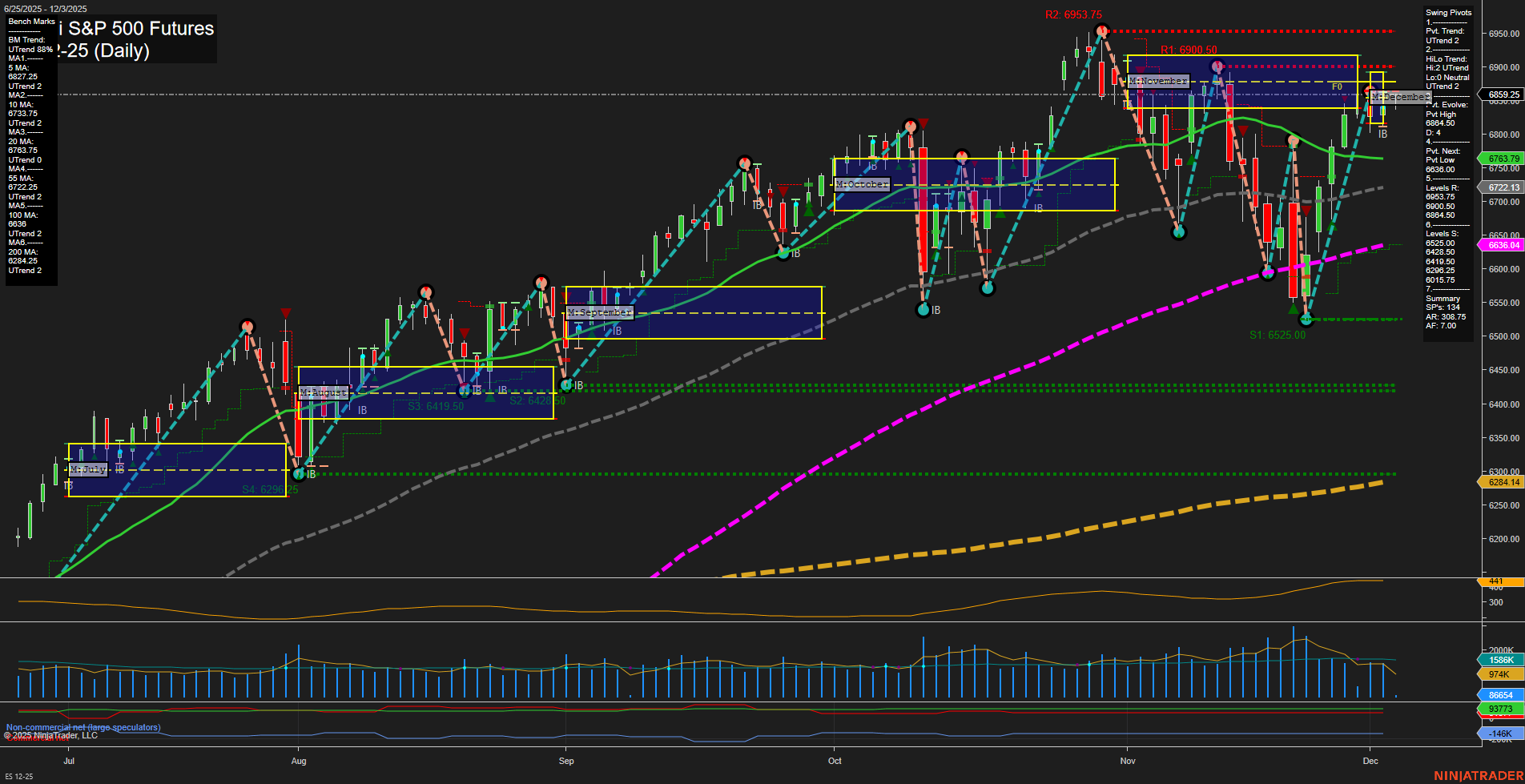

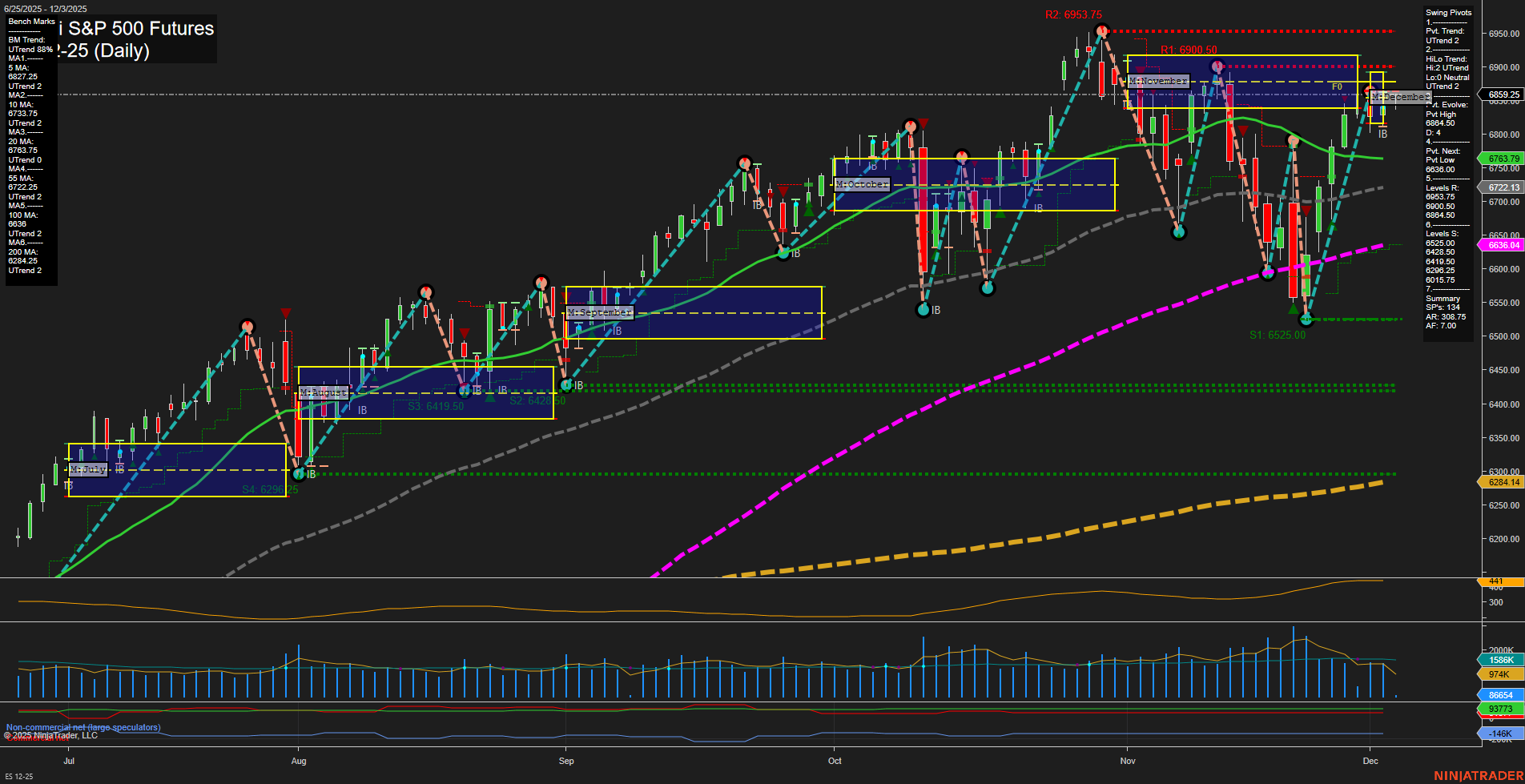

ES E-mini S&P 500 Futures Daily Chart Analysis: 2025-Dec-03 07:06 CT

Price Action

- Last: 6859.25,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 70%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 6845.00,

- 4. Pvt. Next: Pvt low 6525.00,

- 5. Levels R: 6953.75, 6900.50, 6845.00,

- 6. Levels S: 6525.00, 6425.00, 6295.25.

Daily Benchmarks

- (Short-Term) 5 Day: 6827.25 Up Trend,

- (Short-Term) 10 Day: 6733.75 Up Trend,

- (Intermediate-Term) 20 Day: 6723.13 Up Trend,

- (Intermediate-Term) 55 Day: 6634.00 Up Trend,

- (Long-Term) 100 Day: 6536.04 Up Trend,

- (Long-Term) 200 Day: 6284.14 Up Trend.

Additional Metrics

- ATR: 319,

- VOLMA: 1611996.

Recent Trade Signals

- 03 Dec 2025: Long ES 12-25 @ 6855.25 Signals.USAR-MSFG

- 01 Dec 2025: Short ES 12-25 @ 6816.5 Signals.USAR-WSFG

- 26 Nov 2025: Long ES 12-25 @ 6842.75 Signals.USAR.TR720

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The ES E-mini S&P 500 Futures daily chart is showing a strong bullish structure across all timeframes. Price is trading above all key moving averages, with each benchmark MA trending upward, confirming broad market strength. The most recent swing pivot is a high at 6845, with the next significant support at 6525, indicating a healthy distance from major downside risk. The ATR remains elevated, suggesting persistent volatility, while volume is robust, supporting the current price action. Recent trade signals have alternated but the prevailing direction is upward, with the latest signal aligning with the intermediate-term uptrend. The market has recovered from recent pullbacks, forming higher lows and breaking above resistance zones, which is characteristic of a trend continuation phase. No major signs of exhaustion or reversal are present, and the technical landscape favors ongoing bullish momentum as the year-end approaches.

Chart Analysis ATS AI Generated: 2025-12-03 07:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.