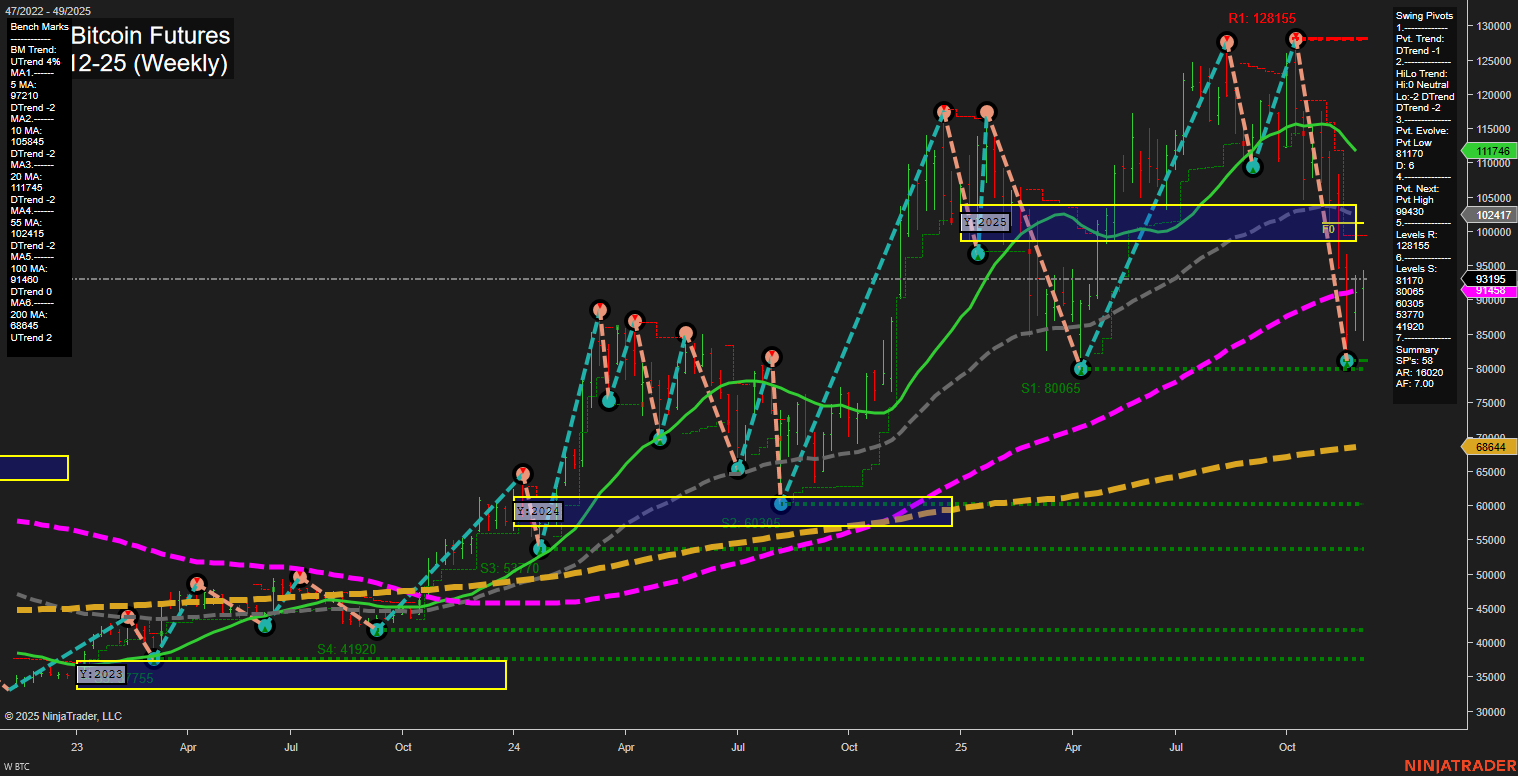

The current weekly chart for BTC CME Bitcoin Futures shows a market in transition. Price action is volatile with large bars and fast momentum, indicating heightened activity and possible attempts at reversal or continuation. Short-term and intermediate-term Fib grid trends are both up, with price holding above their respective NTZ/F0% levels, suggesting some bullish undercurrents. However, the long-term yearly grid remains in a downtrend, with price below the yearly NTZ/F0%, reflecting persistent bearish pressure on a macro scale. Swing pivots highlight a short-term downtrend, with the most recent pivot low at 81,170 and the next resistance at 96,430. Resistance levels are stacked above, with the major swing high at 128,155, while support is clustered around 81,170 and 80,065, then much lower at 63,075 and 59,700. The intermediate-term HiLo trend is neutral, indicating indecision or consolidation after recent volatility. All key weekly moving averages (except the 200-week) are trending down, reinforcing the broader bearish structure, though the 100-week MA is now just below price, hinting at a possible inflection point. Recent trade signals have triggered long entries, reflecting the short-term and intermediate-term grid uptrends, but these are counter to the prevailing long-term downtrend. In summary, the market is at a crossroads: short- and intermediate-term signals are showing some recovery and potential for a bounce, but the long-term structure remains bearish. This environment is typical of a corrective phase or a possible base-building process after a significant sell-off. Swing traders should note the potential for choppy, two-way action as the market tests key resistance and support levels, with volatility likely to persist until a decisive breakout or breakdown occurs.