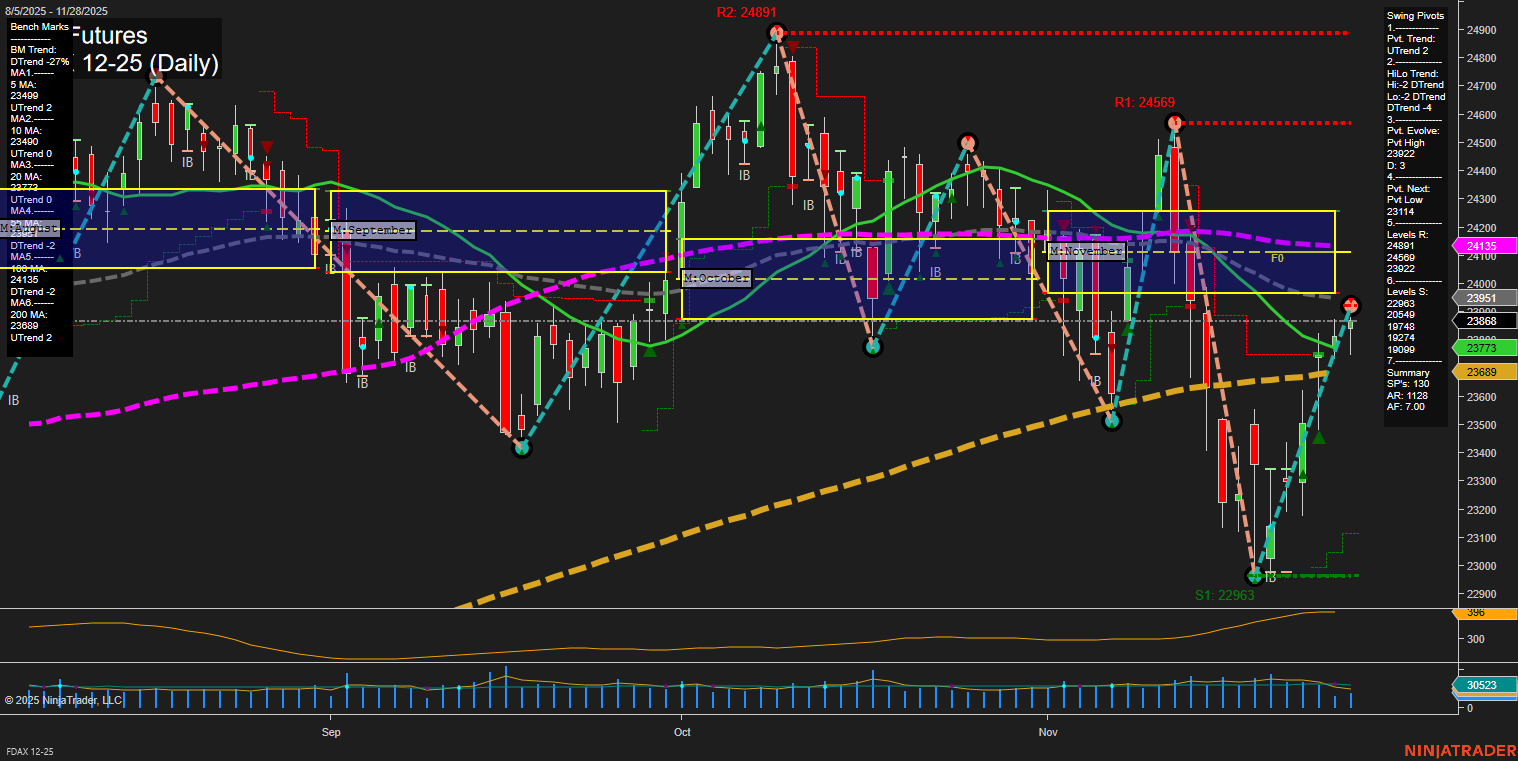

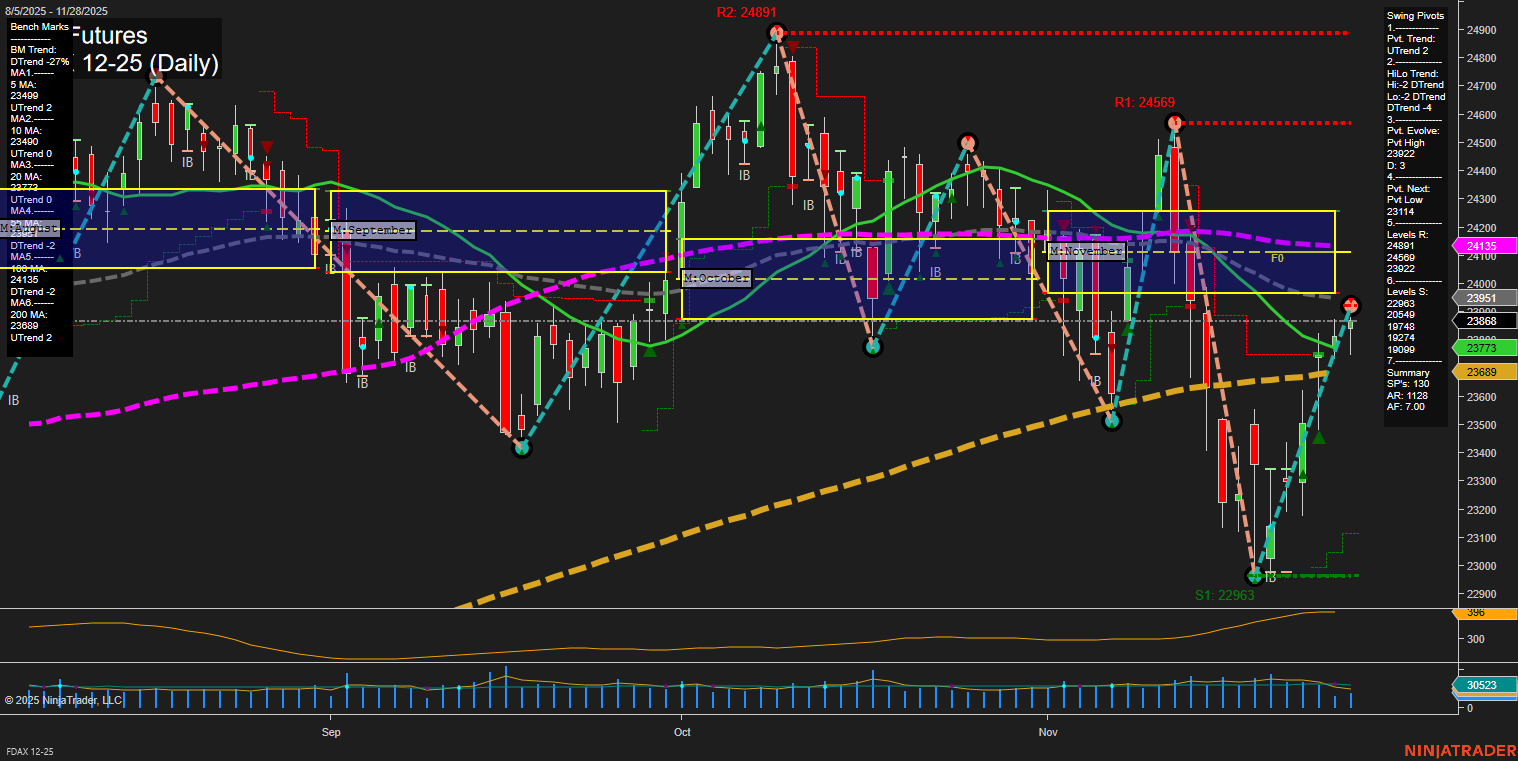

FDAX DAX Futures Daily Chart Analysis: 2025-Nov-30 18:06 CT

Price Action

- Last: 23,779,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 73%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -16%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 105%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 23,982,

- 4. Pvt. Next: Pvt Low 23,114,

- 5. Levels R: 24,569, 24,391, 23,982,

- 6. Levels S: 22,963, 20,549, 19,748, 19,074, 18,274, 19,009.

Daily Benchmarks

- (Short-Term) 5 Day: 23,490 Up Trend,

- (Short-Term) 10 Day: 23,420 Up Trend,

- (Intermediate-Term) 20 Day: 23,773 Up Trend,

- (Intermediate-Term) 55 Day: 24,135 Down Trend,

- (Long-Term) 100 Day: 24,135 Down Trend,

- (Long-Term) 200 Day: 23,889 Up Trend.

Additional Metrics

Recent Trade Signals

- 25 Nov 2025: Long FDAX 12-25 @ 23,480 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The FDAX is currently showing a mixed technical landscape. Short-term momentum is positive, with price action above the weekly session fib grid and both the 5-day and 10-day moving averages trending up. The swing pivot trend is up, and a recent long signal aligns with this short-term bullishness. However, the intermediate-term picture is less favorable, as the monthly session fib grid trend is down and the HiLo swing pivot trend is also down, indicating that the recent rally is still within a broader corrective or consolidative phase. Long-term signals remain constructive, with the yearly fib grid trend and 200-day moving average both pointing up, suggesting the larger trend is still intact. Volatility is moderate, and volume is healthy. The market is currently in a recovery phase after a sharp sell-off, with price rebounding from support and testing key resistance levels. The setup reflects a classic swing environment: short-term traders may find opportunities on the long side, while intermediate-term participants should be alert to potential resistance and the risk of renewed pullbacks.

Chart Analysis ATS AI Generated: 2025-11-30 18:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.