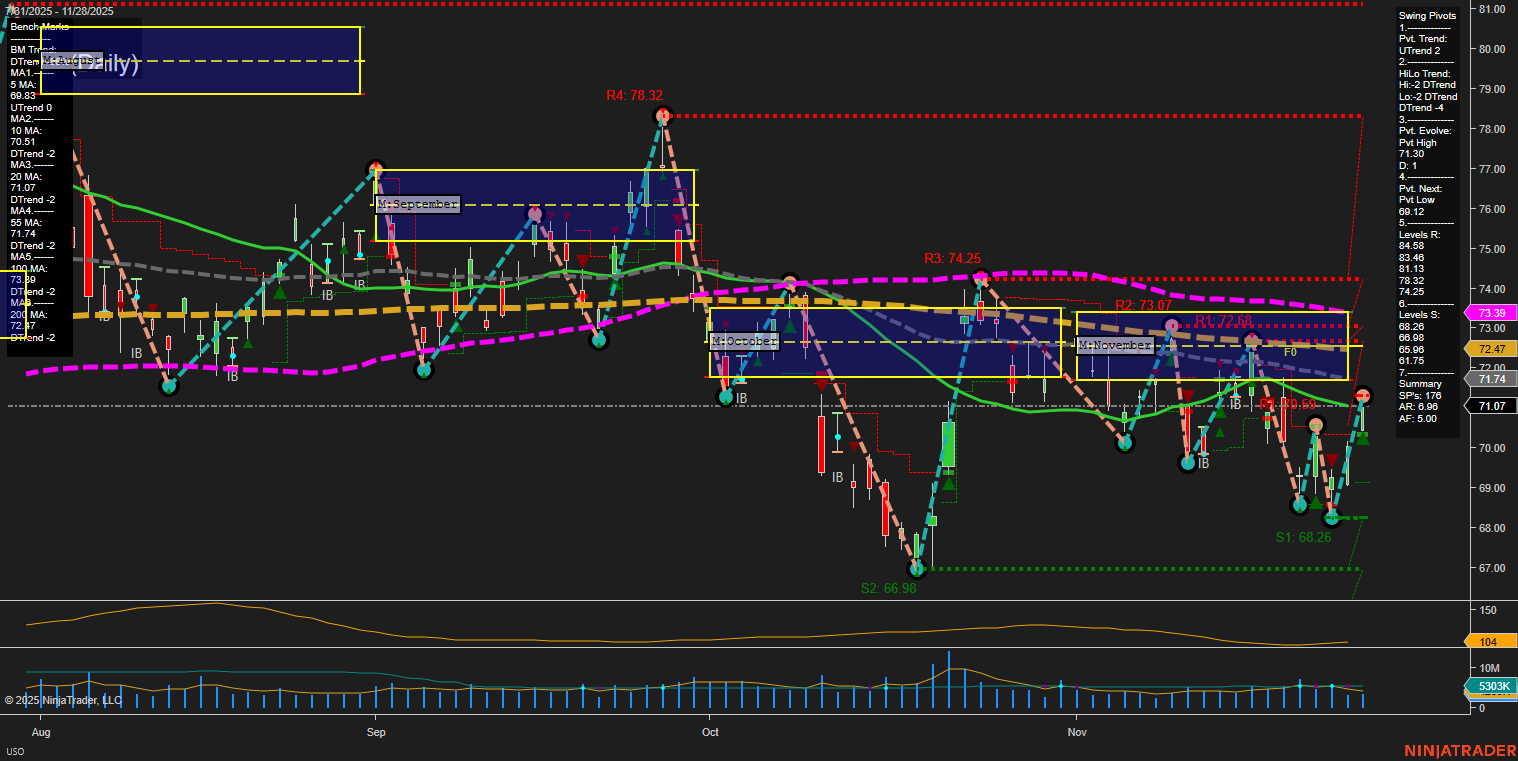

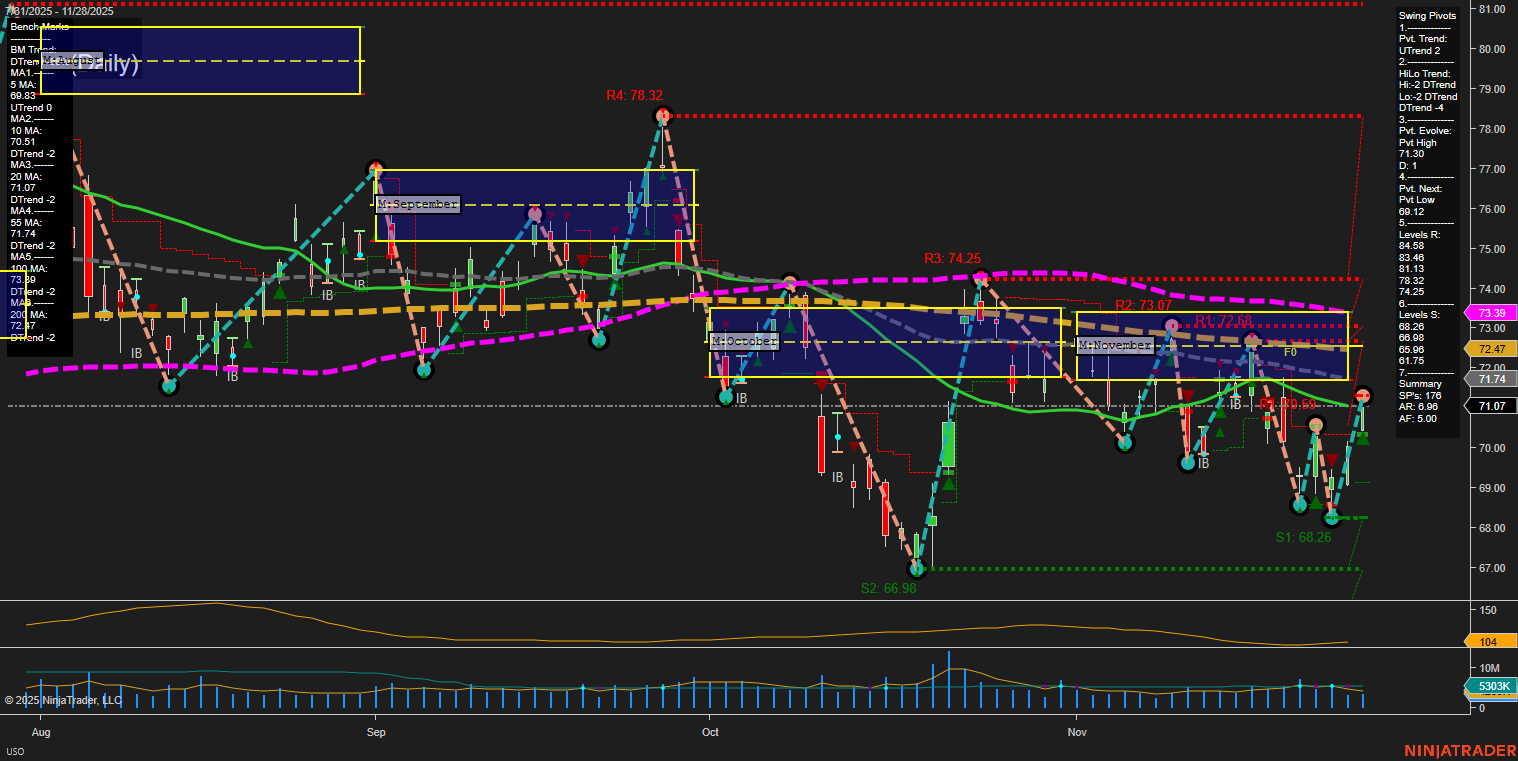

USO United States Oil Fund LP Daily Chart Analysis: 2025-Nov-30 18:15 CT

Price Action

- Last: 73.39,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 71.30,

- 4. Pvt. Next: Pvt Low 69.12,

- 5. Levels R: 78.32, 74.25, 73.07, 72.68, 71.75,

- 6. Levels S: 68.98, 68.26, 66.98, 65.86, 61.75.

Daily Benchmarks

- (Short-Term) 5 Day: 70.51 Up Trend,

- (Short-Term) 10 Day: 71.04 Up Trend,

- (Intermediate-Term) 20 Day: 71.77 Up Trend,

- (Intermediate-Term) 55 Day: 71.74 Down Trend,

- (Long-Term) 100 Day: 73.98 Down Trend,

- (Long-Term) 200 Day: 72.47 Down Trend.

Additional Metrics

- ATR: 138,

- VOLMA: 2,577,640.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

USO is currently showing a short-term bullish swing with the last price at 73.39, supported by upward momentum in the 5, 10, and 20-day moving averages. The short-term swing pivot trend is up (UTrend), but the intermediate-term HiLo trend remains down (DTrend), indicating that while there is a recent bounce, the broader swing structure is still consolidating after a prior downtrend. Resistance levels are clustered between 71.75 and 78.32, with support levels notably lower, suggesting a wide trading range and potential for volatility. The ATR is elevated, reflecting increased price movement, while volume remains steady. The overall technical picture is one of a market in transition, with short-term bullishness facing intermediate and long-term neutrality, as price consolidates within the monthly and yearly session grids. This environment is typical of a market seeking direction after a period of volatility, with both trend continuation and reversal scenarios possible depending on how price interacts with the key resistance and support levels.

Chart Analysis ATS AI Generated: 2025-11-30 18:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.