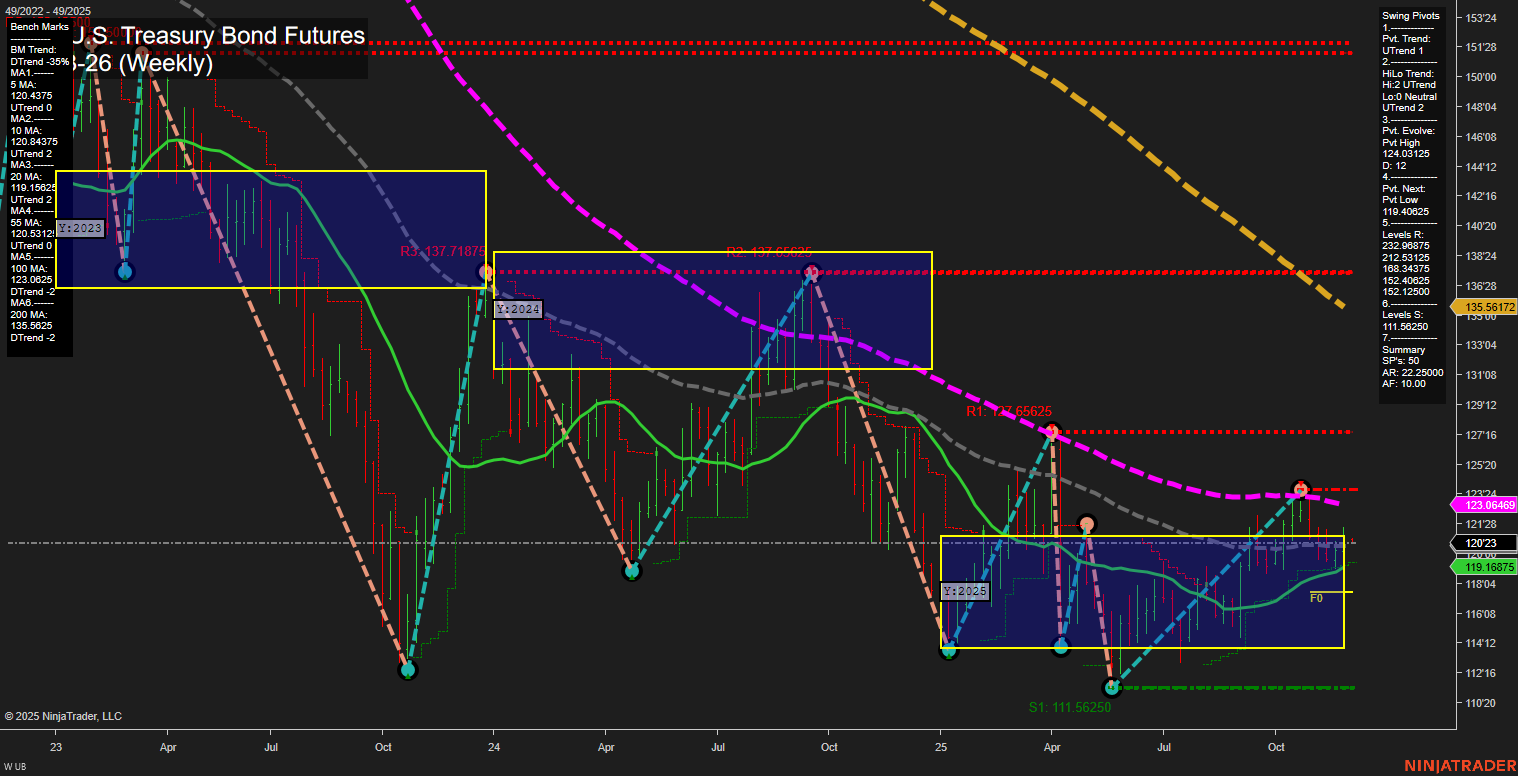

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a notable shift in momentum, with price action currently above all key session Fib grid centers (WSFG, MSFG, YSFG), indicating a broad-based uptrend across short, intermediate, and long-term timeframes. The swing pivot structure confirms an upward trend in both short- and intermediate-term metrics, with the most recent pivot high at 124.03125 and next support at 119.40825. Resistance is layered above, with the nearest at 124.03125 and 132.06875, while support is firm at 119.40825 and 111.56250. Benchmark moving averages reinforce the bullish short- and intermediate-term outlook, as the 5, 10, and 20-week MAs are all trending up and price is currently above these levels. However, the 55, 100, and 200-week MAs remain in a downtrend, suggesting that while the recent rally is strong, the longer-term trend is still in a transition phase and has not fully reversed. Recent trade signals confirm the bullish bias, with long entries triggered on both the weekly and monthly session grid signals. The chart reflects a V-shaped recovery from the yearly lows, with price consolidating above the NTZ center and showing signs of trend continuation rather than a reversal. The market is currently testing overhead resistance, and the structure of higher lows and higher highs supports the ongoing bullish momentum in the short and intermediate term, while the long-term remains neutral as it awaits further confirmation of trend reversal.