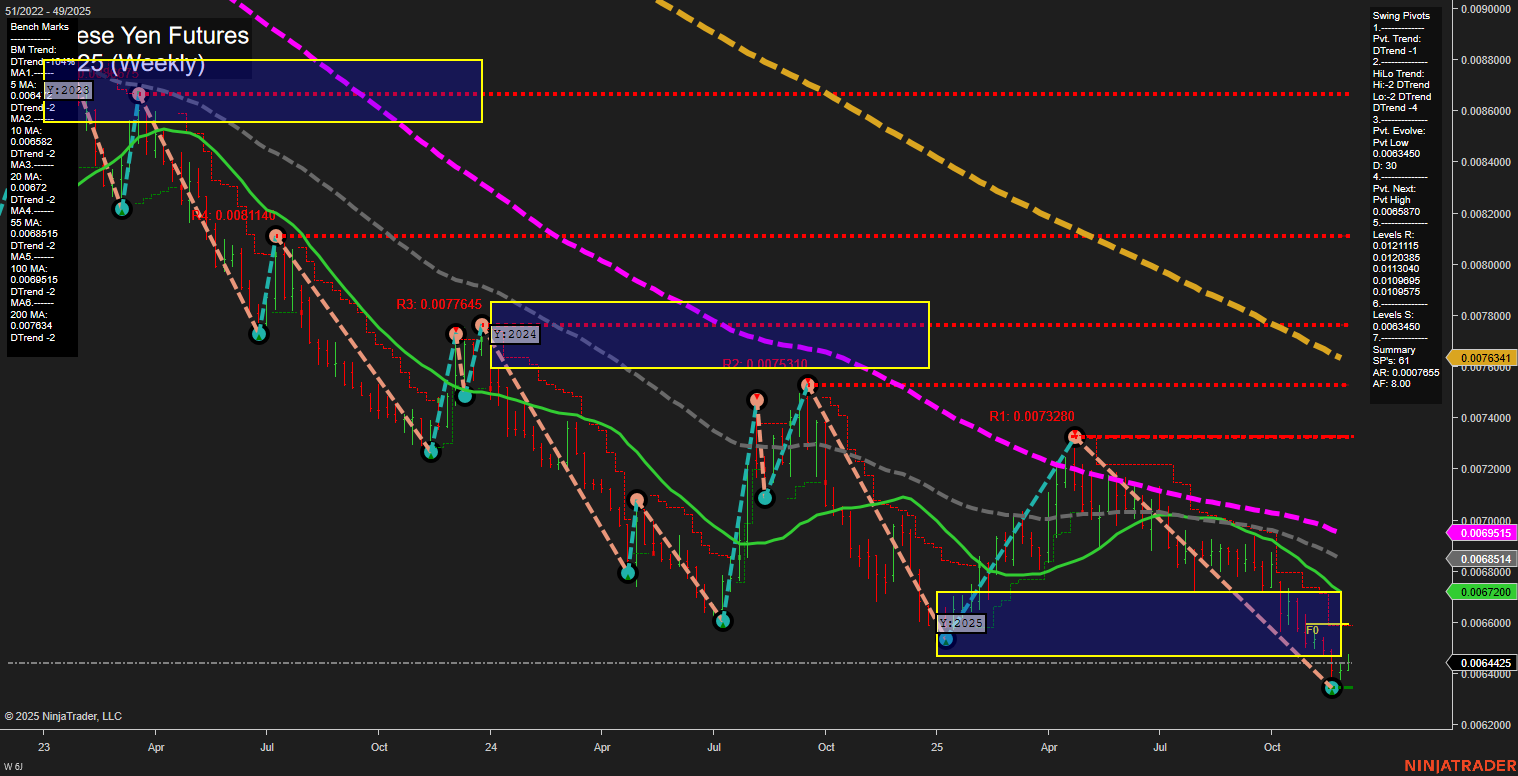

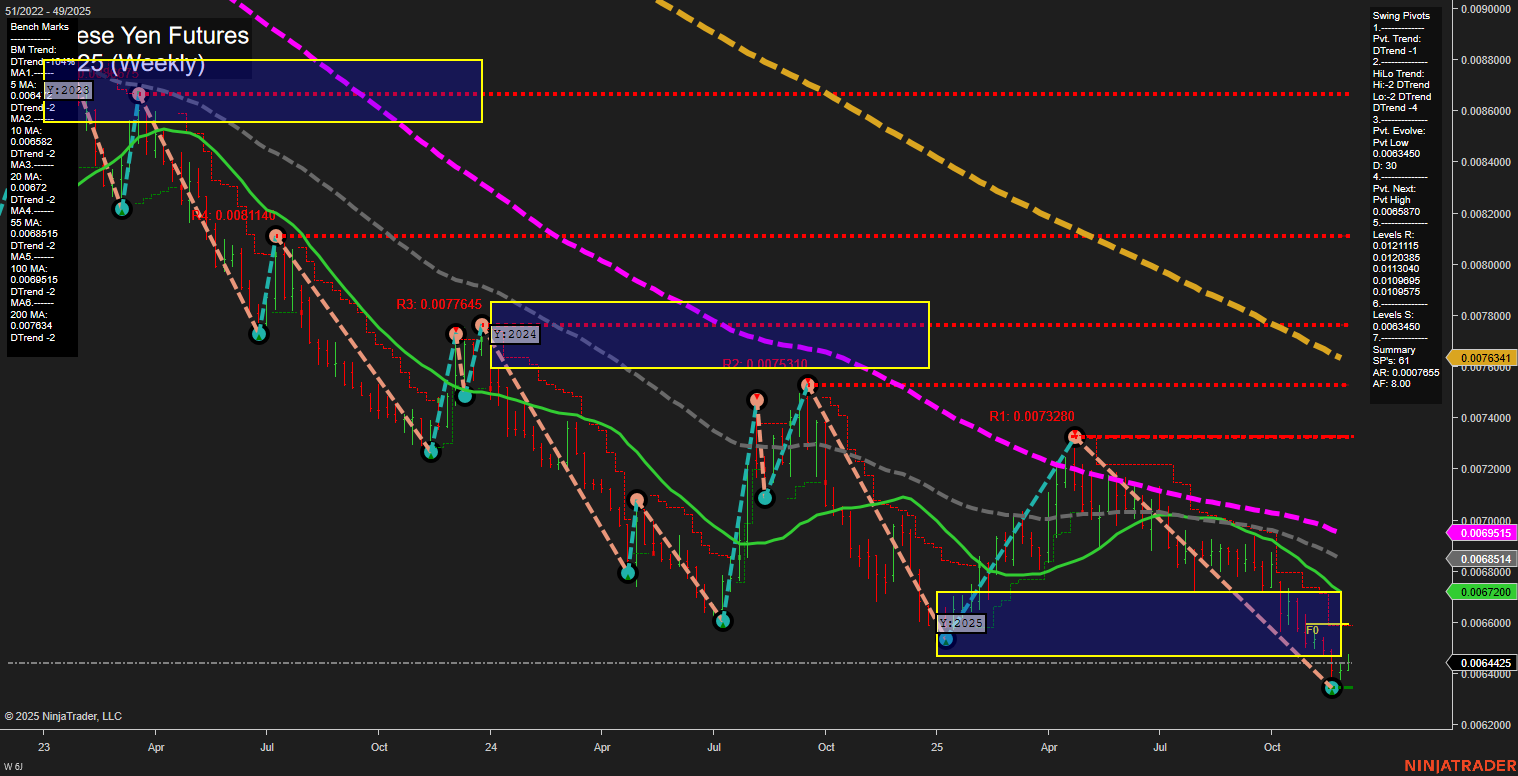

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Dec-03 07:03 CT

Price Action

- Last: 0.0064425,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 32%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -12%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 0.0063450,

- 4. Pvt. Next: Pvt High 0.0065870,

- 5. Levels R: 0.0121115, 0.0113040, 0.0109869, 0.0109575, 0.0073280,

- 6. Levels S: 0.0063450.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.006823 Up Trend,

- (Intermediate-Term) 10 Week: 0.006582 Up Trend,

- (Long-Term) 20 Week: 0.006772 Down Trend,

- (Long-Term) 55 Week: 0.0069515 Down Trend,

- (Long-Term) 100 Week: 0.0089515 Down Trend,

- (Long-Term) 200 Week: 0.007634 Down Trend.

Recent Trade Signals

- 01 Dec 2025: Long 6J 12-25 @ 0.006469 Signals.USAR-MSFG

- 01 Dec 2025: Long 6J 12-25 @ 0.006427 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The 6J Japanese Yen Futures weekly chart shows a market in transition. Price action is stabilizing after a prolonged downtrend, with the most recent bars showing medium size and slow momentum, suggesting a pause or potential base formation. Short-term and intermediate-term Fib grid trends have shifted upward, with price now above their respective NTZ/F0% levels, indicating a possible early-stage reversal or at least a corrective bounce. However, the long-term yearly trend remains down, with price still below the yearly NTZ/F0% and all major long-term moving averages trending lower. Swing pivots confirm a dominant downtrend in both short and intermediate timeframes, but a new pivot low has formed, and the next key resistance is at 0.0065870. The cluster of resistance levels above, combined with the downward slope of the 20, 55, 100, and 200 week moving averages, highlights significant overhead supply. Recent trade signals have triggered long entries, reflecting the short-term and intermediate-term upward bias, but the overall structure remains vulnerable to further downside unless price can reclaim and hold above key resistance and moving averages. The market is currently in a consolidation phase, with potential for a corrective rally, but the broader trend context is still bearish.

Chart Analysis ATS AI Generated: 2025-12-03 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.