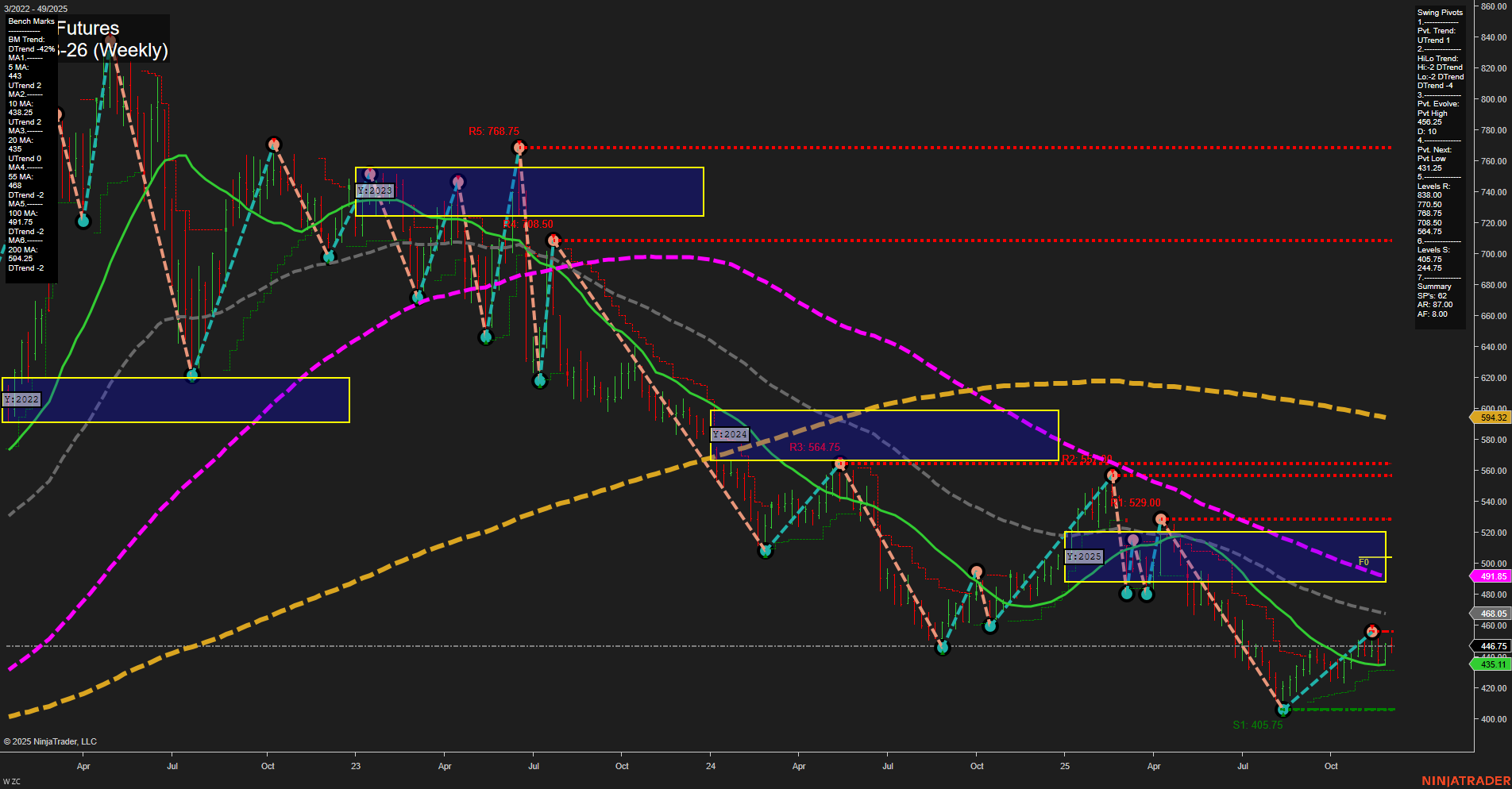

Corn futures are currently exhibiting a mixed technical landscape. Price action shows medium-sized bars and average momentum, with the last price at 446.75. Short-term (WSFG) and long-term (YSFG) session fib grid trends remain down, with price below their respective NTZ/F0% levels, indicating persistent bearish pressure on these timeframes. However, the intermediate-term (MSFG) trend has shifted up, with price above the monthly NTZ/F0%, suggesting a potential recovery or countertrend rally is underway. Swing pivots highlight a short-term uptrend, but the intermediate-term HiLo trend is still down, reflecting ongoing volatility and possible retracement within a broader downtrend. The most recent pivot evolution is a high at 465.49, with the next key support at 431.25. Major resistance levels remain well above current price, while support is established at 405.75 and 244.75. Weekly benchmarks show short- and intermediate-term moving averages (5, 10, 20 week) trending up, supporting the recent bullish momentum, while longer-term averages (55, 100, 200 week) are still in downtrends, reinforcing the dominant bearish structure. Recent trade signals have all been to the long side, aligning with the intermediate-term bullish shift. Overall, the market is in a transitional phase: short-term is neutral as price consolidates after a bounce, intermediate-term is bullish with signs of a recovery, but the long-term outlook remains bearish until major resistance levels are reclaimed and longer-term moving averages turn up. This environment may favor tactical swing trading strategies that capitalize on countertrend rallies within a larger downtrend, with attention to key support and resistance levels and evolving momentum.