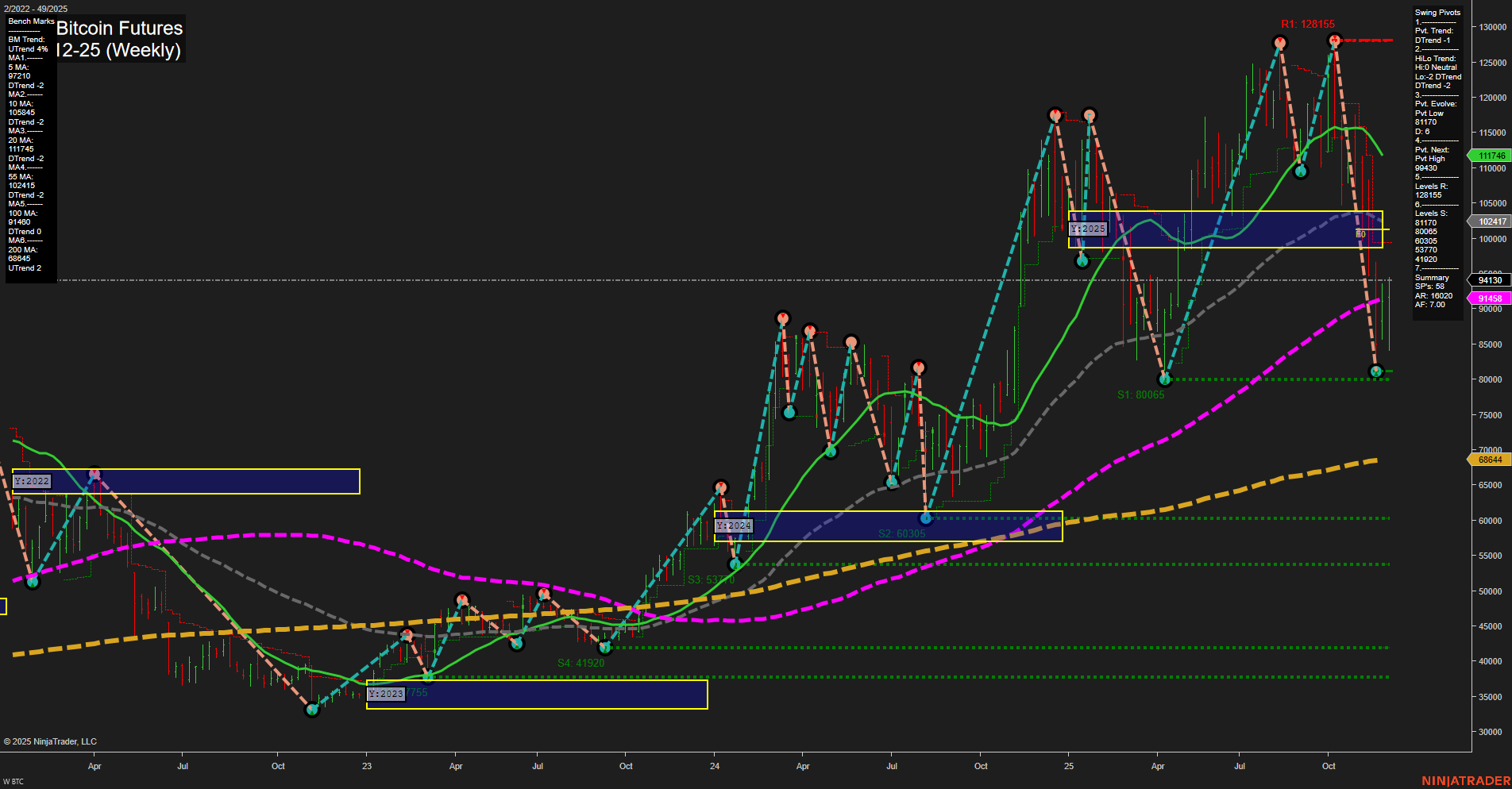

The current weekly chart for BTC CME Bitcoin Futures shows a market in transition. Price action is volatile with large bars and fast momentum, indicating heightened activity and possible volatility spikes. The short-term WSFG is neutral, with price sitting at the NTZ center, suggesting indecision or a pause after recent moves. Intermediate-term MSFG is trending up, with price above the monthly grid, but the swing pivot and HiLo trends are both down, reflecting a recent corrective phase or pullback within a broader uptrend. Long-term YSFG is down, with price below the yearly grid, highlighting that the larger cycle remains under pressure despite recent rallies. Swing pivots show the most recent evolution as a pivot low at 80,065, with the next significant resistance at the previous high of 128,155. Multiple resistance levels cluster above current price, while support is well below, indicating a wide trading range and potential for further swings. Weekly benchmarks are mostly in downtrend mode except for the 100 and 200 week MAs, which are still up, suggesting the long-term structure is intact but under threat if current weakness persists. Recent trade signals have triggered long entries, reflecting attempts to catch a reversal or bounce from oversold conditions. However, the overall rating is mixed: short-term is neutral due to the stalling at NTZ, intermediate-term is bearish given the downtrends in pivots and moving averages, and long-term remains neutral as price is between major support and resistance zones. In summary, the market is in a corrective or consolidation phase after a strong rally, with volatility elevated and both upside and downside levels clearly defined. The technical landscape suggests a wait-and-see approach as the market digests recent moves, with the next major swing likely to set the tone for the coming weeks.