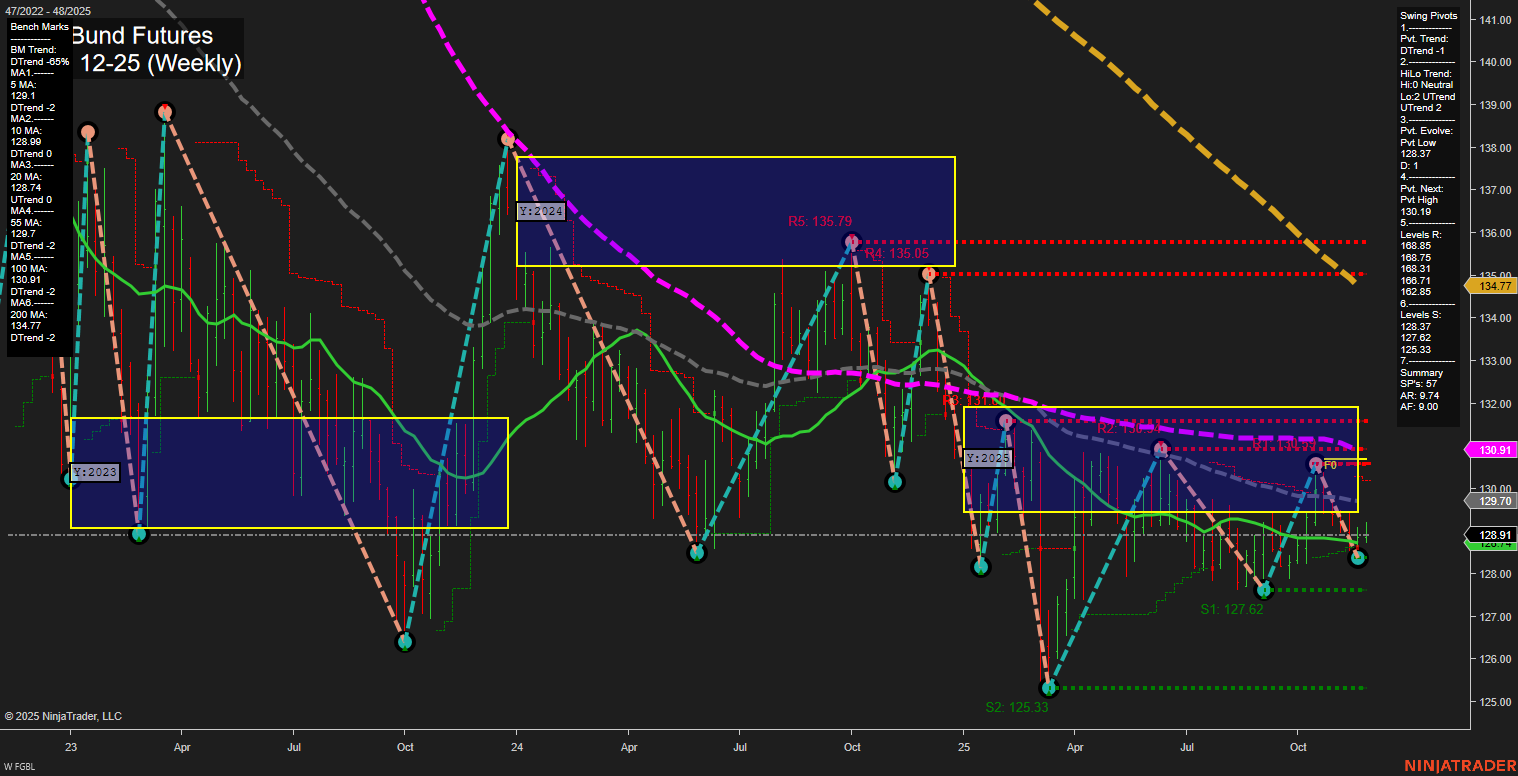

The FGBL Euro-Bund Futures weekly chart shows a market in transition. Price action is currently consolidating with medium-sized bars and slow momentum, reflecting indecision after recent swings. Short-term WSFG and intermediate-term MSFG both indicate an upward trend, with price holding above their respective NTZ/F0% levels, suggesting some bullish bias in the near to intermediate term. However, the yearly YSFG remains negative, with price below the long-term NTZ/F0% and a persistent downtrend, highlighting ongoing bearish pressure on the broader timeframe. Swing pivots show a short-term downtrend (DTrend) but an intermediate-term uptrend (UTrend), with the most recent pivot low at 128.37 and the next resistance at 130.19. Key resistance levels cluster around 130–135, while support is found at 128.37, 127.62, and 125.33. All major moving averages (5, 10, 20, 55, 100, 200 week) are trending down, reinforcing the long-term bearish structure despite the recent bounce. Recent trade signals reflect this mixed environment, with both a short and a long signal triggered in late November, underscoring the choppy, range-bound nature of the current market. Overall, the short-term outlook is neutral due to conflicting signals and slow momentum, the intermediate-term is bullish on the back of recent upward swings, while the long-term remains bearish as the market struggles to break above key resistance and long-term averages. This environment is characterized by volatility, mean reversion, and potential for both countertrend rallies and trend continuation moves, making it a market for nimble swing traders attentive to evolving price structure and key levels.