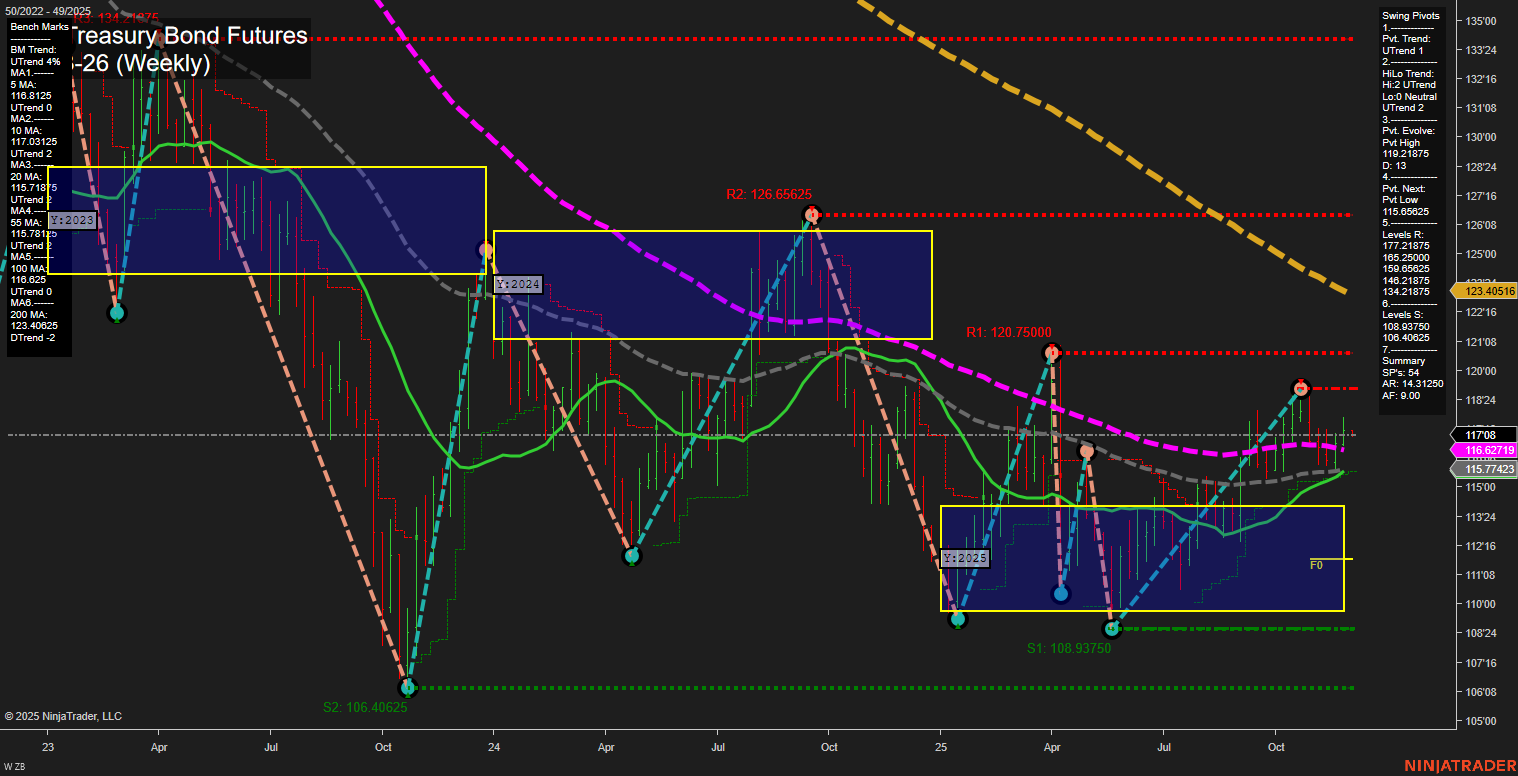

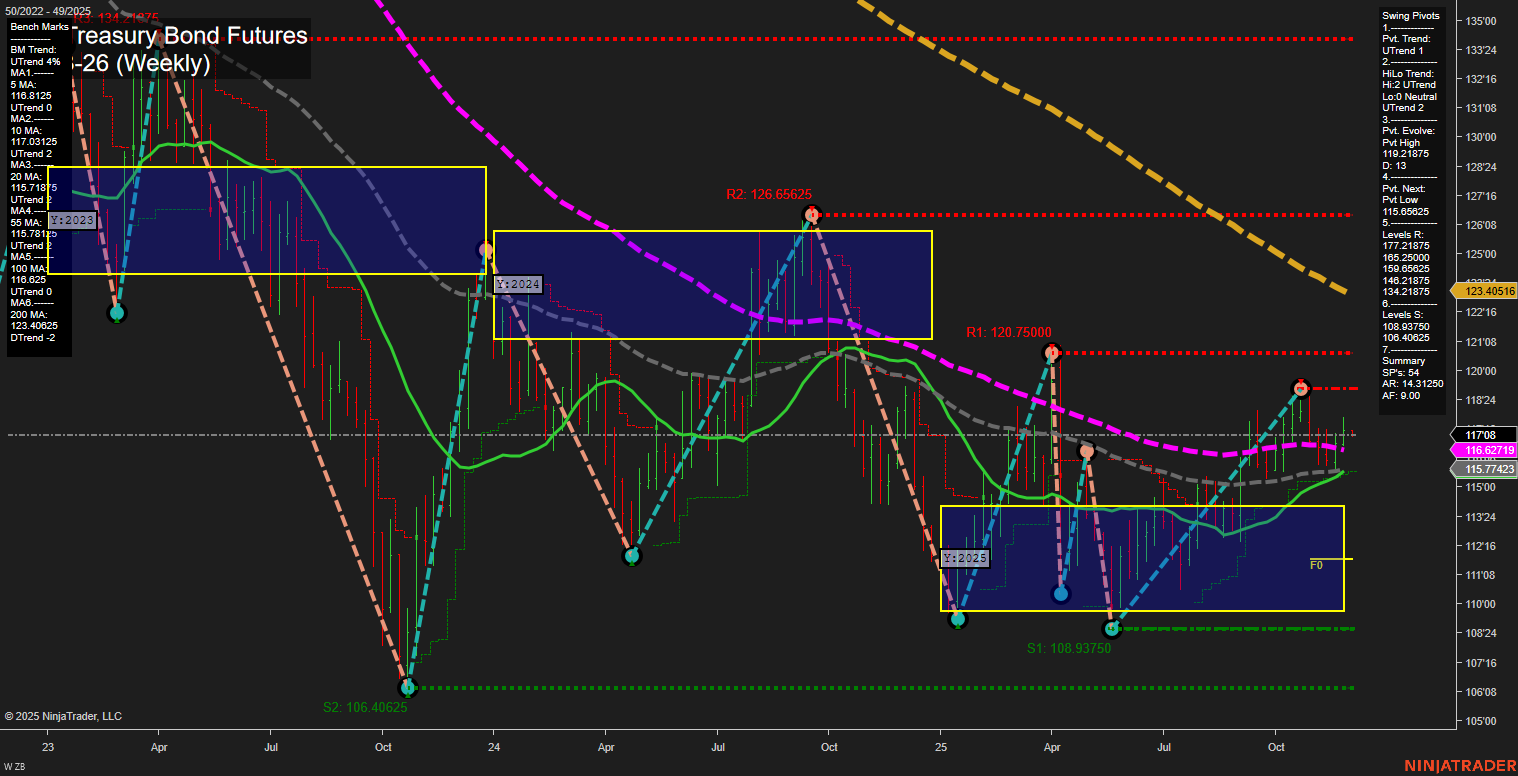

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Nov-30 18:16 CT

Price Action

- Last: 117.08,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 119.21875,

- 4. Pvt. Next: Pvt Low 115.05825,

- 5. Levels R: 119.21875, 115.25000, 108.40625, 134.21875, 126.65625,

- 6. Levels S: 108.93750, 108.40025.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 116.8125 Up Trend,

- (Intermediate-Term) 10 Week: 117.03125 Up Trend,

- (Long-Term) 20 Week: 115.71875 Up Trend,

- (Long-Term) 55 Week: 115.77423 Up Trend,

- (Long-Term) 100 Week: 116.625 Up Trend,

- (Long-Term) 200 Week: 123.40625 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a market in recovery mode, with a clear shift to an uptrend in both short- and intermediate-term swing pivots. Price is consolidating above key moving averages, with all benchmarks except the 200-week MA trending upward, indicating broad-based strength. The most recent swing pivot is a high at 119.21875, with the next key support at 115.05825, suggesting a range-bound environment with upward bias. The neutral stance of the session fib grids across all timeframes points to a market in transition, potentially awaiting a catalyst for a decisive breakout. Volatility has moderated, and the market is digesting prior gains after a strong rally from the yearly lows. The technical structure favors continued consolidation with a bullish tilt, as higher lows and improving momentum support the case for further upside, provided support levels hold. No clear breakout or breakdown is evident, so the focus remains on monitoring for a sustained move above resistance or a reversal at support.

Chart Analysis ATS AI Generated: 2025-11-30 18:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.