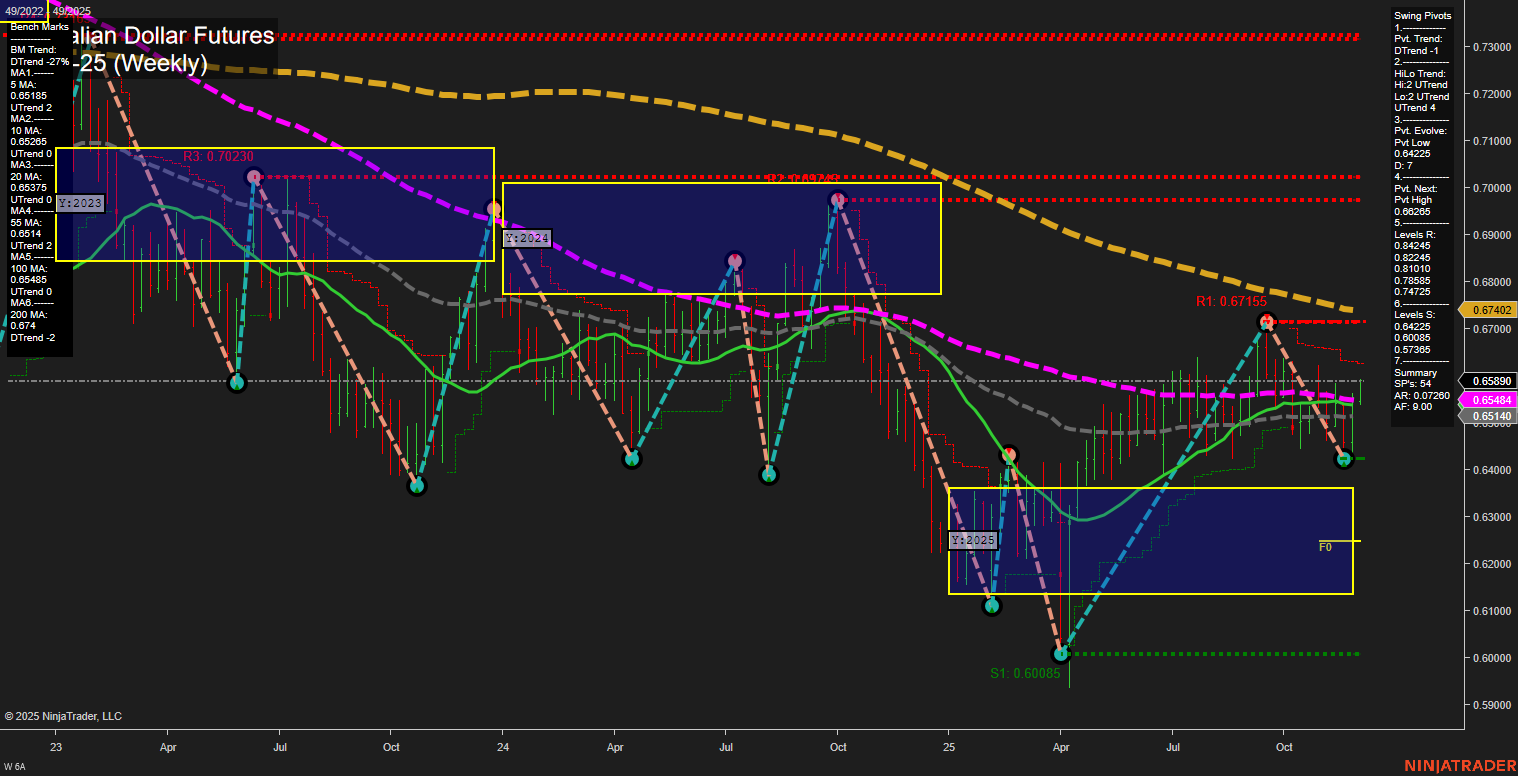

The 6A Australian Dollar Futures weekly chart shows a market in transition. Price action is currently consolidating near 0.65890, with medium-sized bars and average momentum, reflecting a pause after a recent upward move. The short-term (WSFG) and long-term (YSFG) session fib grid trends are neutral, indicating a lack of clear directional bias at these timeframes. However, the intermediate-term (MSFG) trend is showing bullish characteristics, supported by a series of recent long trade signals and upward-trending 5, 10, 20, 55, and 100-week moving averages. The 200-week moving average remains in a downtrend, acting as a potential resistance ceiling. Swing pivot analysis reveals a short-term downtrend but an intermediate-term uptrend, with the most recent pivot low at 0.60825 and the next key resistance at 0.68265. Multiple resistance levels cluster just above current price, suggesting the market may face headwinds if it attempts to rally further. Support is well-defined at the recent swing low. Overall, the chart reflects a market that has rebounded from lows and is now testing the strength of its recovery. The intermediate-term bullishness is tempered by neutral short- and long-term signals, as well as significant overhead resistance. The environment is one of consolidation with a slight bullish tilt, as the market digests recent gains and awaits a catalyst for the next directional move.