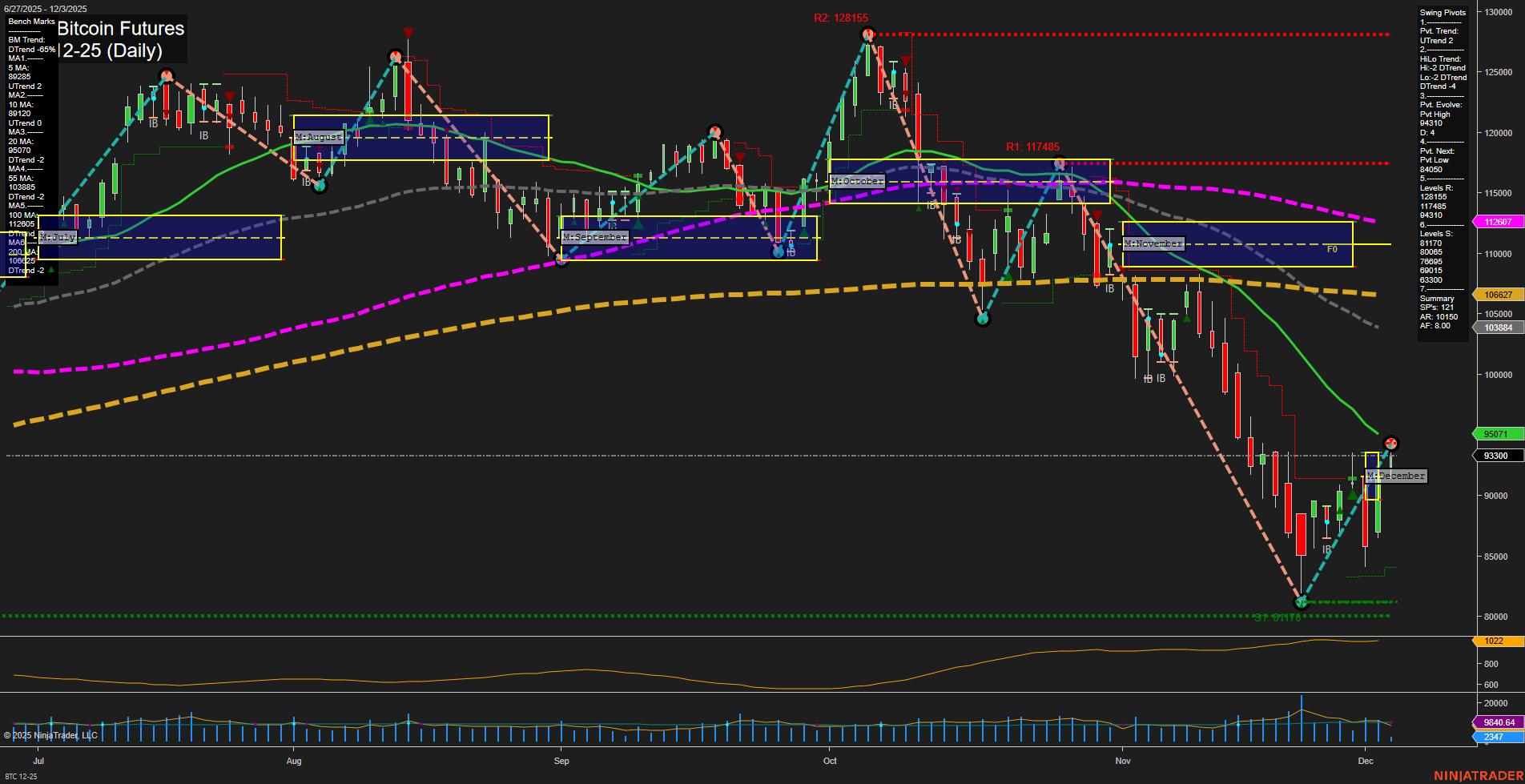

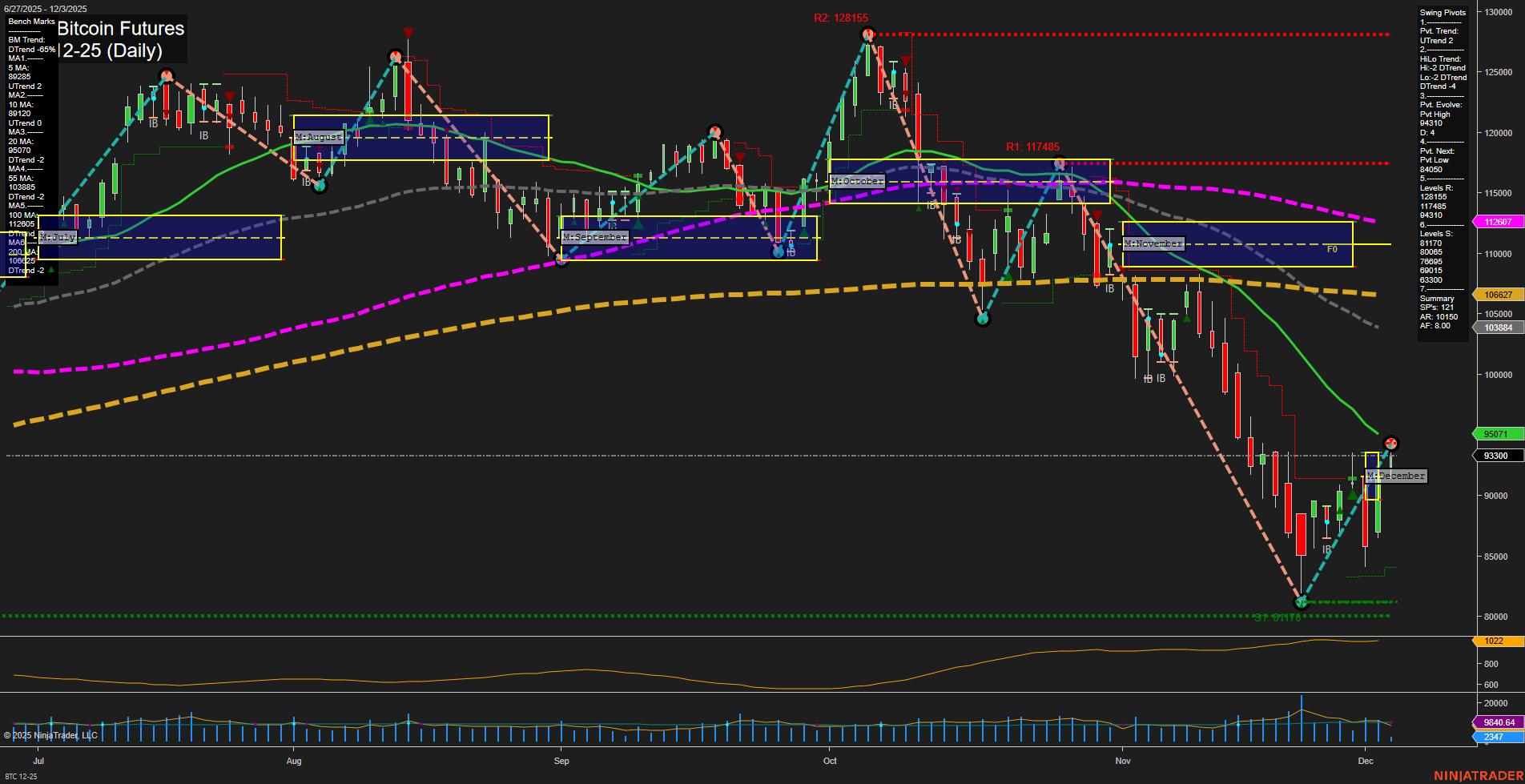

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Dec-03 07:03 CT

Price Action

- Last: 95071,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 28%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -31%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 94319,

- 4. Pvt. Next: Pvt Low 91110,

- 5. Levels R: 128155, 117485, 94319,

- 6. Levels S: 91110, 84050.

Daily Benchmarks

- (Short-Term) 5 Day: 93300 Up Trend,

- (Short-Term) 10 Day: 95071 Up Trend,

- (Intermediate-Term) 20 Day: 95071 Up Trend,

- (Intermediate-Term) 55 Day: 112907 Down Trend,

- (Long-Term) 100 Day: 106627 Down Trend,

- (Long-Term) 200 Day: 98404 Down Trend.

Additional Metrics

Recent Trade Signals

- 03 Dec 2025: Long BTC 12-25 @ 93515 Signals.USAR-WSFG

- 02 Dec 2025: Long BTC 12-25 @ 89690 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

BTC CME Bitcoin Futures have recently staged a notable bounce from the 84,050–91,110 support zone, with price action now above both the weekly and monthly session fib grid centers, indicating renewed short-term and intermediate-term strength. The short-term swing pivot trend has shifted to an uptrend, supported by recent long trade signals and upward momentum in the 5, 10, and 20-day moving averages. However, the intermediate-term HiLo trend remains in a downtrend, and the 55, 100, and 200-day moving averages are still trending lower, reflecting persistent long-term bearish pressure. Resistance is stacked above at 94,319, 117,485, and 128,155, while support is firm at 91,110 and 84,050. Volatility is moderate, and volume is healthy, suggesting active participation in this recovery phase. The overall structure points to a short-term bullish reversal within a broader corrective environment, with the market currently testing whether this bounce can evolve into a sustained trend change or if it will encounter resistance and revert to the prevailing long-term downtrend.

Chart Analysis ATS AI Generated: 2025-12-03 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.