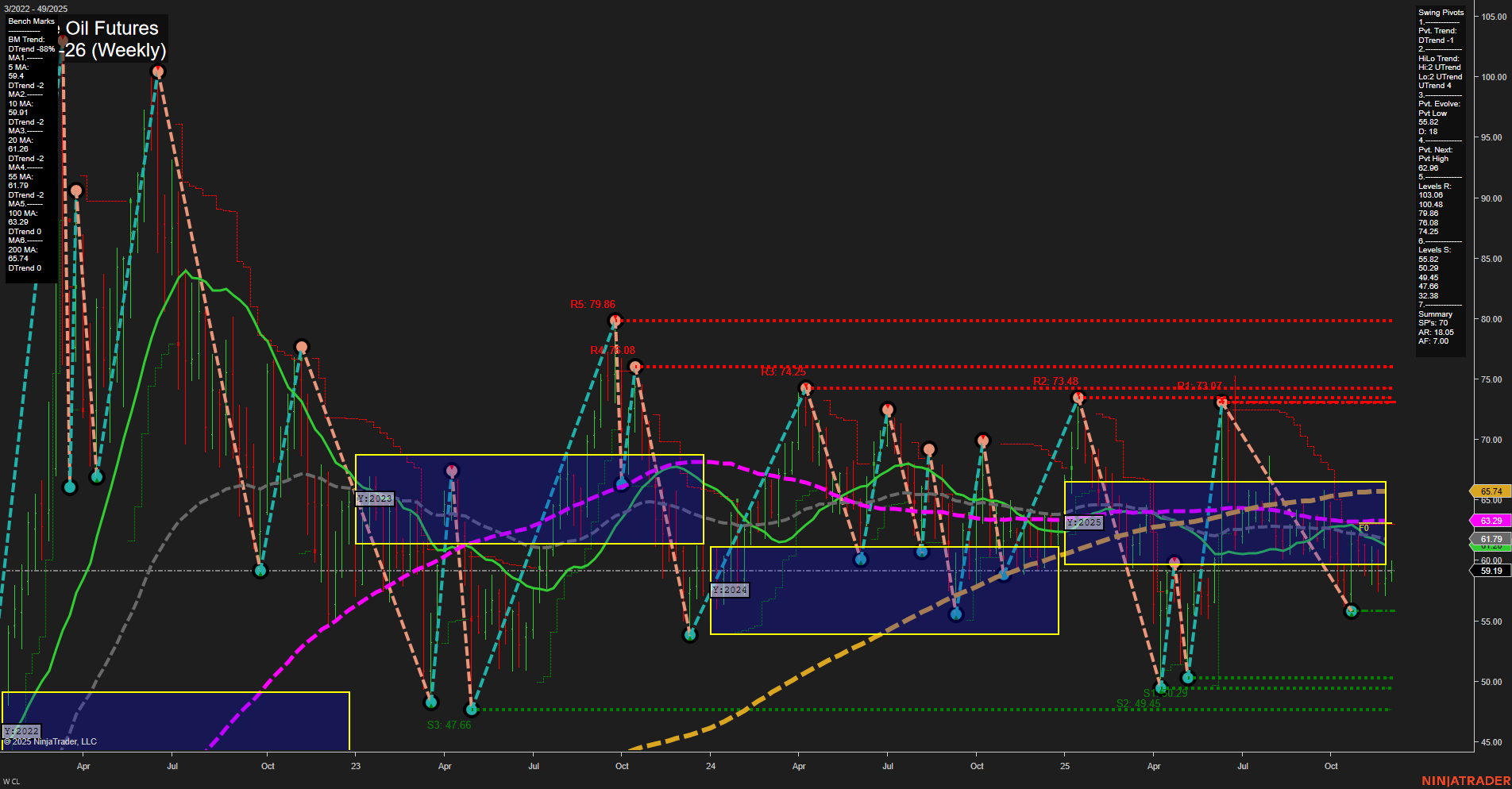

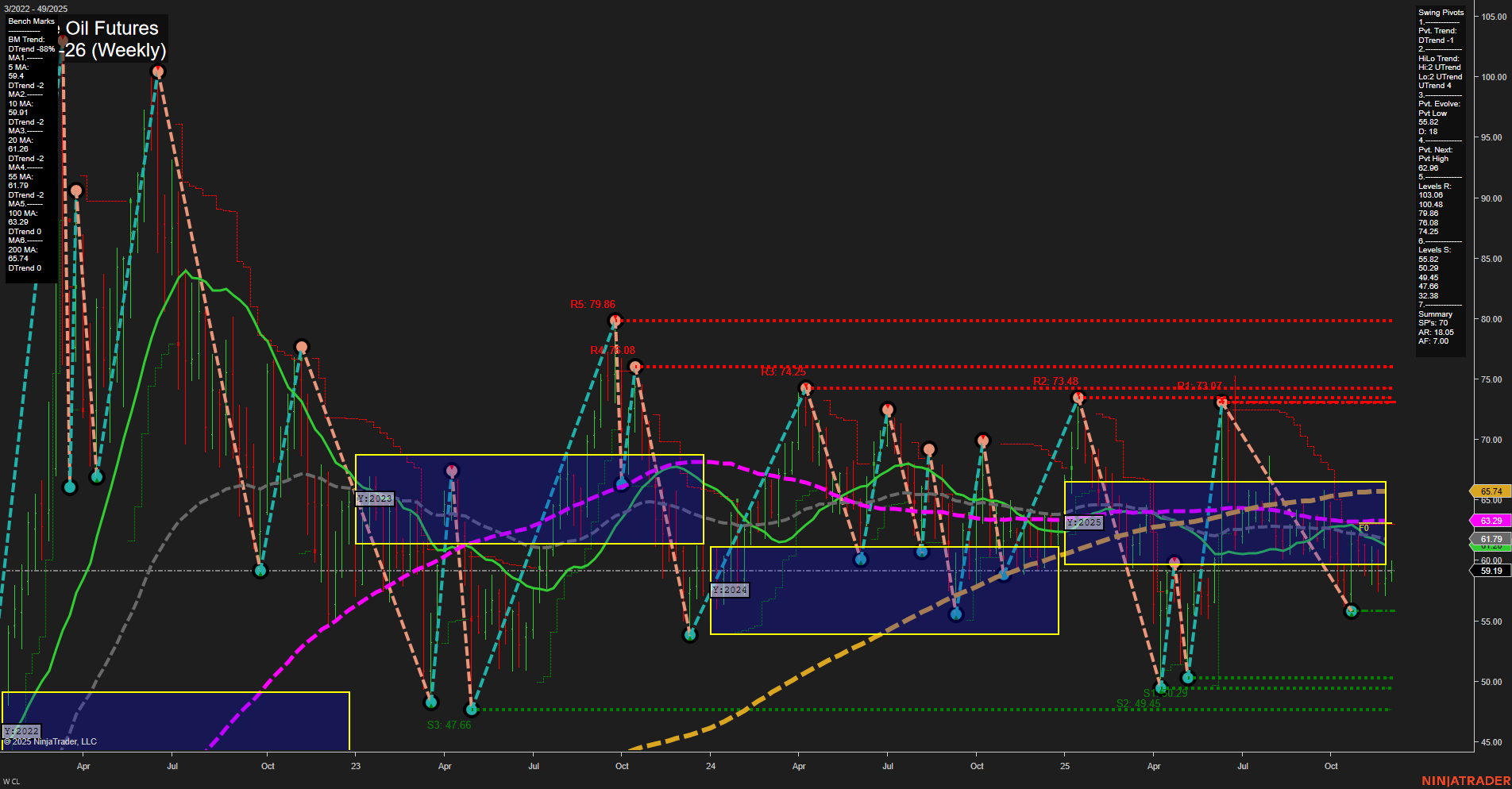

CL Crude Oil Futures Weekly Chart Analysis: 2025-Dec-05 07:04 CT

Price Action

- Last: 59.19,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -10%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 59.18,

- 4. Pvt. Next: Pvt high 62.96,

- 5. Levels R: 100.06, 79.86, 78.08, 73.48, 73.07, 71.25,

- 6. Levels S: 59.18, 50.82, 49.66, 47.45, 40.46, 39.45, 37.28, 32.33.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 59.54 Down Trend,

- (Intermediate-Term) 10 Week: 61.79 Down Trend,

- (Long-Term) 20 Week: 65.74 Down Trend,

- (Long-Term) 55 Week: 63.19 Down Trend,

- (Long-Term) 100 Week: 63.90 Down Trend,

- (Long-Term) 200 Week: 66.70 Down Trend.

Recent Trade Signals

- 05 Dec 2025: Long CL 01-26 @ 59.57 Signals.USAR-WSFG

- 04 Dec 2025: Long CL 01-26 @ 59.86 Signals.USAR.TR120

- 04 Dec 2025: Short CL 01-26 @ 58.89 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

CL Crude Oil Futures are currently trading near recent swing lows, with price action showing slow momentum and medium-sized bars, indicating a lack of strong conviction in either direction. The short-term WSFG trend is up, with price just above the NTZ center, but the swing pivot trend remains down, suggesting a possible short-term pause or consolidation after a recent decline. Intermediate and long-term trends, as indicated by the MSFG and YSFG, are both down, with price below their respective NTZ centers and all major moving averages trending lower. The most recent swing low at 59.18 is being tested, with the next significant resistance at 62.96 and multiple overhead resistance levels clustered in the 70s and 80s. Support levels are layered below, with the next major support at 50.82. Recent trade signals show mixed short-term activity but a prevailing bearish bias in the intermediate and long-term outlooks. The overall structure suggests a market in a broad consolidation or potential basing phase, with downside risk still present unless a sustained move above key resistance levels materializes.

Chart Analysis ATS AI Generated: 2025-12-05 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.