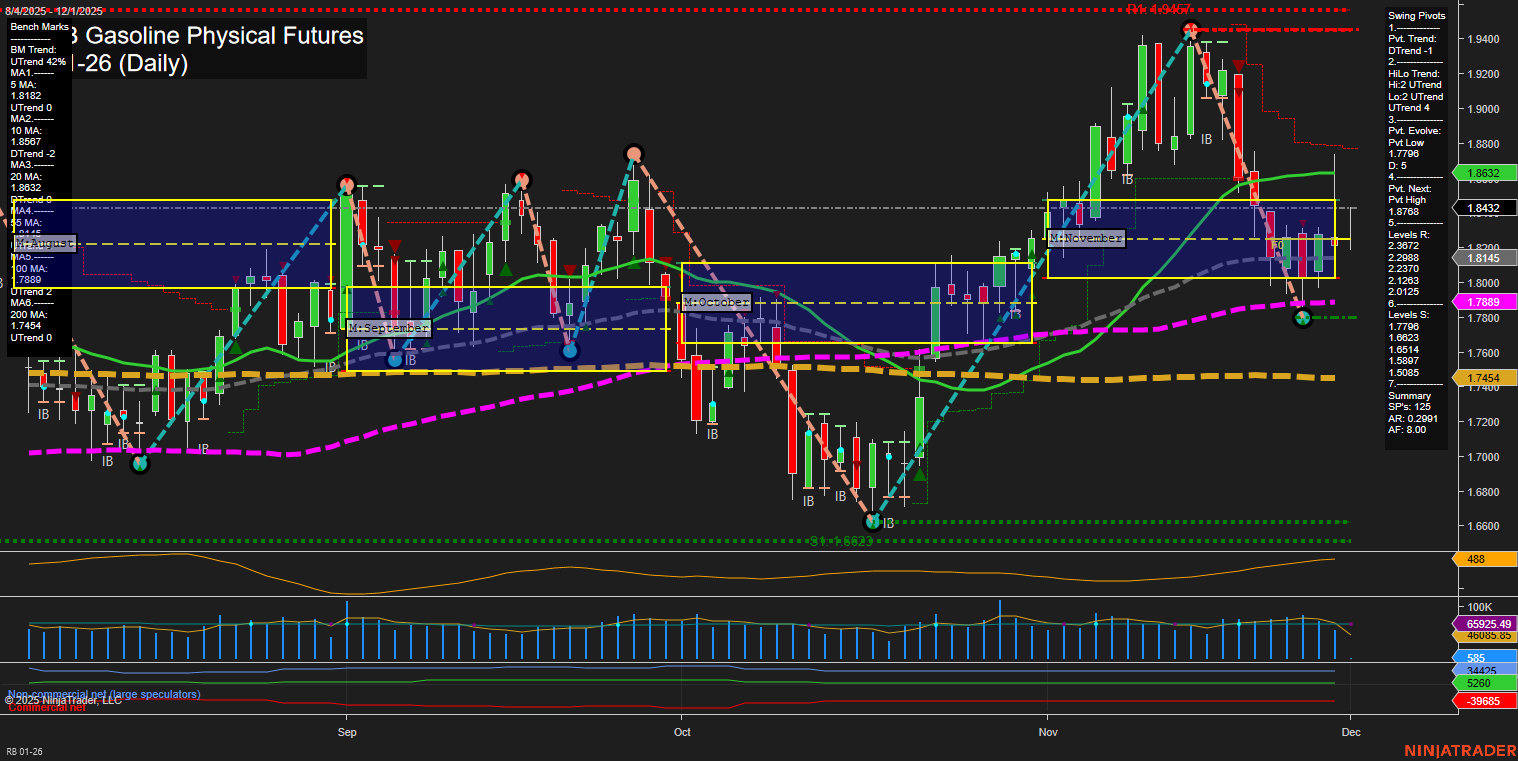

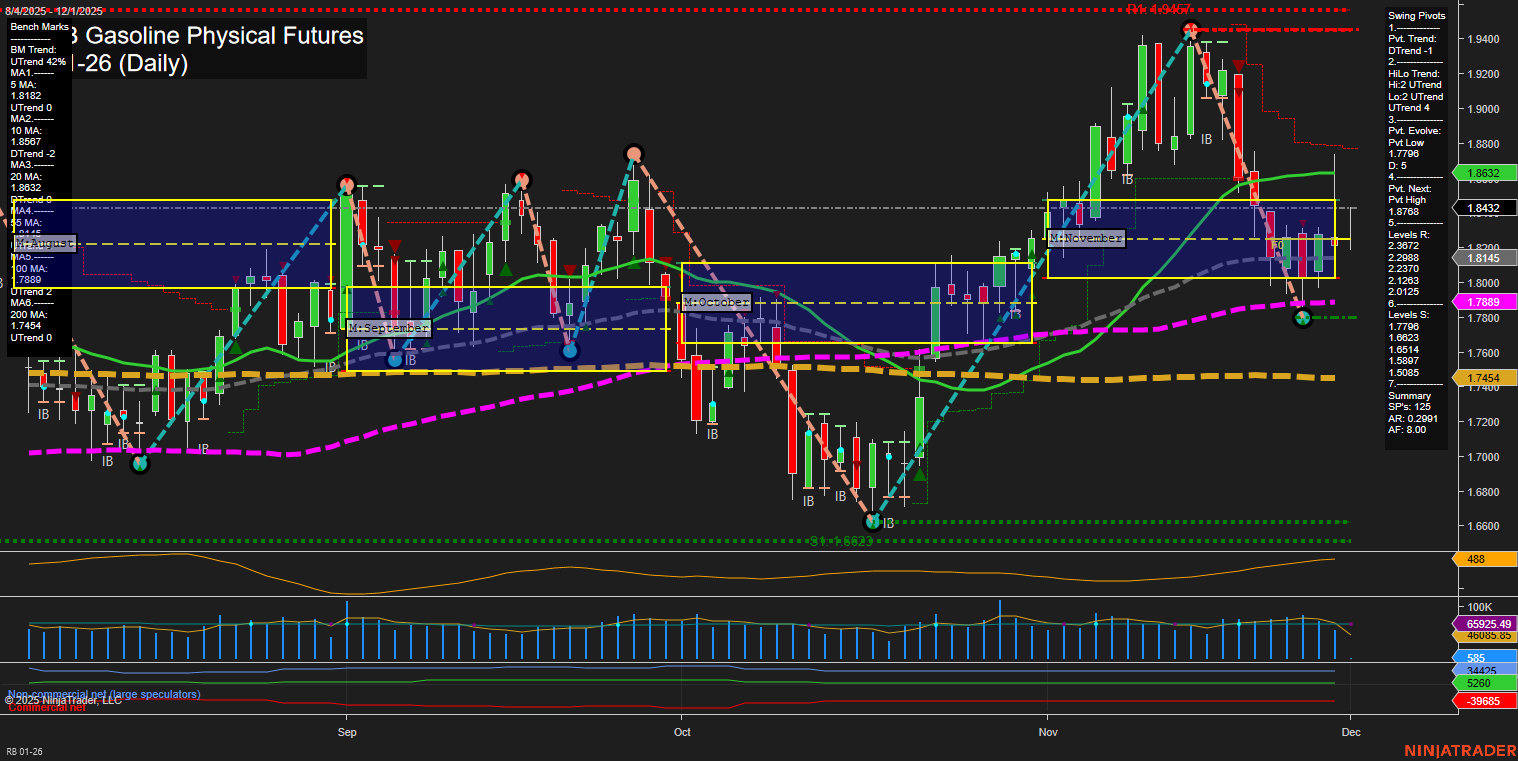

RB RBOB Gasoline Physical Futures Daily Chart Analysis: 2025-Nov-30 18:11 CT

Price Action

- Last: 1.8432,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 38%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 44%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 1.7889,

- 4. Pvt. Next: Pvt High 1.8632,

- 5. Levels R: 1.9465, 1.8788, 1.8632, 1.8432,

- 6. Levels S: 1.7889, 1.7798, 1.6823, 1.6514, 1.5887, 1.5085.

Daily Benchmarks

- (Short-Term) 5 Day: 1.8182 Up Trend,

- (Short-Term) 10 Day: 1.8657 Down Trend,

- (Intermediate-Term) 20 Day: 1.8632 Down Trend,

- (Intermediate-Term) 55 Day: 1.7889 Up Trend,

- (Long-Term) 100 Day: 1.7889 Up Trend,

- (Long-Term) 200 Day: 1.7454 Up Trend.

Additional Metrics

Recent Trade Signals

- 27 Nov 2025: Long RB 01-26 @ 1.838 Signals.USAR.TR120

- 27 Nov 2025: Long RB 01-26 @ 1.8235 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The chart for RB RBOB Gasoline Physical Futures as of late November 2025 shows a market that has recently experienced a corrective pullback but is now attempting to stabilize above key support levels. Price action is medium in range with average momentum, and the last price is holding above the monthly and yearly session fib grid centers, indicating underlying strength. The short-term swing pivot trend is down, but the intermediate and long-term trends remain up, supported by the 55, 100, and 200-day moving averages all trending higher. The 5-day MA is rising, but the 10 and 20-day MAs are still in a short-term downtrend, reflecting recent volatility and a possible transition phase. Resistance is layered above at 1.8632 and 1.8788, with strong support at 1.7889 and below. Recent long trade signals suggest a potential for a bounce or trend resumption, especially as price holds above the NTZ and key moving averages. Volatility remains elevated, and volume is robust, supporting the potential for further directional moves. Overall, the market is in a consolidation-to-recovery phase, with bullish undertones on the intermediate and long-term horizons, while the short-term remains neutral as the market digests recent swings and tests resistance.

Chart Analysis ATS AI Generated: 2025-11-30 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.