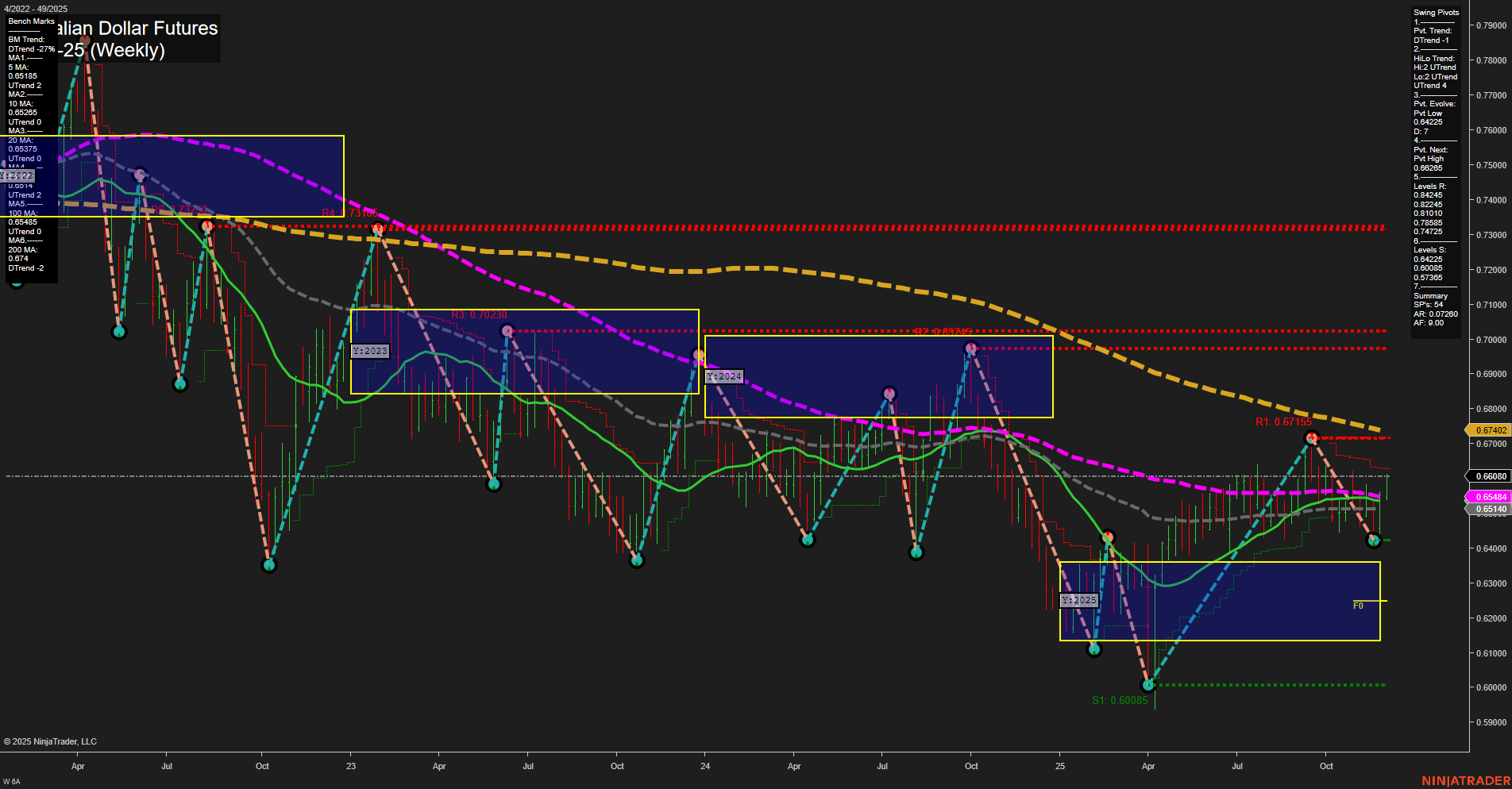

The 6A Australian Dollar Futures weekly chart shows a market in transition, with price currently at 0.65800 and trading within a medium range. Momentum is average, reflecting a lack of strong conviction in either direction. The short-term (WSFG) and long-term (YSFG) session fib grid trends are neutral, indicating consolidation and a lack of clear directional bias. The intermediate-term (MSFG) trend is also neutral, but recent swing pivot analysis reveals a divergence: the short-term pivot trend is down, while the intermediate-term HiLo trend is up, suggesting a possible shift or a corrective phase within a broader recovery attempt. Swing pivot resistance is layered above at 0.67155 and 0.66285, with support at 0.63085 and 0.60085, highlighting a well-defined trading range. The weekly benchmarks show short- and intermediate-term moving averages turning up, while longer-term averages (55, 100, 200 week) remain in downtrends, reflecting a market attempting to base after a prolonged decline. Recent trade signals have favored the long side, aligning with the uptrend in the 5 and 10 week MAs and the intermediate-term HiLo trend. Overall, the chart suggests a market in consolidation with emerging bullish undertones in the intermediate-term, but still facing significant overhead resistance and longer-term trend pressure. The price structure is consistent with a potential basing pattern, with the possibility of further range-bound action or a gradual trend reversal if resistance levels are overcome. Volatility remains moderate, and the market is likely to remain sensitive to macroeconomic developments and shifts in risk sentiment.