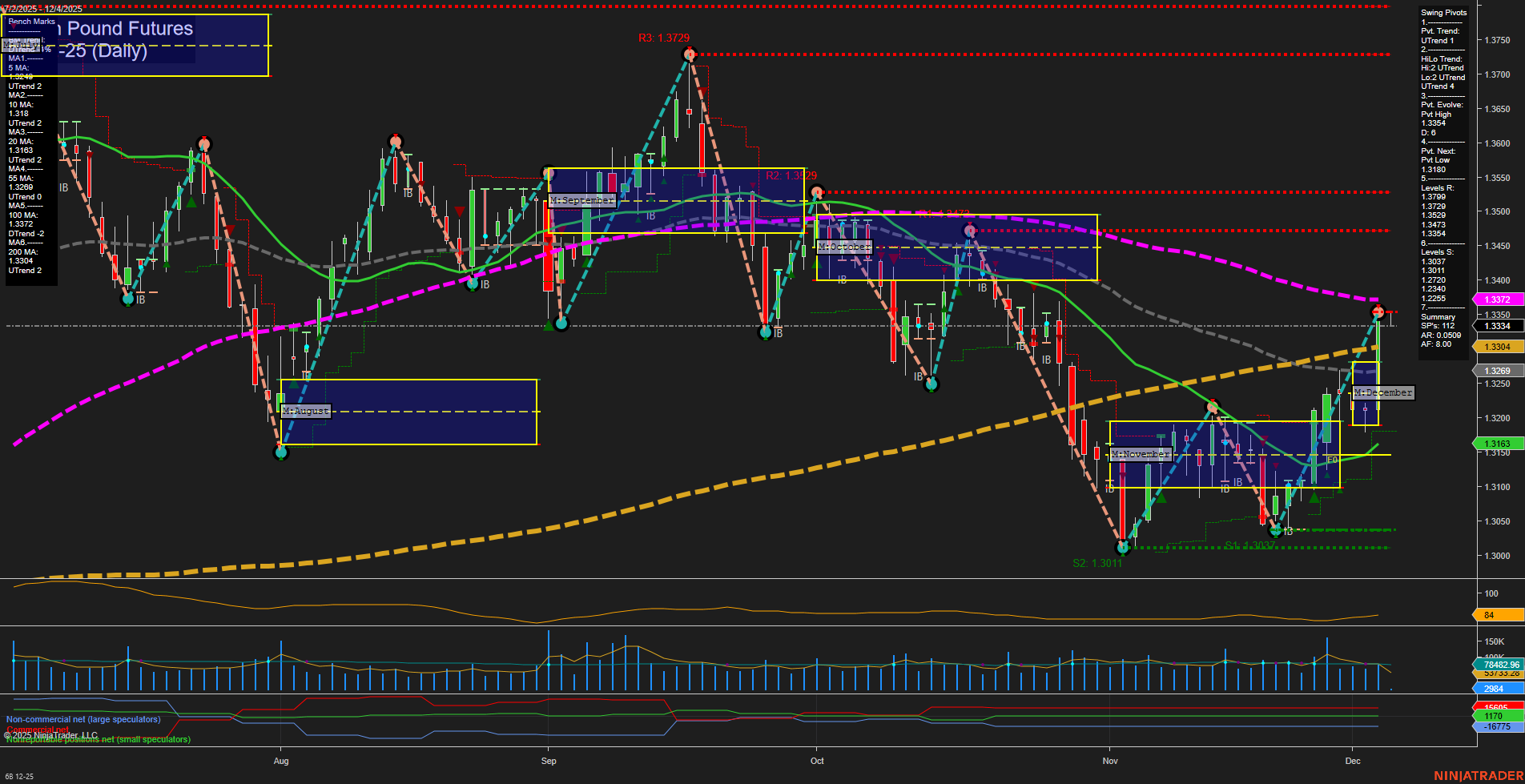

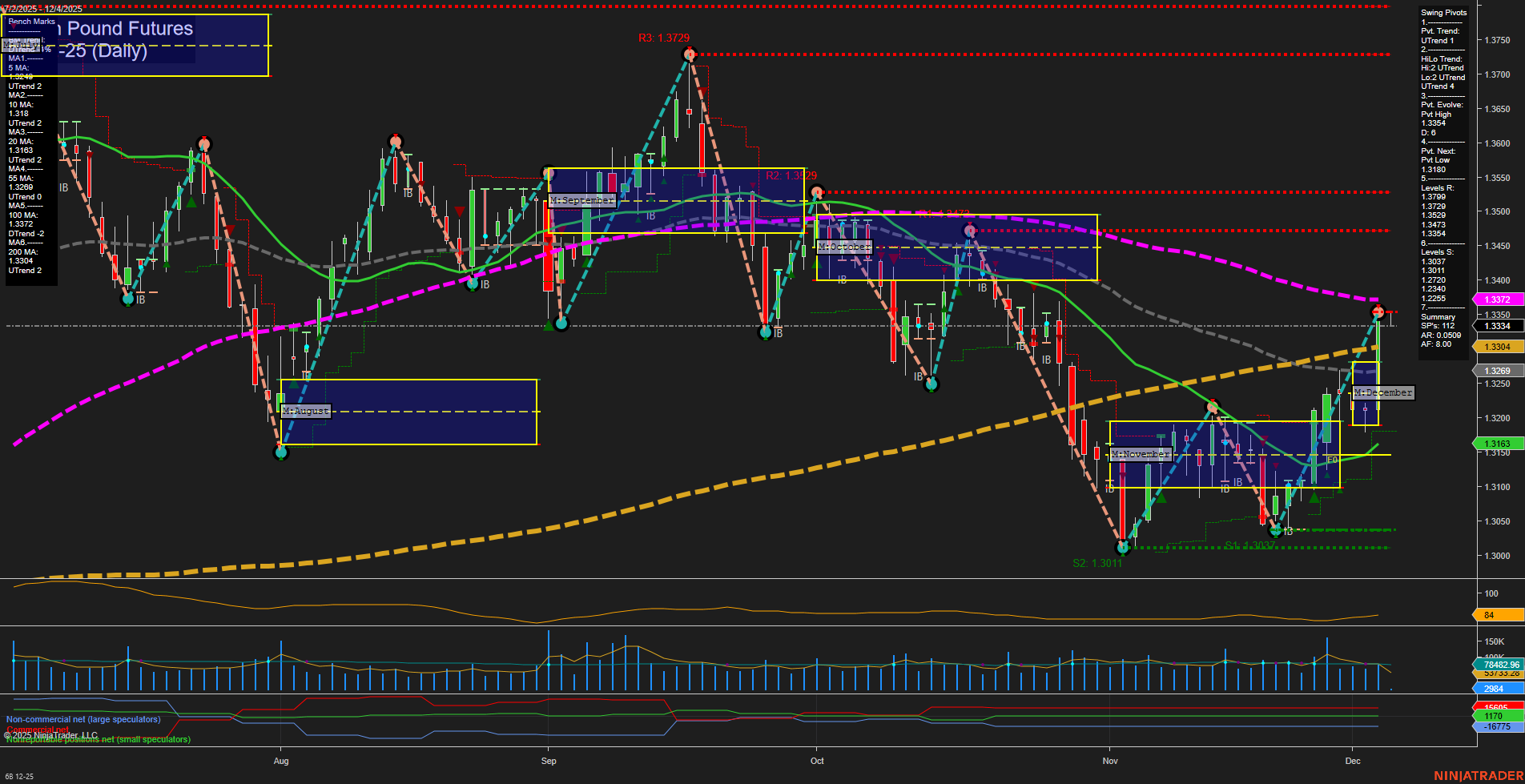

6B British Pound Futures Daily Chart Analysis: 2025-Dec-05 07:00 CT

Price Action

- Last: 1.3289,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 70%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 32%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 40%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 1.3364,

- 4. Pvt. Next: Pvt low 1.3180,

- 5. Levels R: 1.3729, 1.3529, 1.3372, 1.3330,

- 6. Levels S: 1.3180, 1.3011, 1.2724, 1.2255.

Daily Benchmarks

- (Short-Term) 5 Day: 1.3186 Up Trend,

- (Short-Term) 10 Day: 1.3163 Up Trend,

- (Intermediate-Term) 20 Day: 1.3163 Up Trend,

- (Intermediate-Term) 55 Day: 1.3334 Down Trend,

- (Long-Term) 100 Day: 1.3372 Down Trend,

- (Long-Term) 200 Day: 1.3304 Down Trend.

Additional Metrics

Recent Trade Signals

- 03 Dec 2025: Long 6B 12-25 @ 1.3283 Signals.USAR-MSFG

- 03 Dec 2025: Long 6B 12-25 @ 1.326 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The British Pound Futures (6B) daily chart is showing a strong recovery phase, with price action characterized by large, fast momentum bars breaking above key short- and intermediate-term resistance levels. The short-term and intermediate-term trends are both firmly bullish, supported by the upward trajectory of the 5, 10, and 20-day moving averages, and confirmed by the latest swing pivot structure (UTrend) and recent long trade signals. Price is trading above the NTZ center lines for weekly, monthly, and yearly session fib grids, indicating broad-based strength across multiple timeframes. However, the long-term trend remains neutral as the 55, 100, and 200-day moving averages are still in a downtrend, suggesting that the market is in a transitional phase and has not yet confirmed a full long-term reversal. Volatility and volume are elevated, reflecting strong participation and potential for continued movement. The next resistance levels to watch are 1.3330 and 1.3372, with support at 1.3180 and 1.3011. Overall, the market is in a bullish swing phase with momentum favoring further upside, but long-term confirmation is still pending.

Chart Analysis ATS AI Generated: 2025-12-05 07:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.