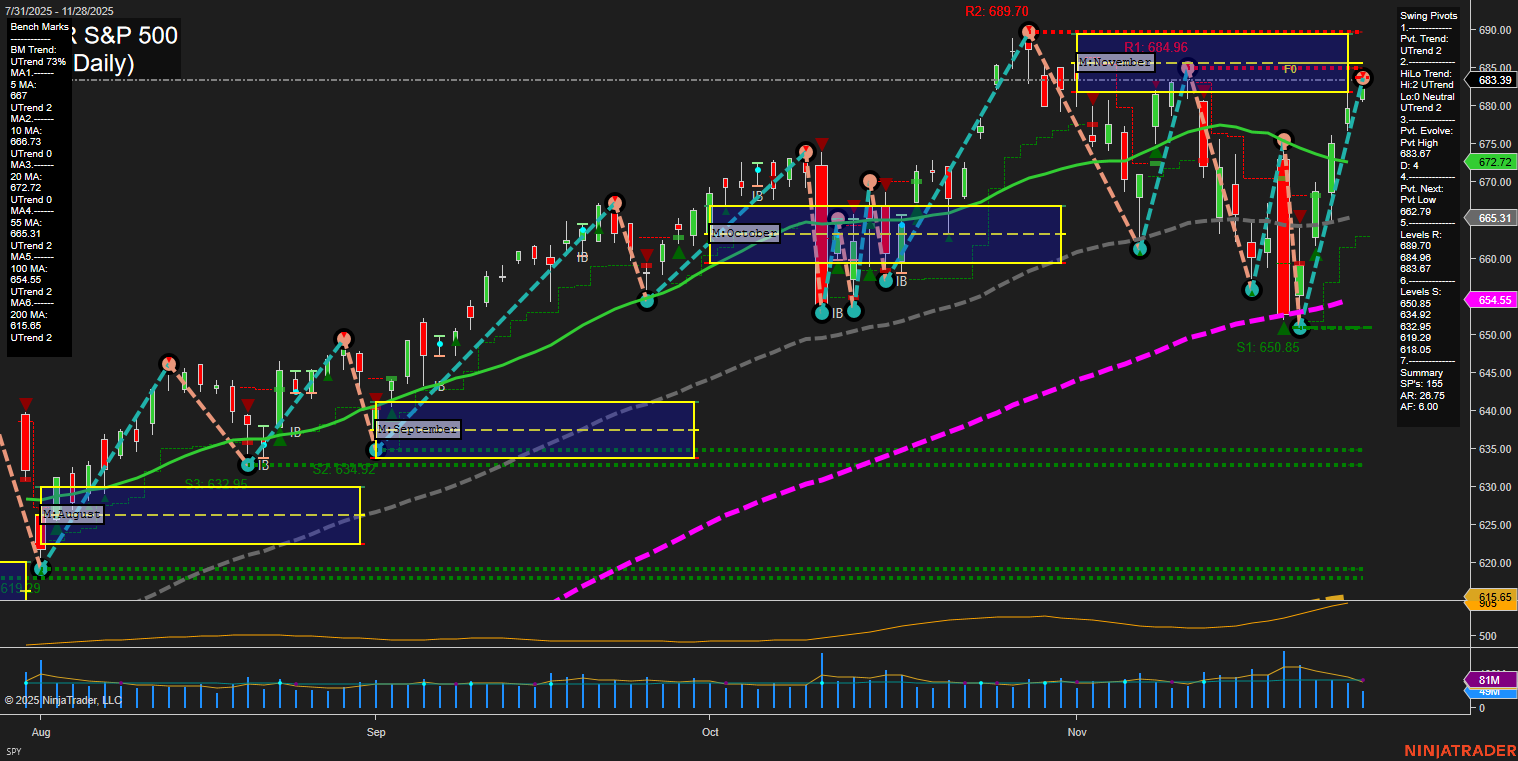

The SPY daily chart as of late November 2025 shows a strong bullish structure across all timeframes. Price action is characterized by medium-sized bars and average momentum, indicating steady participation without excessive volatility. All benchmark moving averages (from short to long-term) are in uptrends, confirming broad market strength. The swing pivot structure is in an uptrend both short and intermediate term, with the most recent pivot high at 683.07 and the next key pivot low at 662.79, suggesting the market is making higher highs and higher lows. Resistance is layered just above current price, with the highest at 689.70, while support is well-defined below, starting at 650.85. The ATR and volume metrics indicate healthy but not extreme volatility and participation. The neutral bias on the session fib grids (weekly, monthly, yearly) suggests price is not extended relative to recent ranges, supporting the idea of a stable uptrend rather than a frothy or overbought market. Overall, the technical landscape favors trend continuation, with no immediate signs of reversal or exhaustion. The market appears to be in a consolidation phase near highs, potentially setting up for a breakout or further trend continuation if resistance is cleared.