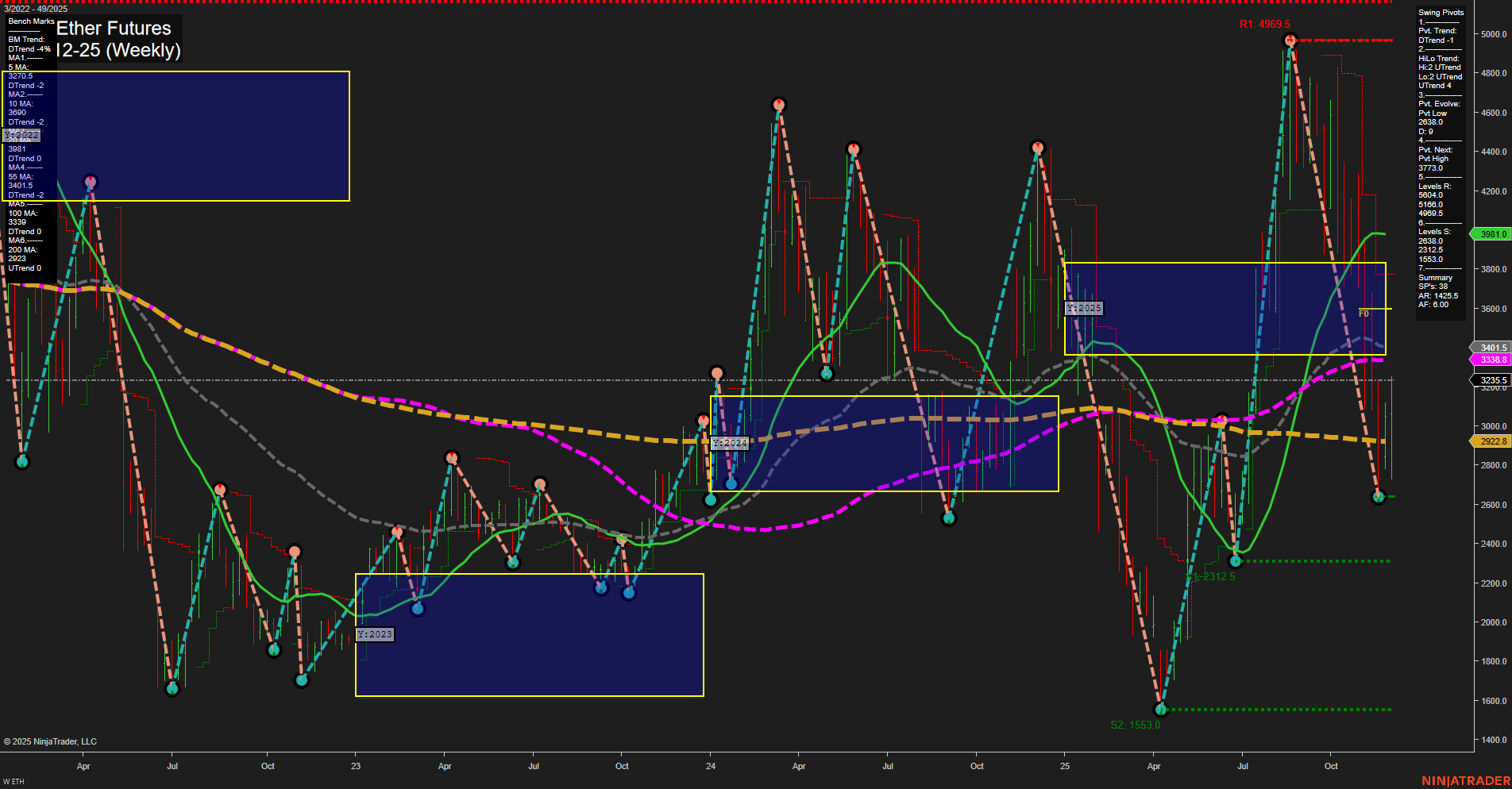

The current weekly chart for ETH CME Ether Futures shows a market in transition. Price action is volatile with large bars and fast momentum, indicating heightened activity and potential for sharp moves. Short-term (WSFG) and intermediate-term (MSFG) session fib grid trends are both up, with price holding above their respective NTZ/F0% levels, suggesting underlying bullishness in these timeframes. However, the yearly fib grid (YSFG) remains in a downtrend, with price below the yearly NTZ/F0%, reflecting longer-term headwinds. Swing pivots highlight a short-term downtrend but an intermediate-term uptrend, with the most recent pivot low at 2312.5 and resistance levels overhead at 3235.5, 3881, and 4969.5. Support is established at 2312.5 and 1553.0. Weekly benchmarks show mixed signals: short and intermediate-term moving averages are trending down, while longer-term averages (55, 100, 200 week) are turning up or holding steady, indicating a possible shift in the broader trend. Recent trade signals have triggered long entries, aligning with the intermediate-term bullish bias. The overall structure suggests the market is attempting to recover from a significant pullback, with potential for further upside if resistance levels are breached. However, the presence of large bars and fast momentum also points to ongoing volatility and the possibility of sharp retracements. The market is currently in a consolidation phase, with the potential for a breakout or further choppy action as it tests key resistance and support levels.