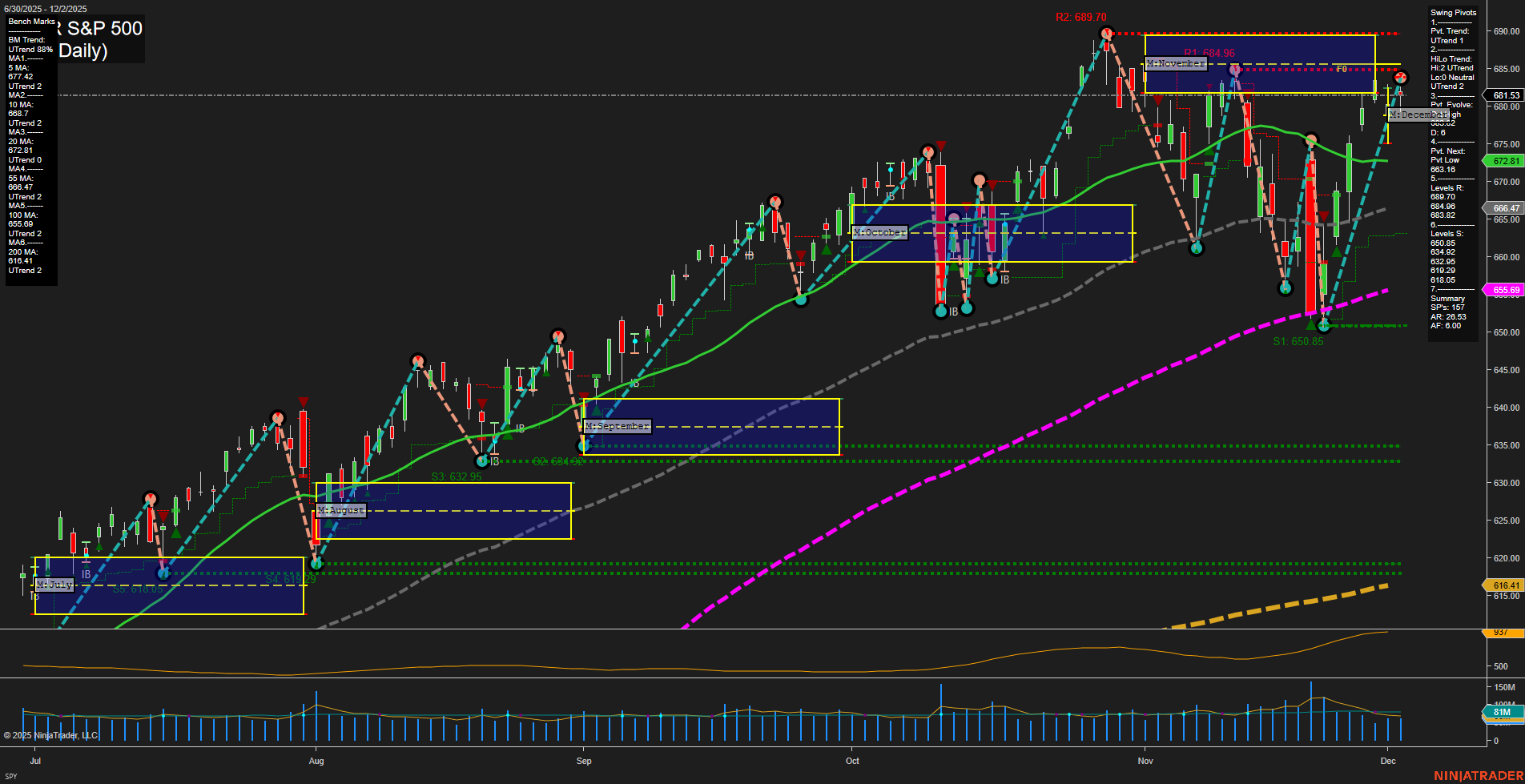

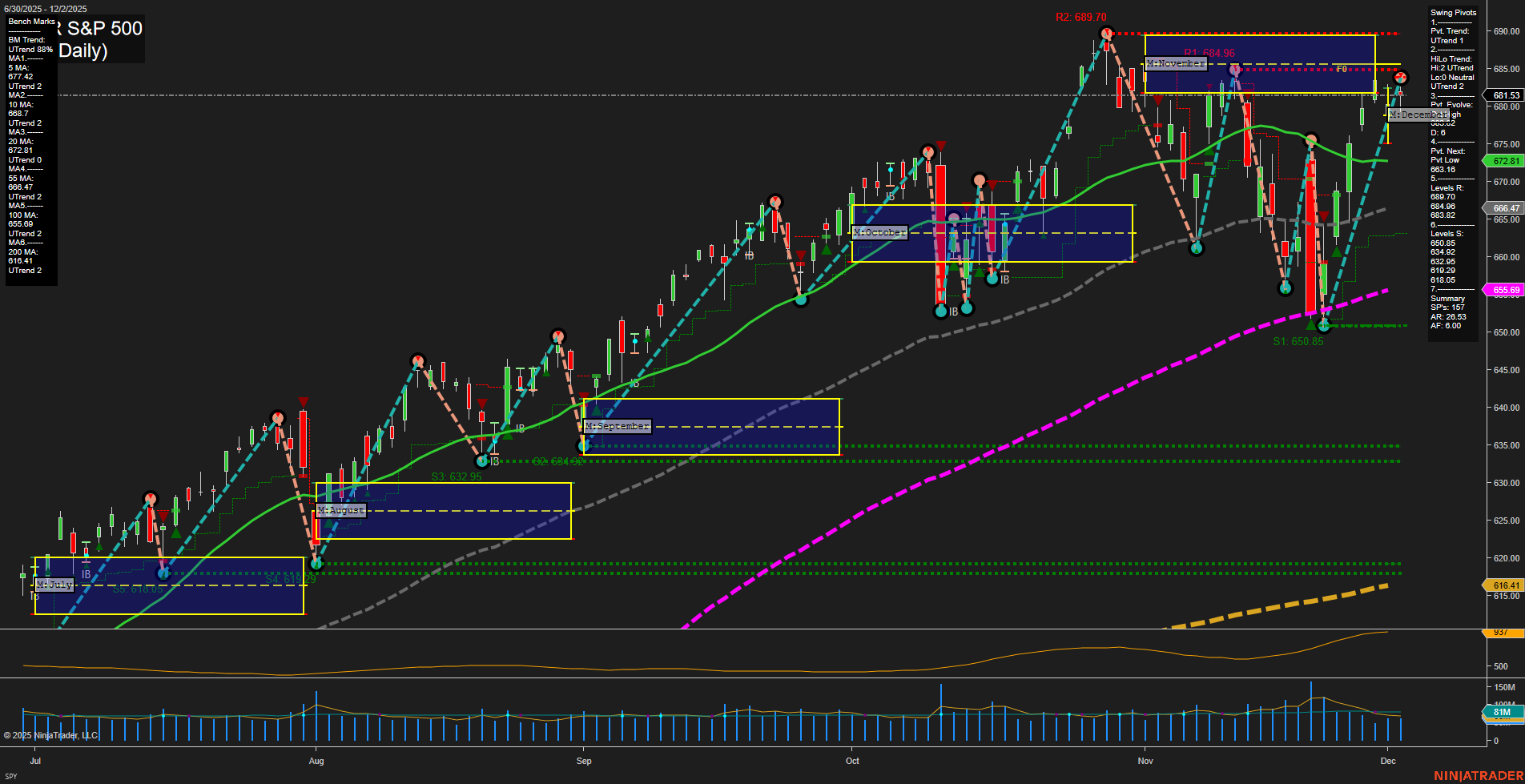

SPY SPDR S&P 500 Daily Chart Analysis: 2025-Dec-03 07:17 CT

Price Action

- Last: 671.05,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 681.53,

- 4. Pvt. Next: Pvt low 650.85,

- 5. Levels R: 694.96, 688.70, 684.96, 681.53,

- 6. Levels S: 650.85, 632.95, 616.41.

Daily Benchmarks

- (Short-Term) 5 Day: 677.42 Up Trend,

- (Short-Term) 10 Day: 668.67 Up Trend,

- (Intermediate-Term) 20 Day: 672.81 Up Trend,

- (Intermediate-Term) 55 Day: 666.47 Up Trend,

- (Long-Term) 100 Day: 655.69 Up Trend,

- (Long-Term) 200 Day: 616.41 Up Trend.

Additional Metrics

- ATR: 56.4,

- VOLMA: 47,470,907.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPY daily chart shows a strong bullish structure across all timeframes, with price currently trading above all key moving averages and the most recent swing pivot confirming an uptrend. The short-term and intermediate-term swing trends are both up, with resistance levels layered above at 681.53, 684.96, 688.70, and 694.96, while support is well-defined at 650.85, 632.95, and 616.41. The average momentum and medium-sized bars suggest steady participation, and volatility (ATR) remains moderate. Volume is healthy, supporting the current trend. The market has recently rebounded from a significant support zone, forming a higher low and pushing toward previous highs, indicating trend continuation rather than reversal. No clear signs of exhaustion or major pullback are present, and the technical environment remains constructive for trend-following strategies. The overall context is one of sustained bullish momentum, with the market respecting both moving average support and swing structure.

Chart Analysis ATS AI Generated: 2025-12-03 07:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.