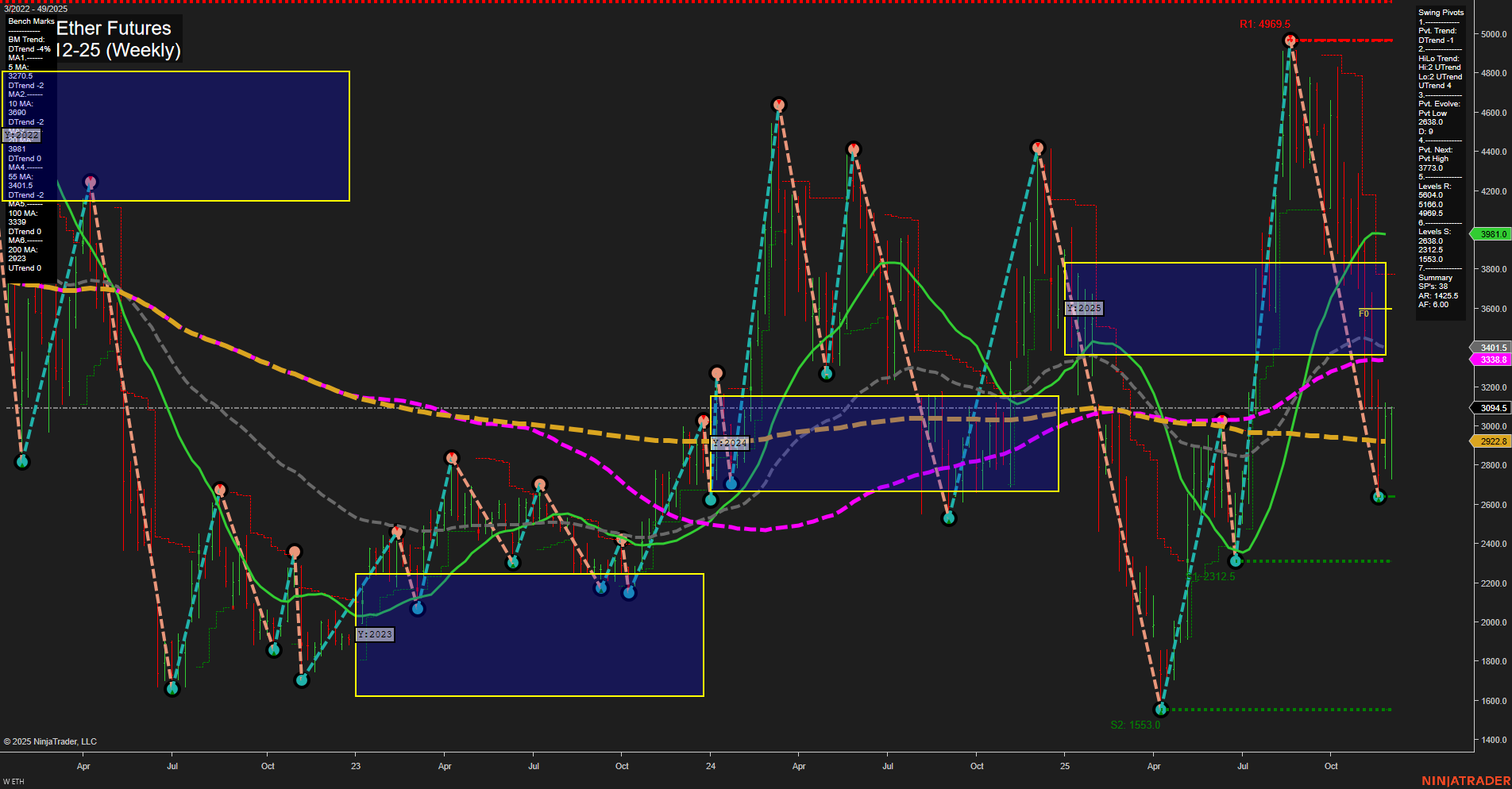

The current weekly chart for ETH CME Ether Futures shows a market in transition. Price action is volatile with large bars and fast momentum, indicating heightened activity and potential for sharp moves. Short-term (WSFG) and intermediate-term (MSFG) session fib grid trends are both up, with price holding above their respective NTZ/F0% levels, suggesting recent bullish momentum. However, the yearly (YSFG) trend remains down, with price below the annual NTZ/F0%, reflecting a longer-term bearish structure. Swing pivots highlight a short-term downtrend, but the intermediate-term HiLo trend is up, showing a possible shift in market sentiment. Key resistance levels are set at 4969.5, 3798.1, and 3338.8, while support is found at 2922.0, 2312.5, and 1553.0. The most recent pivot low at 2922.0 is being tested, and the next significant pivot high is at 3798.1. All major weekly moving averages (5, 10, 20, 55, 100, 200) are trending down, reinforcing the long-term bearish bias. Recent trade signals have triggered long entries, aligning with the short- and intermediate-term uptrends, but these are counter to the prevailing long-term downtrend. Overall, the market is in a consolidation phase with mixed signals: short-term neutral, intermediate-term bullish, and long-term bearish. The chart suggests a battleground between bulls and bears, with the potential for further volatility as price tests key support and resistance levels. Swing traders should be attentive to evolving pivots and the interplay between shorter-term bullish momentum and the overarching long-term downtrend.