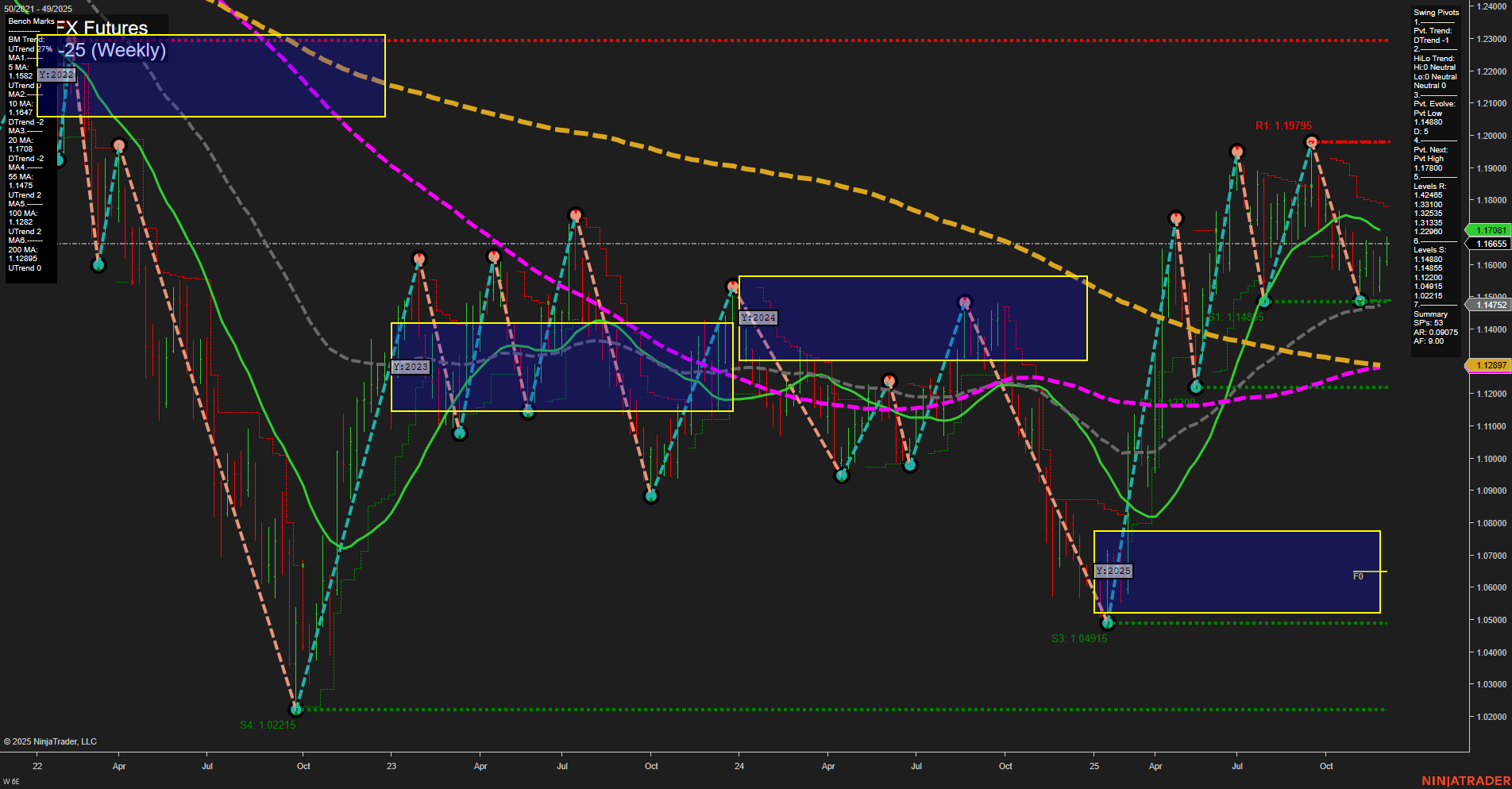

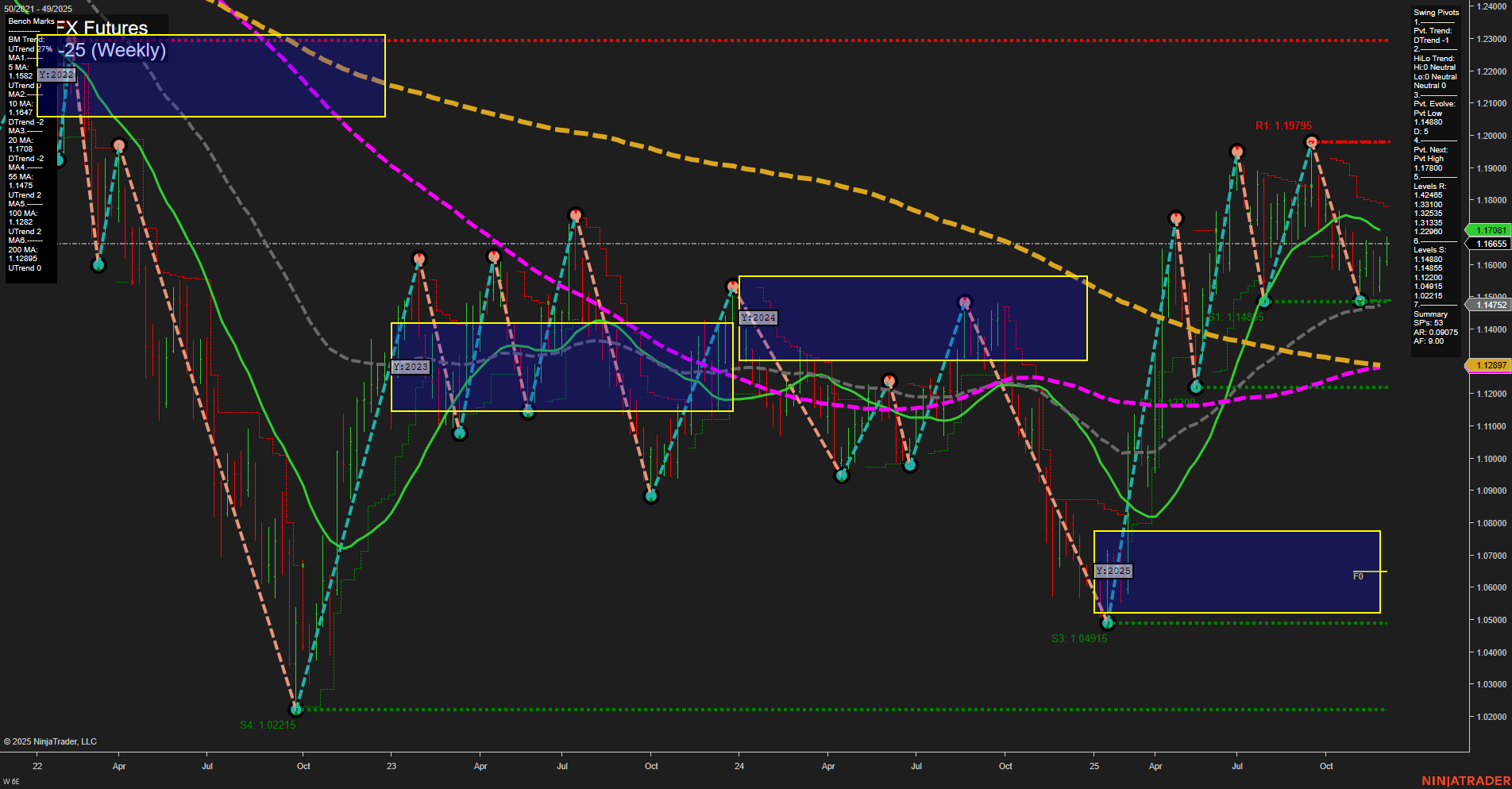

6E Euro FX Futures Weekly Chart Analysis: 2025-Dec-05 07:01 CT

Price Action

- Last: 1.17081,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 40%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 18%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 75%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.14752,

- 4. Pvt. Next: Pvt high 1.17880,

- 5. Levels R: 1.19795, 1.17880, 1.16335,

- 6. Levels S: 1.14752, 1.12997, 1.11465, 1.04915, 1.02215.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.1655 Down Trend,

- (Intermediate-Term) 10 Week: 1.1623 Down Trend,

- (Long-Term) 20 Week: 1.1708 Up Trend,

- (Long-Term) 55 Week: 1.1475 Up Trend,

- (Long-Term) 100 Week: 1.1299 Down Trend,

- (Long-Term) 200 Week: 1.2023 Down Trend.

Recent Trade Signals

- 05 Dec 2025: Long 6E 12-25 @ 1.16645 Signals.USAR-MSFG

- 01 Dec 2025: Long 6E 12-25 @ 1.16315 Signals.USAR.TR720

- 01 Dec 2025: Long 6E 12-25 @ 1.1631 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a market in transition, with price action currently above all major session fib grid centers (WSFG, MSFG, YSFG), indicating a broad upward bias across timeframes. The most recent swing pivot trend is down in the short term, but the intermediate-term HiLo trend remains up, suggesting a corrective pullback within a larger uptrend. Price is consolidating above the 20 and 55 week moving averages, both of which are trending up, while the shorter-term 5 and 10 week averages are in a downtrend, reflecting recent weakness or consolidation. Key resistance is seen at 1.17880 and 1.19795, with support at 1.14752 and 1.12997. Recent trade signals have been long, aligning with the intermediate and long-term bullish structure. The overall technical landscape points to a market that is digesting gains after a strong rally, with the potential for further upside if resistance levels are overcome, but with short-term caution as the market works through a corrective phase.

Chart Analysis ATS AI Generated: 2025-12-05 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.