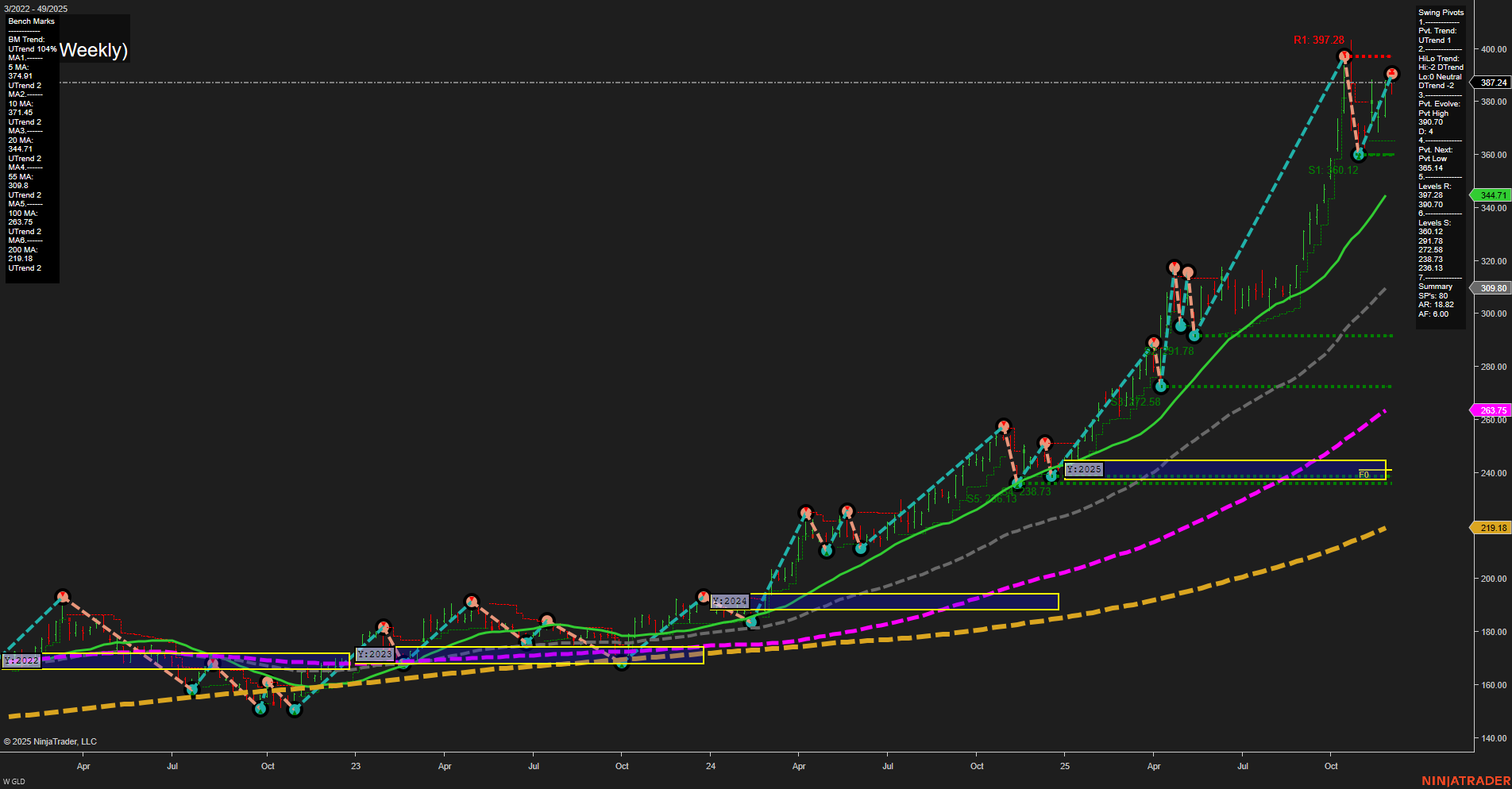

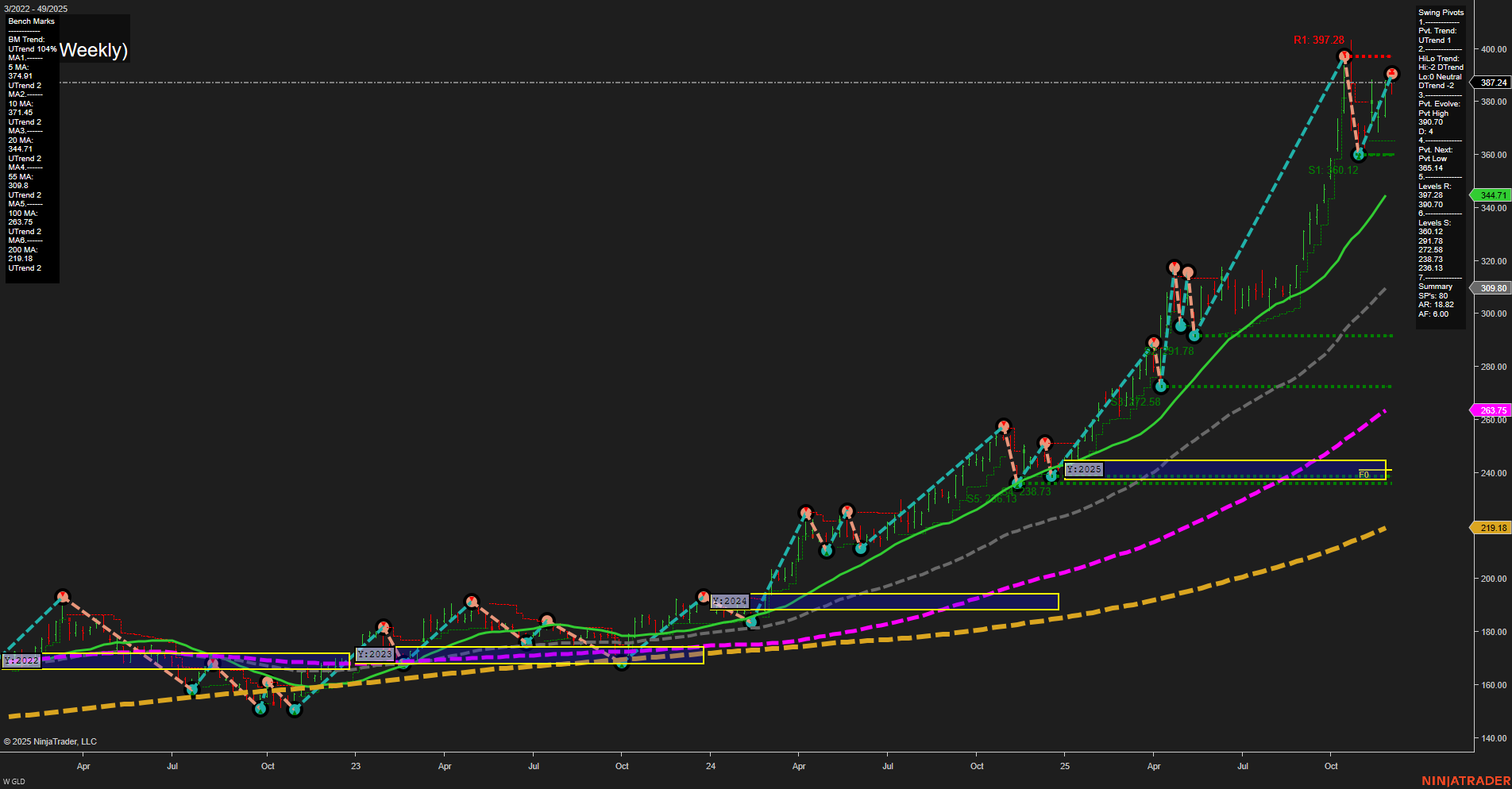

GLD SPDR Gold Shares Weekly Chart Analysis: 2025-Dec-03 07:10 CT

Price Action

- Last: 387.24,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 397.28,

- 4. Pvt. Next: Pvt low 360.12,

- 5. Levels R: 397.28,

- 6. Levels S: 360.12, 291.78, 272.58, 229.78, 220.18, 219.13.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 374.01 Up Trend,

- (Intermediate-Term) 10 Week: 317.48 Up Trend,

- (Long-Term) 20 Week: 344.71 Up Trend,

- (Long-Term) 55 Week: 309.80 Up Trend,

- (Long-Term) 100 Week: 263.75 Up Trend,

- (Long-Term) 200 Week: 219.18 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

GLD has experienced a strong and rapid advance, as evidenced by large weekly bars and fast momentum, pushing price to new highs near 397.28 before a recent pullback. The short-term swing pivot trend remains up, but the intermediate-term HiLo trend has shifted to down, suggesting some consolidation or corrective action after the recent rally. All major moving averages from 5-week to 200-week are in strong uptrends, confirming robust long-term bullish structure. Key support levels are layered below, with the nearest at 360.12, and deeper supports at 291.78 and 272.58, indicating areas where buyers previously stepped in. Resistance is defined by the recent high at 397.28. The neutral bias in the session fib grids across all timeframes suggests the market is pausing after a significant move, possibly digesting gains. Overall, the chart reflects a market in a strong long-term uptrend, with short-term bullishness intact, but with some intermediate-term caution as the market consolidates gains after a major breakout.

Chart Analysis ATS AI Generated: 2025-12-03 07:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.