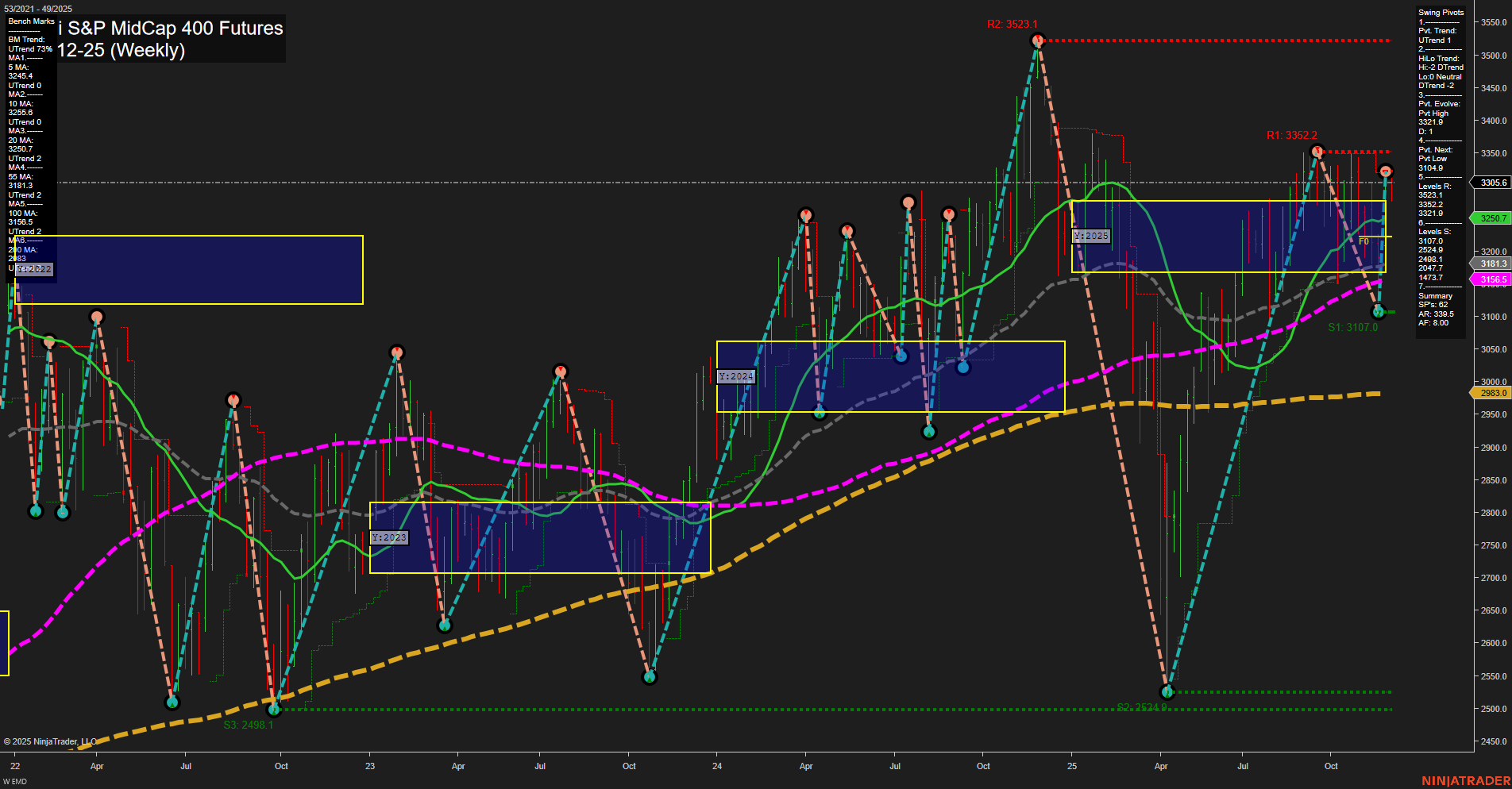

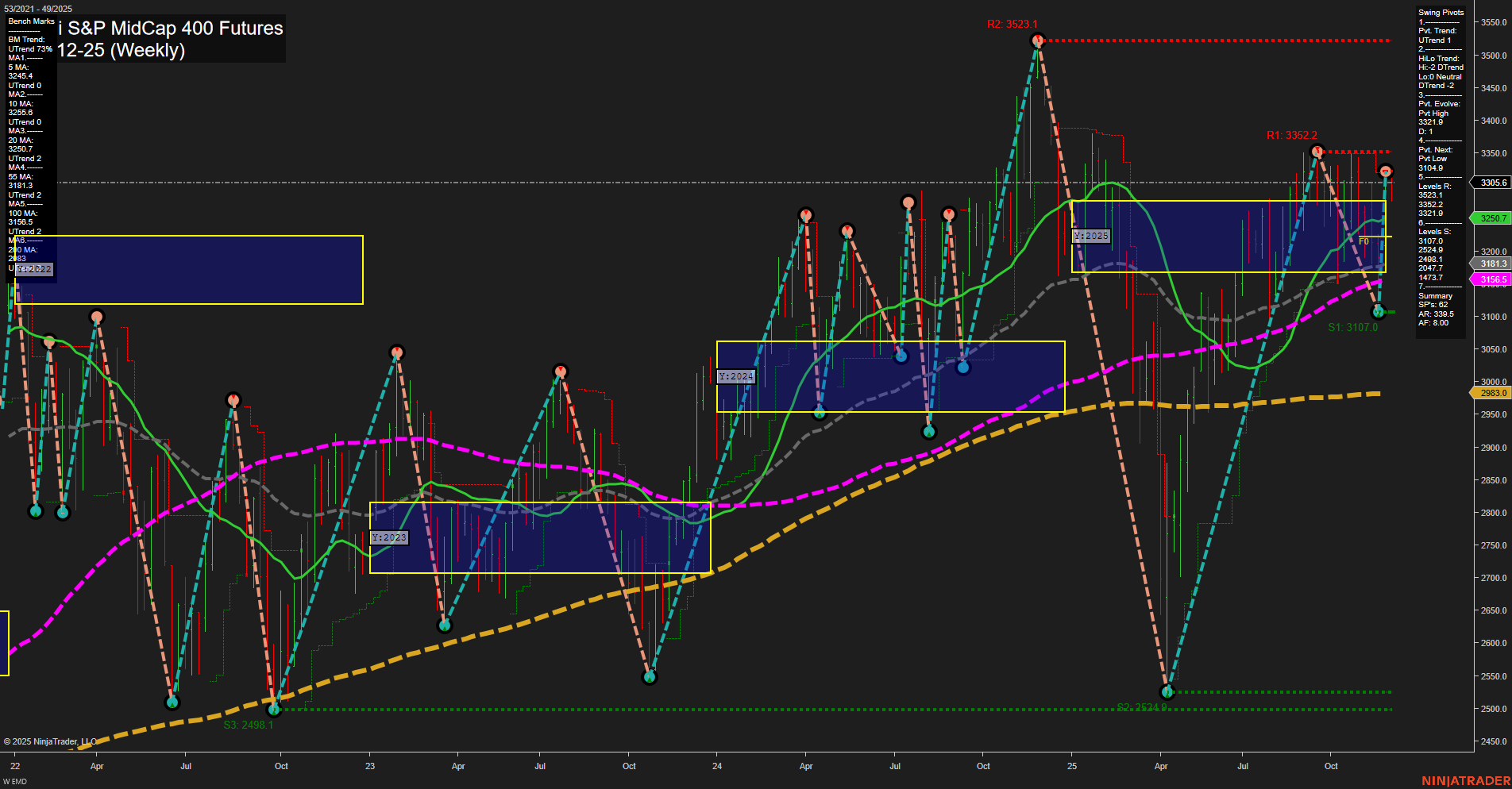

EMD E-mini S&P MidCap 400 Futures Weekly Chart Analysis: 2025-Dec-05 07:05 CT

Price Action

- Last: 3326.5,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 17%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 3219.1,

- 4. Pvt. Next: Pvt high 3352.2,

- 5. Levels R: 3523.1, 3352.2,

- 6. Levels S: 3219.1, 3107.0.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3324.4 Up Trend,

- (Intermediate-Term) 10 Week: 3286.2 Up Trend,

- (Long-Term) 20 Week: 3250.7 Up Trend,

- (Long-Term) 55 Week: 3181.1 Up Trend,

- (Long-Term) 100 Week: 3155.6 Up Trend,

- (Long-Term) 200 Week: 2863.3 Up Trend.

Recent Trade Signals

- 04 Dec 2025: Long EMD 12-25 @ 3328.7 Signals.USAR-WSFG

- 04 Dec 2025: Long EMD 12-25 @ 3326.2 Signals.USAR-MSFG

- 02 Dec 2025: Short EMD 12-25 @ 3284.2 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The EMD futures weekly chart shows a market in a broad uptrend across all major timeframes, with price action currently above all key moving averages and session fib grid centers. The short-term swing pivot trend is up, supported by recent long signals and a positive WSFG trend, while the intermediate-term HiLo trend is down, indicating some consolidation or corrective action within the broader uptrend. Resistance is defined at 3352.2 and 3523.1, with support at 3219.1 and 3107.0, suggesting a range-bound environment between these levels. Momentum is average, and the market has recently bounced from support, with higher lows visible on the chart. The overall structure favors bullish continuation in the long term, but the intermediate-term trend suggests monitoring for potential pullbacks or sideways movement before a decisive breakout. The technical landscape is constructive, with all long-term benchmarks trending higher, indicating underlying strength in the midcap segment.

Chart Analysis ATS AI Generated: 2025-12-05 07:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.