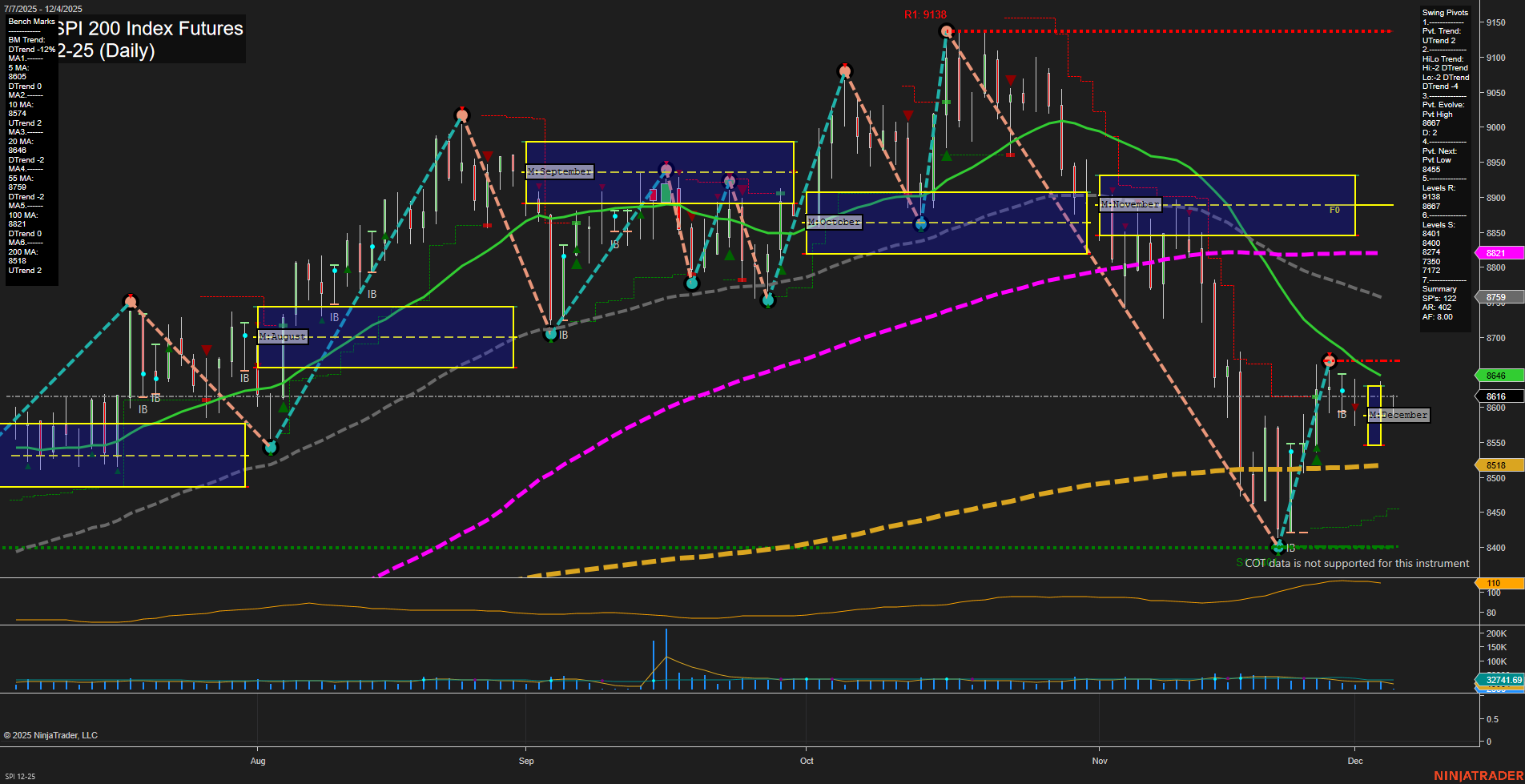

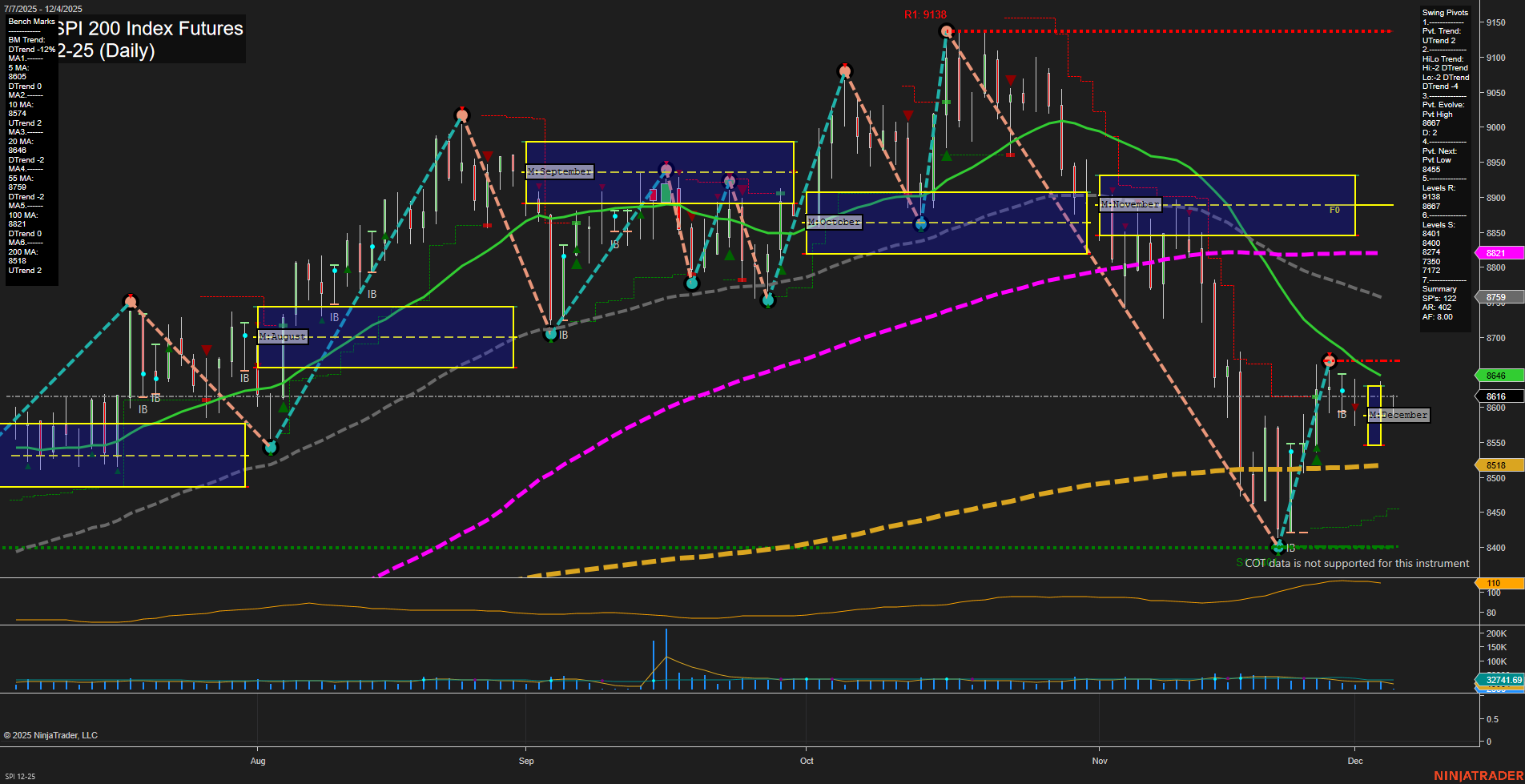

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2025-Dec-03 07:16 CT

Price Action

- Last: 8616,

- Bars: Medium,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 8497,

- 4. Pvt. Next: Pvt low 8445,

- 5. Levels R: 9138, 8867, 8687,

- 6. Levels S: 8497, 8445, 8401, 8300, 7712.

Daily Benchmarks

- (Short-Term) 5 Day: 8574 Up Trend,

- (Short-Term) 10 Day: 8646 Up Trend,

- (Intermediate-Term) 20 Day: 8616 Down Trend,

- (Intermediate-Term) 55 Day: 8821 Down Trend,

- (Long-Term) 100 Day: 8759 Down Trend,

- (Long-Term) 200 Day: 8518 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The SPI 200 Index Futures have recently shown a sharp recovery from the late November lows, with fast momentum and medium-sized bars indicating renewed buying interest. The short-term swing pivot trend has shifted to an uptrend, supported by both the 5-day and 10-day moving averages turning upward. However, the intermediate-term trend remains bearish, as indicated by the 20-day, 55-day, and 100-day moving averages, all trending down. Resistance is clustered above at 8687, 8867, and the major swing high at 9138, while support is established at 8497 and 8445. The market is currently consolidating just below the 20-day MA, suggesting a potential inflection point. Volatility remains moderate, and volume is steady. The overall structure reflects a market in transition, with short-term bullish momentum facing intermediate-term resistance, and long-term direction still undecided. This environment is typical of a market attempting to recover from a significant sell-off, with the potential for either a continuation of the bounce or renewed downside if resistance holds.

Chart Analysis ATS AI Generated: 2025-12-03 07:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.